The debate between buying and renting homes has once again resurfaced, and search trends from Magicbricks reveal an inclination among customers toward homeownership. With rising rental yields and a growing sentiment for owning property, data from Magicbricks highlights a notable shift in consumer behavior.

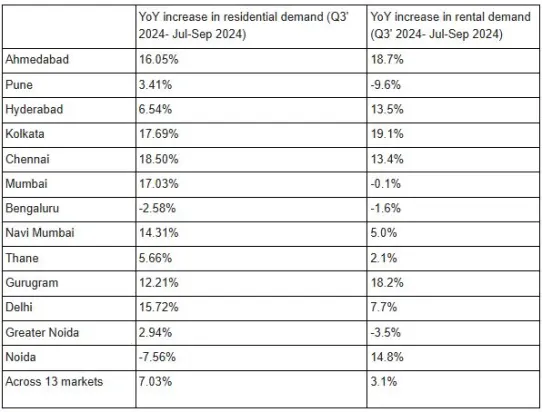

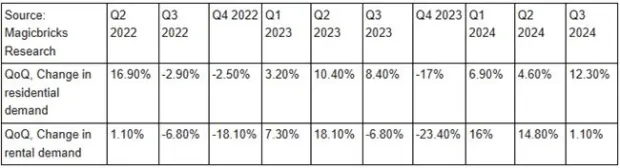

According to Magicbricks, across 13 metros, residential demand (searches) increased 7% YoY between July and September 2024, compared to a 3.1% YoY growth in rental demand (searches).

Drilling down further, Bengaluru witnessed an 18.2% QoQ rise in residential demand (searches) during this period, while rental demand (searches) dropped by 2.8% QoQ. A similar pattern emerged in other major metros like Delhi, where residential demand (searches) grew by 17.2% QoQ compared to a 9.9% increase in rental demand. Mumbai also followed suit, with residential demand climbing by 7.9% QoQ and rental searches decreasing by 4.7% QoQ.

These trends underscore a robust preference for homeownership, further supported by rising rental yields in key markets. Bengaluru, Mumbai, Chennai, and Navi Mumbai have reported an average rental yield of 3.6%. In Delhi, rental yields reached 2.5% between July and September 2024, up from 2.3% in the previous quarter.

Interestingly, the Greater Noida market emerged as an outlier, where rental demand continued to outpace residential demand, signaling unique dynamics in the region.

These insights reflect evolving market trends and the sustained confidence of homebuyers in the real estate sector, particularly in metro cities where the aspiration for homeownership remains strong.

(13 metros include Delhi, Gurugram, Noida, Greater Noida, Mumbai, Navi Mumbai, Thane, Bengaluru, Pune, Ahmedabad, Chennai, Kolkata, Hyderabad)

Commenting on the report, Varun Sharma, Founder and Managing Director, MVN Infrastructure, said, “The residential real estate market in metropolitan areas is witnessing significant growth, driven by rising rental yields. The increasing demand for rental properties reflects a shift in consumer preferences as more individuals prioritize flexibility and affordability amidst fluctuating market conditions. Recent data reveals that the average gross rental yield across 13 major Indian cities has reached 3.62%. With rental yields on the rise, investors are recognizing the potential for lucrative returns, making both buying and renting viable options depending on personal circumstances. This dynamic landscape underscores the importance of strategic decision-making for potential homeowners and investors alike, as they navigate the evolving real estate market.”

Harinder Dhillon, Senior Vice President-Sales, BPTP, said, “The residential demand in Gurugram, which is frequently referred to as the Millennium City, is strong, with both buyers and renters eager to reserve a place in this flourishing area. This demand has been mostly driven by rising rental returns, which over the past year have increased by 10–12% in desirable areas like Sohna Road, Golf Course Road, Dwarka Expressway and Golf Course Extension road.”

The demand for homes is still rising due to a number of causes, including urbanization, rising incomes, and changing lifestyle preferences. “The growth in rental returns, which have risen by 8–10% annually in major cities like Bengaluru, Delhi, and Mumbai, is one noteworthy trend. Although renting provides flexibility, Gurugram’s steady property appreciation—which has increased by 14-16% annually over the past five years—makes buying more alluring. Recent government infrastructure projects like the Metro extension, DMIC, Sohna Elevated Expressway and the Dwarka Expressway have also increased the value of real estate,” added Dhillon.

Abhishek Trehan, Executive Director, Trehan Iris, said, “As a developer, we are observing a significant transformation in the real estate market, particularly in Tier I and Tier II cities, where residential demand continues to grow steadily. This demand is fueled by rapid urbanization, rising income levels, and evolving lifestyle preferences. A key trend complementing this surge is the notable increase in rental yields. Recent data from Magicbricks highlights that the average gross rental yield across 13 major Indian cities has climbed to 3.62%, underscoring the potential of real estate as a lucrative investment avenue.”

Thus, while homeownership remains a cornerstone of long-term financial security, offering equity growth and stability, renting is gaining traction among many for its flexibility and lower upfront costs.

“Additionally, an increasing number of investors view rental income as a reliable alternative revenue stream, since it provides the dual benefits of rental income and capital appreciation that makes real estate a compelling choice. The combination of steady rental yields and long-term asset appreciation presents an opportunity to achieve enhanced total returns, making it an ideal time to explore the potential of real estate investments,” Trehan added.