Most smart investors in the market are always on the lookout for companies that boast of less or no debt and a high return on capital employed (ROCE). Zero debt means minimised risk because the company does not have to worry about interest payments which only eat into their profits. A high ROCE demonstrates that the company is good at making profits with its money or is highly “Capital Efficient.”

Now that’s a sweet spot that most Warren Buffett’s of India look for. After all these companies have proven that they are good at building and running a sustainable business, that has all the requisites to be the next big thing.

The companies we look at today are even more interesting as these are smaller or less known ones. No debt makes them safer a safer bet for investors, clubbed with a high ROCE which means they are likely to give solid returns. If one is looking for a combination of growth and stability, these are a must know.

Let us dive into these two zero debt kings of capital efficiency.

Advani Hotels & Resorts (India) Ltd

Incorporated in 1987, Advani Hotels and Resorts India Ltd is in the business of running a hotel.

With a market cap of Rs 535 cr, the company has a current ROCE of almost 46%, which means for every Rs 100 it spends as capital, it makes a profit of Rs 46 on it. This is probably one of the highest when compared to peers in the same industry. The industry median ROCE is just about 12%.

The 10-Year ROCE for Advani Hotels & Resorts is also amongst the highest at 31%, while the industry median for that period is just 7%.

The company’s sales have grown from Rs 70 cr in FY20 to Rs 107 cr in FY25, logging in a compound growth rate of 9% in the last 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Advani Hotels grew from Rs 17 cr in FY20 to Rs 35 cr in FY25, recording a 16% CAGR.

As for the net profits, the company has logged in a compound growth of 19% from Rs 11 cr in FY20 to Rs 26 cr in FY25.

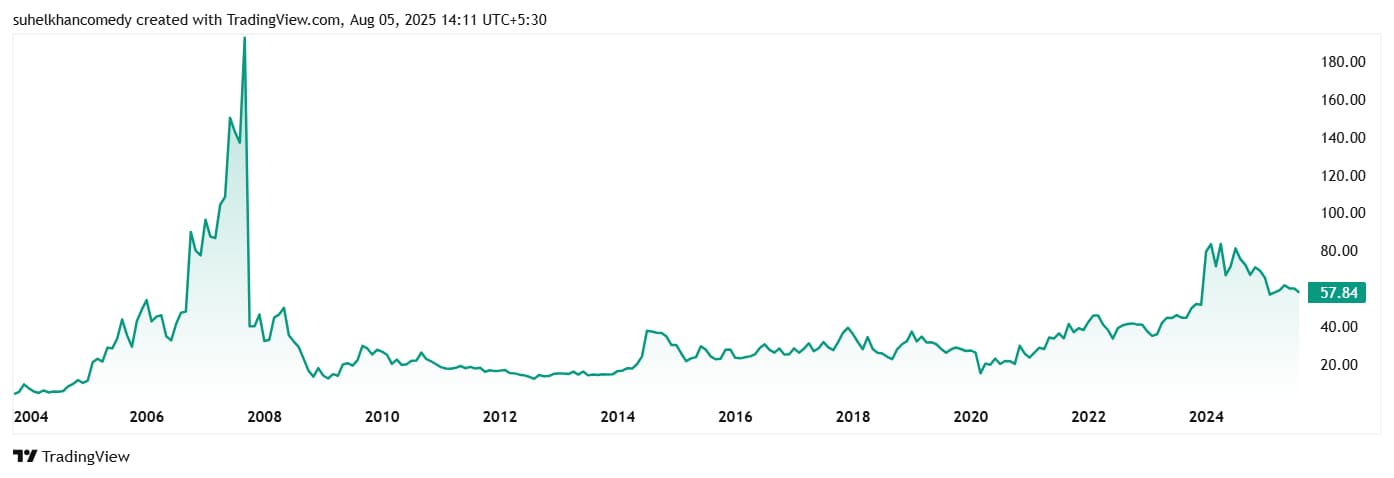

The share prices for Advani Hotels & Resorts India Ltd were around Rs 20 in August 2020, and as on 5th of August 2025, it was Rs 58, which is a 190% jump in 5 years. Rs 1 lac invested in the stock 5 years ago would have been close to Rs 3 lacs today.

Even at the current price, the stock is trading at a discount of about 37% from its all-time high price of Rs 92.

As for valuations, the company’s current PE is 21x, while the current industry median is 39x. The 10-year median PE for Advani Hotels & Resorts is however 28x while the industry median for the same period is 35x.

The company has reduced its debt in the last 5 years and is almost debt free. It also has a dividend yield of 3.3% and maintains a healthy dividend payout ratio of 85%.

Advani Hotels & Resorts have however seen a drop in numbers for the quarter ending June 2025, in terms of sales, EBITDA and Net profit. What is interesting is that Warren Buffett of India, the retail king Radhakishan Damani has steadily held 4.2% stake in the company since March 2023 and continues to hold the same despite the fall in numbers for the June quarter.

Global Education Ltd

Incorporated in 2011, Global Education Ltd is an educational service and consultancy provider.

With a market cap of Rs 321 cr the company is also capital efficient like Advani Hotels & Resorts, as the current and 10-year ROCE for the company is a 36%. Which means, for every Rs 100 it spends as capital currently, the company makes a profit of Rs 36 which is probably one of the highest when compared to industry peers. The current Industry median ROCE is 7%.

The company’s sales jumped from Rs 27 cr in FY20 to Rs 68 cr in FY25, logging in a compound growth of 20% in the last 5 years.

EBITDA for Global Education has grown at a compound rate 25% from Rs 11 cr in FY20 to Rs 34 cr in FY25.

As for the net profits, the company logged in a compound growth of 26% from Rs 8cr in FY20 to Rs 25cr in FY25.

The share price of Global Education Ltd was about Rs 10 in August 2020 and as of 5th August 2025, it was Rs 63, which is a jump of 530%. Rs 100,000 invested in Global Education 5 years ago would have been a little over to Rs 6 lacs today.

The stock is currently trading at a discount of almost 60% from its all-time high price of Rs 153.

Valuation wise, the company’s share is trading at a PE of 14x, while the industry median is 42x. The 10-year median PE for Global Education is 12x and the industry median for the same period is 33x.

The company has also reduced debt and is almost debt free. Plus, it has a decent dividend yield of 2.4% and maintains a healthy dividend payout ratio of 29%.

In the company’s latest annual report, Chairman Gururaj Karajagi said- “Our objective will be to drive growth through the investments we have made, whether it is into transformation frameworks, disruptive solutions, products or services. While we continue to focus on profitable growth and maximization of value for our stakeholders as the key agenda, it is imperative for us to consolidate what all we have created so far. India remains a spectacular market for education products and services that is largely unpenetrated. With the largest number of young people in the world that are hungry for education, you can expect Global in the coming years to rapidly grow its network of consumers by providing services and products that are tailored to customer needs.”

Add to Watchlist?

Global Education Ltd and Advani Hotels & Resorts Ltd have caught the eye of smart investors, probably for the reasons we saw today. Their solid performance in terms of Sales, profits, EBITDA, ROCE, gains have gotten the eyes onto them. Plus, they are trading at discounts form their all-time high prices.

Now the big question however is, will these two less known underdogs continue to keep clocking such numbers and make the most of investors. Or will the steam fizzle out? Remember, in case of small companies, in general, there are more unknowns and therefore one needs to dig in deep before considering any investment.

Whatever happens in the near and long-term future, one this goes without saying is that these companies deserve attention right now, given where they stand. Adding them to a watchlist and keeping an eye on them sounds like a good plan.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.