In India’s crowded life insurance space, quarterly results often dominate the headlines. But sometimes, the real story lies not in what’s changed in three months, but in how a company chooses to evolve for the long haul.

HDFC Life’s Q1 FY26 results may appear uneventful at first glance. The profits rose by 14%, premium income grew by 15.6%, and policy renewals remained strong. Yet beneath those steady figures is a quiet transformation, one that signals a deeper shift in how the company wants to grow.

Rather than chasing rapid growth through flashy, market-linked policies, HDFC Life is leaning into long-term profitability, customer loyalty, and product quality. It’s choosing to sacrifice short-term pace for long-term durability.

And in doing so, it’s becoming a life insurer that values sustainable income over short-lived growth. This story is not about a quarterly report, but about a strategic change.

How did this story unfold?

From Chasing Premiums to Margins

In the past, HDFC Life focused on selling more unit-linked insurance plans (ULIPS). Insurance plans linked to the stock market that had numbers but not much profit. Now, the company is focusing more on traditional savings, annuities, and protection plans. These are safer, easier to understand, and bring in better margins for HDFC Life.

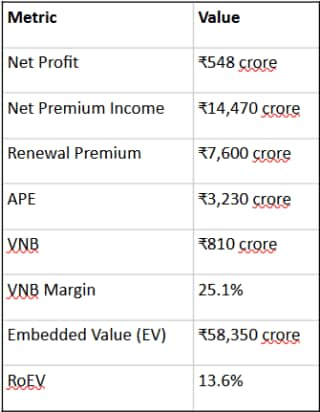

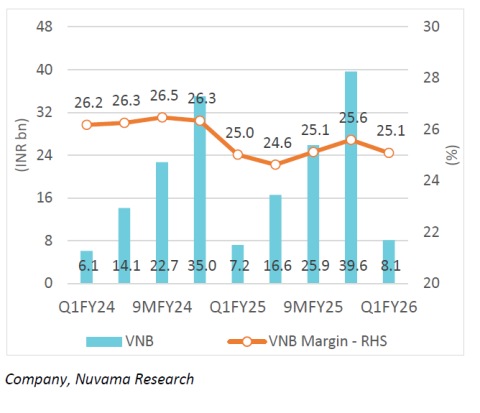

According to Nuvama’s July report, HDFC Life’s value of new business (VNB) margin slid to 25.1% this quarter, compared to 26.5 % in Q4FY25, falling 145 basis points (1.45%). The annualized premium equivalent (APE) fell 37.8% to ₹32.3bn in Q1FY26 compared to ₹51.9 bn in Q4FY25. HDFC Life gave up some of its short-term speed for long-term profitability.

Q1 Weakness Is Not A Warning

The company’s CEO, Vibha Padalkar, said the first half of this financial year may appear slow when it is compared to last year’s very high numbers. And there’s also some pressure from the economy. But this slow start doesn’t mean something is wrong.

Think of it like training for a very long race. At first, you may not run fast, but you’re building stamina. HDFC Life is building strong business foundations now so it can grow faster in the future.

One key number shows this strength: the company’s embedded value (which is the total future value of its policies) went up 17.6% from ₹49,610 crore last year to ₹58,350 crore. Its return on value (RoEV) was 13.6% in Q1FY26, indicating HDFC Life is using its money wisely.

While the start of FY26 may seem a bit slow, HDFC Life is laying the groundwork for strong performance in the second half and beyond.

Key Financial Indicators (Q1 FY26):

Are Margins Sustainable?

The rules for insurance companies in India are evolving, especially those related to tax exemptions and product approvals. These rules can make it harder for companies to sell certain high-value policies. For some, these new rules can also hurt profits. But it seems like HDFC Life may be ready for such a change.

HDFC Life sells its policies through several channels, including agents, banks, and online. This reduces the risk of dependence on one method of distribution. It also sells more long-term and savings-based plans that aren’t affected by the new rules.

For example, ULIPs have been reduced to just 11.8% YoY share of individual business. Within the group, savings grew 19%, annuities grew 12.4% and protection grew 8.5% YoY. These savings, annuity, and protection products are not only stable but also bring better profits.

Another good sign is the company’s renewal premium; the money people pay to continue their existing policies grew by 18.6% YoY this quarter, showing that customers are staying with HDFC Life.

The Market Is Not Convinced Yet

Even though HDFC Life showed good results, its stock price hasn’t moved up much. That’s because investors are being cautious. While the company is improving its margins, overall business growth is still slower than expected.

So, the big question is: Can HDFC Life continue to make strong profits while selling fewer high-risk products, such as ULIPs?

So far, it seems the answer is yes. In this quarter, it sold policies worth ₹3,225 crore (in terms of APE) and earned a profit value (VNB) of ₹809 crore, keeping its profit margin steady at 25.1%.

VNB & VNB Margin

Even though HDFC Life’s numbers were steady, the stock has not seen a big jump. APE (Annual Premium Equivalent) for Q1 FY26 came in at ₹3,225 crore, with individual APE up 7% and group APE up 5%. Group business, while adding to volume, brought lower margins.

Still, the 25.1% VNB margin shows HDFC Life is staying profitable despite its slow start. The real test will be whether this margin can stay high while growth picks up in the second half of the year.

Next Frontier of Premium Growth

A big change is happening quietly. Now, over 65% of new buyers are from small towns and cities compared to 58% in FY21 as per HDFC Life’s investor presentation. Many of them are buying life insurance for the first time. The company is expanding its network in these areas using a mix of agents and digital tools.

This is important because India still has people who don’t have life insurance. Smaller cities are where the future growth will come from. People want simple, easy-to-understand plans, and HDFC Life is creating exactly that – innovative products and localised communication to serve those markets better.

With its large network of agents and digital tools, the company is reaching these new customers better than ever.

Renewal Income and Persistency: The Next Step

While most look at new sales, a life insurance company’s real power is in how many people keep their policies year after year. This “renewal income” is like a steady stream of money that helps the company grow without always chasing new customers. HDFC Life made ₹7,600 crore in renewal income this quarter.

A strong base of long-term policyholders helps the company stay profitable even when the economy slows down or new sales dip.

Persistency ratios (customers pay regularly after 1 year, 13th/ 37th-month, etc.) have been steady this quarter. While 13th and 37th-month persistency saw a small dip of 130bp/10bp (1bp is 0.01%), respectively, the long-term persistency during the 49th and 61st months grew 350 bp/ 410 bp YoY.

What Should Investors Watch For?

With HDFC Life readjusting its strategy, investors must keep an eye on things beyond the headlines and quarterly profit figures.

1. Steady VNB Margins

Track HDFC Life’s value of new business. Is it better than before or worse? Checking for these details is important now that it is moving away from its regular ULIPs to savings and annuity products.

If the margin increases, it means the company has stuck to its new strategy. A sharp drop, however, could suggest rising costs or product cannibalisation. Right now, HDFC Life has a healthy VNB margin of 25.1% though it’s slightly lower compared to Q4FY25.

2. Renewal Premium Growth

Keep an eye on renewal premium trends and how fast it is growing. Low growth in renewal premiums could mean customer dissatisfaction.

Consistent growth, on the other hand, signals repeated renewals. Such premiums mean predictable cash flows at small costs, compared to new acquisitions.

3. Growth in Persistency

Watch for the persistence rates for the first year or the fifth. Better persistency ratios mean HDFC Life’s customers are paying premiums after the first year or the fifth.

High persistency leads to better embedded value (EV) and future profit, the two things investors look for in their investments.

4. APE Growth and Product Mix

HDFC Life’s APE grew by 12.4% in Q1—driven by a similar rise in individual business and group products. While growth was positive, it was below street expectations. Investors must check if Q2 FY26 sees a rebound, especially in retail segments.

How fast does the annual premium equivalent (APE) grow, and what policies are being sold, low-return ULIPs versus high-return annuity products?

5. Consistent Embedded Value & Returns

Investors must keep an eye on HDFC Life’s embedded value. See if it stays flat or grows in the next two quarters. A decline in the EV or Return on EV could mean lower profits or improper capital distribution.

The EV tells us the value of HDFC Life’s profits in the present and the future. Return on embedded value tells us how efficiently it’s growing that value. These are long-term health indicators that investors must watch.

6. Market Expansion in Smaller Cities

HDFC Life is deliberately reducing ULIPs (now 11.8% of the individual business) and growing annuity and traditional savings plans with higher margins.

Has the product mix changed? See if HDFC Life is selling more ULIPs. If it is, then it could mean they are under pressure to increase sales even at the cost of returns.

Since HDFC Life is expanding, growth in distribution networks, agents, and new tech improvements in Tier II and Tier III towns could mean it is on the right path.

7. Policy Changes

Has the tax, product rule, or commission guidelines changed? Any policy change in taxes, such as taxes on high-premium policies and other insurance products, can affect sales and profits.

HDFC Life’s switch to non-ULIP plans has helped it reduce the regulatory hit. But further reforms are coming, and agility will be tested again. Keep an eye on the company’s commentary in earnings calls and analyst reports. Is it adapting product design quickly? Is it shifting sales focus without losing customers?

8. Stock Valuation vs Sector Peers

Compare HDFC Life’s performance to SBI Life, ICICI Prudential, and LIC. A drop in growth without better margins could affect share prices.

At 86.4x price-to-earnings (P/E) and 9.5x price-to-book (P/B the stock is priced for strong performance. If growth reduces or competition increases, this high assessment could become a risk for investors.

A Company Evolving

HDFC Life’s slow growth in the first quarter may seem worrisome, but it would mean investors are missing its future potential.

HDFC Life is changing for the better, from the way it functions to the introduction of products that bring high long-term returns. They are concentrating on customer happiness, not just selling.

This strategic shift may not translate into growth immediately, but look closely and you will see the signs -steady returns, increasing renewals, and expanding reach.

If HDFC Life maintains its plans, then it could become sturdier, growing in size and quality.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling, and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.