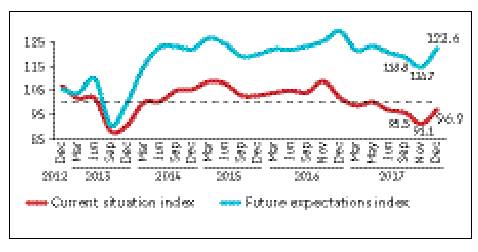

Urban consumers appear to have turned a shade optimistic as they look at the year ahead and compare it with today’s situation. The Reserve Bank of India’s (RBI) future expectations index rose to 122.6 in December from 114.7 in November. However, although they see income going up, they

believe spending — both on essential and non-essentials — will fall. Meanwhile, the pick-up in rural nominal wages has started to moderate and

farm distress hasn’t eased meaningfully. However, farm incomes could get a boost from the government’s plans to compensate farmers for

any shortfall in crop prices and also its rural infrastructure push next year. High frequency indicators show while volumes for some products — tractors for instance — are growing fast, for a whole host of products, sales volumes could take time to meaningfully cross previous peaks.

For one, low employment generation in urban India could keep a lid on spends, especially on big ticket items such as homes. Rural spends would depend on the crop output and the remuneration.

Analysts point out, the increase in expenditure in the 2018-19 budget is pencilled in at just 9% higher with most of the incremental spends to be incurred on interest payments, food subsidies and pensions. This is worrying since growth in both private consumption and government consumption has moderated over the last few quarters. The rise in private consumption slowed to a four quarter low of 6.5% y-o-y in Q2FY18 from 11.1% in Q3FY17. Government spending slowed to just 4.1% in Q2FY18 from 17.2% y-o-y in Q1FY18 and 31.9% y-o-y in Q4FY17. Consumer companies in the organized sector saw a definite improvement in Q3FY18; revenues for a clutch of firms — stables and discretionary — grew by close to 10%, primarily on the back of a low base of Q2FY17, which was the demonetization quarter. However analysts point