Car loans have become a popular means to afford a vehicle without having to pay the entire amount upfront. They are a type of financing offered by banks, financial institutions, or car dealerships to individuals looking to purchase a vehicle. Instead of paying the full price upfront, borrowers can repay the loan amount in instalments over a predetermined period, typically ranging from one to seven years.

These loans come with an interest rate, which is the additional cost paid by the borrower. Often it is believed that the cost of a car loan is just the principal and the interest, but there can be other charges as well besides the downpayment which you must pay.

Costs to Consider Before Taking a Car Loan

The interest rate is one of the most significant factors determining the cost of a car loan. It’s essential to compare interest rates offered by different lenders to find the most favourable terms.

Tenure and Downpayment

The duration of a loan impacts the total interest paid. While longer loan terms may reduce the monthly instalment, they lead to higher overall interest payments. Making a substantial down payment reduces the loan amount and, consequently, the interest paid over the loan term. It’s advisable to save up for a sizable down payment to minimise the burden of the loan.

Also Read: Retirement Planning: Why managing your retirement savings is important

Fees and Penalty

Lenders may charge processing fees for initiating the loan. Borrowers should inquire about these fees and factor them into the total cost. Some lenders impose penalties for prepaying the loan amount before the tenure ends. Understanding these penalties is crucial, especially if there’s a possibility of early repayment.

Insurance Costs and Hidden Charges

Car loans often require borrowers to purchase comprehensive insurance coverage, adding to the overall cost. It’s essential to obtain quotes from different insurers to find the most affordable option. Be vigilant for any hidden charges or additional fees buried in the loan agreement. Reading the fine print thoroughly can help avoid unexpected expenses.

The True Cost of Buying a Car

When calculating the actual cost of purchasing a car in India, it’s vital to consider not only the price tag of the vehicle but also various associated expenses:

Vehicle Price and Registration

This includes the ex-showroom price of the car, excluding taxes and other charges. Every state in India levies registration fees for vehicle registration, which varies based on the car’s price and engine capacity. Road tax is a one-time tax payable at the time of registration and varies across states.

Insurance Premium

Comprehensive insurance coverage is mandatory for all vehicles in India. The premium depends on factors such as the car’s make, model, age, and the insurer’s terms.

Maintenance and Fuel Costs

Regular maintenance, servicing, and repairs add to the long-term cost of ownership. Fuel prices and the car’s mileage significantly impact the ongoing expenses of owning a vehicle.

Adhil Shetty, CEO, Bankbazaar.com, says, “Owning a car on a loan comes with multiple costs, including interest rates, loan tenure, down payment, processing fees etc. Factor in not just the cost of the vehicle, but also associated expenses like insurance, maintenance, and fuel. Understanding all these expenses will ensure that your car loan journey is smooth and financially sound.”

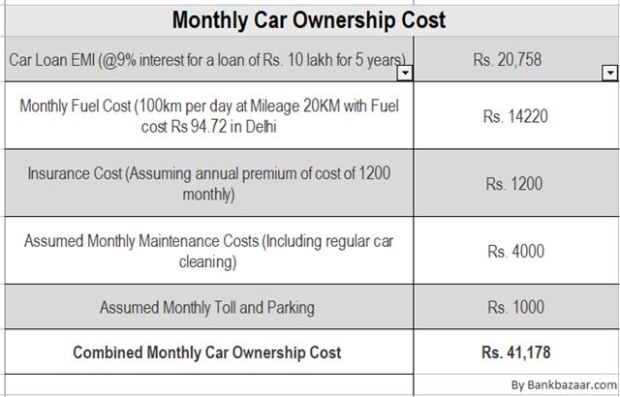

To understand the total monthly expenses of owning a car, let’s take an example. We’ve assumed a Rs 10-lakh petrol car purchased with a 9% car loan covering 80% LTV for 5 years. Do note the actual variable figures could vastly differ based on your lifestyle, and the usage, type and condition of your car, among other things like applicable fuel prices, parking and maintenance costs, etc.

Before opting for a car loan, it’s important to evaluate the price. While a car loan provides the convenience of spreading payments over time, borrowers must consider all expenses, including interest, fees, insurance, and maintenance costs. There are also other costs like the cost of depreciation and driver’s salary, if you want to hire a driver. Comparing loan offers, negotiating terms, and budgeting wisely can help you take an informed decision.