Radhakishan Damani, the name synonymous with India’s retail giant DMart, is a master player in the Indian stock market. Currently holding 13 stocks with a net worth of Rs 161,187 cr as per trendlyne.com, his investment strategy and stock market acumen have made him one of India’s wealthiest individuals. Damani is one of the Warren Buffett’s of India recognized for his value investing approach, focusing on long-term growth and sustainable business practices.

He was also the mentor of ace investor, late Rakesh Jhunjhunwala.

No wonder everyone from big institutions to individual investors, watches his every move. So, when he stays invested in two less known microcap companies, in a market where everyone’s chasing quick gains, it demands attention.

What does he see in these companies that others don’t? What’s piqued the interest of this seasoned investor? Let’s look at these stocks to see if we can find the answers.

Advani Hotels & Resorts (India) Ltd – AHRIL

Incorporated in 1987, Advani Hotels and Resorts India Ltd is in the business of luxury hotels and owns and operates the Caravela Beach Resort, Goa; an independent, 201-key, 5-Star Deluxe golf resort on the Arabian Sea, designed by the world-famous architects Wimberly Allison Tong & Goo (WATG).

With a market cap of Rs 540 cr, Damani has held 4.2% of AHRIL worth Rs 22.6 cr at least since March 2016 (since records were available), per Trendlyne.com.

Let us look at the financials of the company to see we can find out what has caught Damani’s interest,

The company’s sales were at Rs 27 cr for FY21, which jumped to Rs 105 cr in FY24, which is a compounded growth of 57% in 3 years.

In the 3 quarters for April 2024 to December 2024, the company has already recorded sales of Rs 75 cr.

When it comes to net profits, AHRIL has seen nothing short of a resurrection. From losses of Rs 4 cr in FY21, to net profits of Rs 25 cr in FY24..

That could be one reason why Damani has continued interest in the company.

To add to it, the EBITDA (earnings before interest, taxes, depreciation, and amortization) for AHRIL was a negative Rs 3 cr in FY21 which has gone up to Rs 34 cr in FY24.

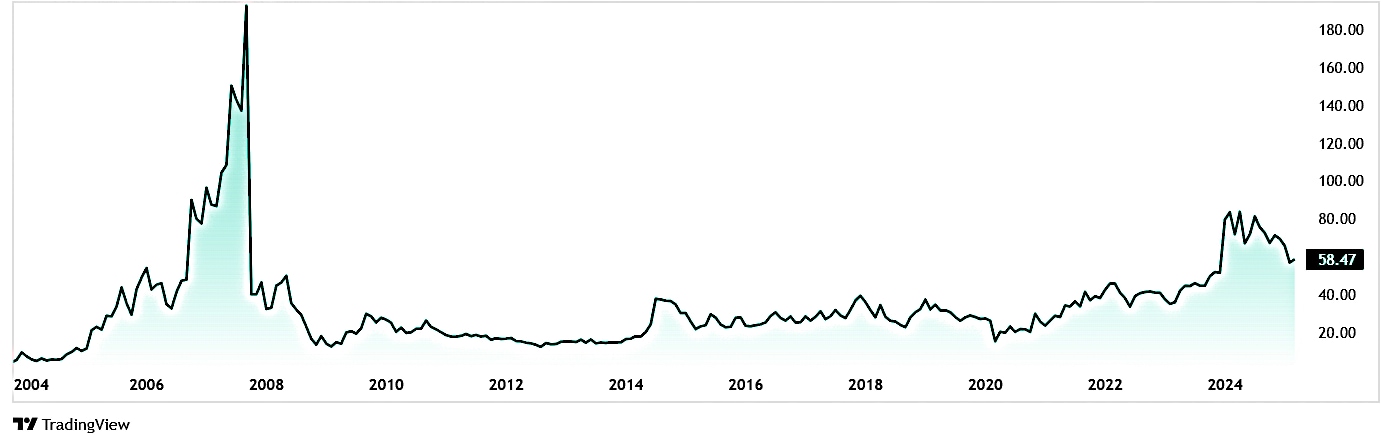

The share price of AHRIL was Rs 24 in March 2020 and is currently Rs 58.4 as on closing on 6th March 2025, which is a jump of 143%.

The company’s share is trading at a current PE of 21x while the industry median when compared to peers is 35x. The 10-year median PE for AHRIL is 22.5x while that of the industry is 34x.

What must also be noted is that the company is almost debt free, is providing a good dividend yield of 3.08% and maintaining a healthy dividend payout of 95.9%.

AHRIL is among the top 10 dividend paying companies by percentage among all listed corporations in India, based on dividends paid over the last 10 years.

Mangalam Organics Ltd (MOL)

Mangalam Organics Ltd was incorporated in 1981 and is a manufacturer of Camphor, Resin

and Sodium Acetate.

Infact, MOL is the world’s largest manufacturer of Camphor and an ISO Certified manufacturer of Pine Chemicals such as Terpene, Synthetic Resins, etc.

With a market cap of Rs 348 cr, MOL has companies like Asian Paints, Kansai, Berger, Pidilite, Henkel, Bostik, Dmart, Reliance, Spencer, Amazon and Bigbasket in their list of clienteles.

Damani has held 2.2% of stake in MOL at least since June 2020 (since records were available), per Trendlyne.com.

As for the financials, the company’s sales grew from Rs 375 cr in FY20 to Rs 405 cr in FY24 which is a compounded growth of 2%.

The net profit is an area that raises a lot of questions on Damani’s holding in the company. The net profit of MOL was Rs 48 cr in FY20. In FY23, the company saw losses of Rs 25 cr and in FY24, the net profits were at Rs 4 cr.

Between FY20 and FY24, the net profits fell by over 90%.

EBITDA also saw a big drop from Rs 86 cr in FY20 to Rs 34 cr in VY24.

MOL’s share price was Rs 151 in March 2020 and saw a high of around Rs 1,200 in January 2022. It has been however on a downslide since then and is currently trading at Rs 408 (as on closing of 6th March 2025)

The company’s share is trading at a current PE of 41x while the industry median when compared to peers is 29x. The 10-year median PE for the company is 10x and the industry median for the same period is 23x.

Patience or Prophecy?

Radhakishan Damani, or as we like to call him one of the Warren Buffett’s of India, has kept the investment circles alive all this while with his two lesser-known microcap companies—Advani Hotels & Resorts (AHRIL) and Mangalam Organics Ltd (MOL). While AHRIL showcases remarkable financial turnaround and growth, MOL’s performance raises questions, with its net profits plummeting by over 90% in recent years.

AHRIL’s resurgence, marked by soaring sales and profits, aligns with his preference for sustainable growth. On the other hand, MOL’s struggles, despite its strong clientele and market position, make Damani’s continued interest even more intriguing.

For investors, these stocks serve as a reminder that behind every seemingly puzzling move lies a story of patience, foresight, and perhaps, prophecy. Whether these microcaps will deliver on their promise remains to be seen, but Damani’s track record ensures they remain under the spotlight.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.