In a dramatic turn of events, US President Donald Trump has hit Indian exports with a 25% tariff, accusing India of having “the most strenuous and obnoxious trade barriers” in the world.

The move comes just months after Prime Minister Modi’s White House visit, crushing hopes of a favourable trade deal.

To make matters worse, Trump also hinted at further penalties tied to India’s energy trade with Russia.

With the new tariffs kicking in, Indian companies heavily dependent on the US market are expected to feel the heat.

In this editorial, we spotlight 3 Indian stocks that export nearly 70% of their goods to the US.

Which Indian stocks derive the majority of their revenue from the US?

#1 Gokaldas Exports

First on the list is Gokaldas Exports.

The company is a leading apparel manufacturer with over four decades of industry experience. The company specialises in producing a wide range of garments, including outerwear, activewear, and fashion wear for all seasons.

With over 20 state-of-the-art manufacturing units and the ability to produce 36 million (m) pieces annually, Gokaldas has the scale and efficiency global retailers look for.

Today, it serves more than 50 brands across multiple countries. The company has operations in India, Kenya, and Ethiopia, and marketing offices in the UAE and the US.

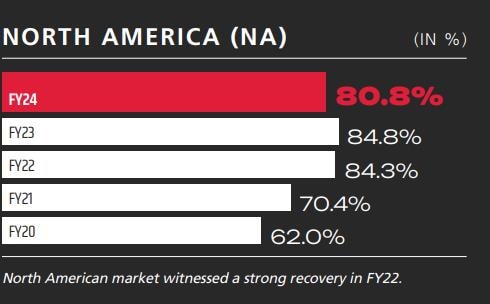

With Rs 149,643.72 million (m) out of Rs 196,325.3 m in finished goods sales coming from the US in FY24, the company derives over 80% of its revenue from the US market.

This high dependency makes it extremely vulnerable to the recently announced 25% tariff on Indian imports by the US.

A 25% duty on its US sales would mean an added cost of nearly Rs 37,411 m for the company—a massive financial blow that could significantly hurt earnings if not managed well.

And it’s not just about costs. Such a steep tariff might force American clients to rethink — maybe switch to local suppliers or countries not facing the same duties. If that happens, VBL could see a drop in orders, and worse, its future sales visibility could start looking hazy.

#2 Goldiam International

Next on the list is Goldiam International.

The company is in the manufacturing and export of diamond-studded gold and silver jewellery. The company is a fully integrated original equipment manufacturer (OEM) partner for retailers.

The company operates through two segments: jewellery manufacturing and investment activity. Its products include engagement rings, wedding bands, anniversary rings, bridal sets, and more.

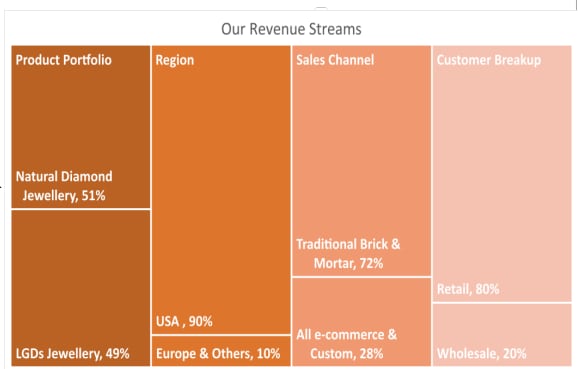

It exports its diamond products to the US, Europe, and other countries.

According to its Q4 & FY24 investor presentation, nearly 90% of Goldiam’s revenue comes from the US market.

This is a staggering concentration that now places the company directly in the crosshairs of the newly announced 25% US tariff on Indian exports.

The impact goes beyond just Goldiam. India is the global hub for diamond cutting and polishing, processing nearly 90% of the world’s diamonds. The US alone accounts for over US$ 10 bn, or 30.4% of India’s annual US$ 32 bn in gems and jewellery exports.

Given Goldiam’s heavy reliance on this market, the new tariff could not only hurt its top line but also disrupt operations and force a reassessment of its market strategy.

Going forward, the company plans to add 150-200 stores over the next 3-5 years.

#3 Indo Count

Last on the list is Indo Count.

The company is an India-based home textile bed linen company. It’s engaged in the manufacturing and exporting of bedsheets, bed linen, and quilts.

Its products include bedsheets, fashion bedding, utility bedding, institutional bedding and bedding.

The company maintains an omnichannel presence for its branded portfolio (owned and licensed). Its brands include Wamsutta, Pure Earth, Boutique Living, and more.

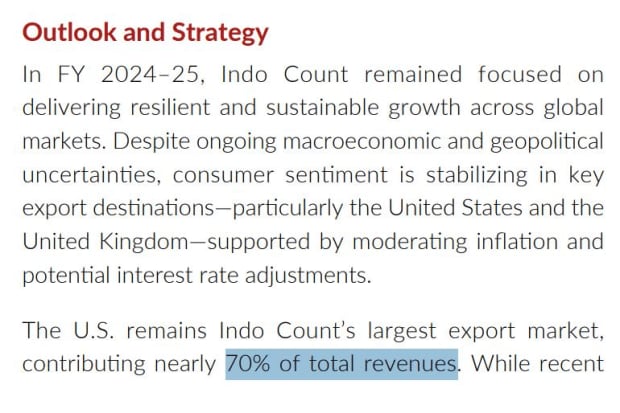

In FY25, the company doubled down on building steady and sustainable growth across its global markets. The US and UK led the way, with the US firmly holding its spot as the biggest revenue driver, contributing close to 70% of total sales.

But with the US now imposing a steep 25% tariff on Indian imports, the road ahead looks bumpy. This could push up costs, eat into margins, and make Indo Count’s products less competitive.

Conclusion

The upcoming 25% tariff on Indian exports to the US introduces a significant near-term challenge for companies which derive a large portion of their revenue from the American market.

At the same time, these companies have built strong US-facing businesses over the years, and may look for ways to navigate the situation, including exploring other export destinations.

A lot will depend on how trade dynamics evolve and what moves each company makes in the coming quarters.

For investors, it’s a good time to dig deeper — focus on business fundamentals, how clean the company’s governance is, and whether the stock’s valuation still makes sense.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.