The Income Tax Department will be able to check your social media profiles, emails, bank accounts, online investments and trading accounts, from April 2026. If tax officials suspect that a person has evaded taxes or has hidden his property, cash, gold, jewellery or valuables, they can check emails and social media accounts of that individual to investigate the matter, according to the New Income Tax Bill, 2025.

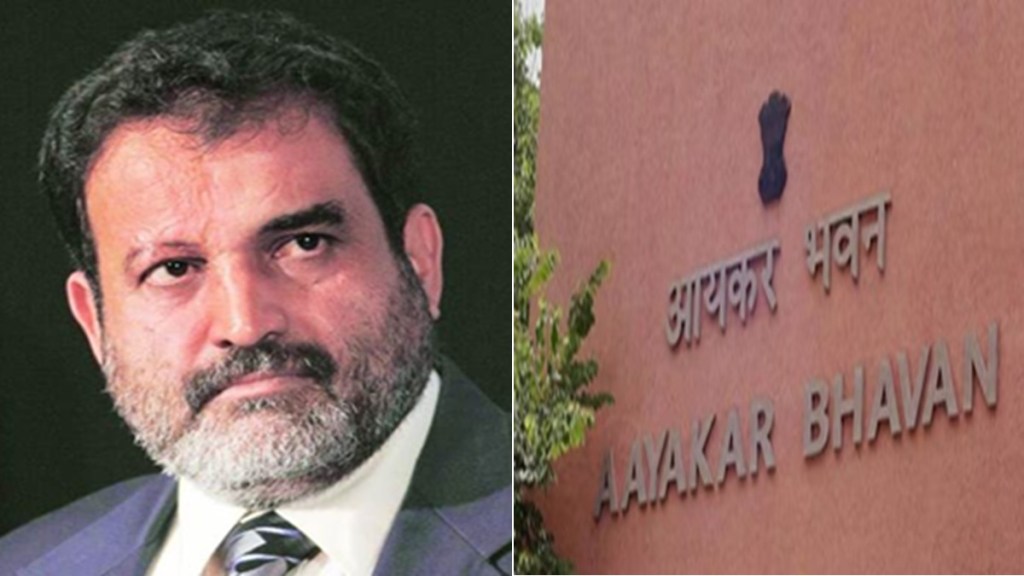

Expressing displeasure over this proposal, former Infosys CFO Mohandas Pai said that the decision to give tax officials access to a person’s social media accounts and emails is an “assault” on people’s rights.

Tagging PM Modi on his post, Pai wrote on social media platform ‘X’, “Your email and social media account can be accessed by income tax officers starting next financial year in these cases – This is an assault on our rights! Govt should provide safeguards against misuse, get a court order before this.”

Pai’s comments came in response to news reports suggesting the New Income Tax Bill has a provision that allows the Income Tax Department to check social media profiles, emails, bank accounts of citizens.

On this, Pai in his ‘X’ post suggests that tax officials must obtain a court order before this new rule gets implemented.

Finance Minister Nirmala Sitharaman introduced the Income Tax Bill 2025 in Parliament last month, which she described as a major reform in the tax system that has been in place for the last 60 years.

The most discussed provision in this bill is that now the “virtual digital space” i.e. your online activities, can also come under the purview of tax investigation. This is a big change from the current rules.

Also read: Income tax officials can access your email, social media accounts from next year: Report

What does Section 247 of the Income Tax Bill 2025 say?

Under Section 247, from April 1, 2026, income tax officers will be able to investigate your emails, social media accounts, bank details and investment portfolios under certain circumstances. If they suspect that you have evaded tax or have hidden any undeclared assets, they can also monitor your digital activities.

“Break open the lock of any door, box, locker, safe, almirah, or other receptacle for exercising the powers conferred by clause (i), to enter and search any building, place, etc., where the keys thereof or the access to such building, place, etc., is not available, or gain access by overriding the access code to any said computer system, or virtual digital space, where the access code thereof is not available,” the new Income Tax Bill says.