Semiconductors are the foundation of today’s digital economy. They’re tiny chips that power everything from your smartphone and automobile to defence and medical devices. However, India currently imports nearly 90% of its domestic needs. This dependence on imports makes India vulnerable to supply chain risks, as seen in the post-pandemic period.

To boost semiconductor manufacturing, the Indian government launched the India Semiconductor Mission (ISM) with an outlay of ₹760 billion. Of this, 10 projects with cumulative investments of around ₹1.60 trillion in 6 states have already been approved (as of August 2025), with more to follow.

According to McKinsey, the Indian semiconductor industry is expected to help reduce India’s import dependence by $10-20 billion. India Electronics and Semiconductor Association projects that India’s semiconductor market will grow from ₹4.5 trillion in 2024 to ₹9 trillion by 2030. This offers a massive opportunity for companies. The government of India estimates that this will boost manufacturing, design, and employment opportunities.

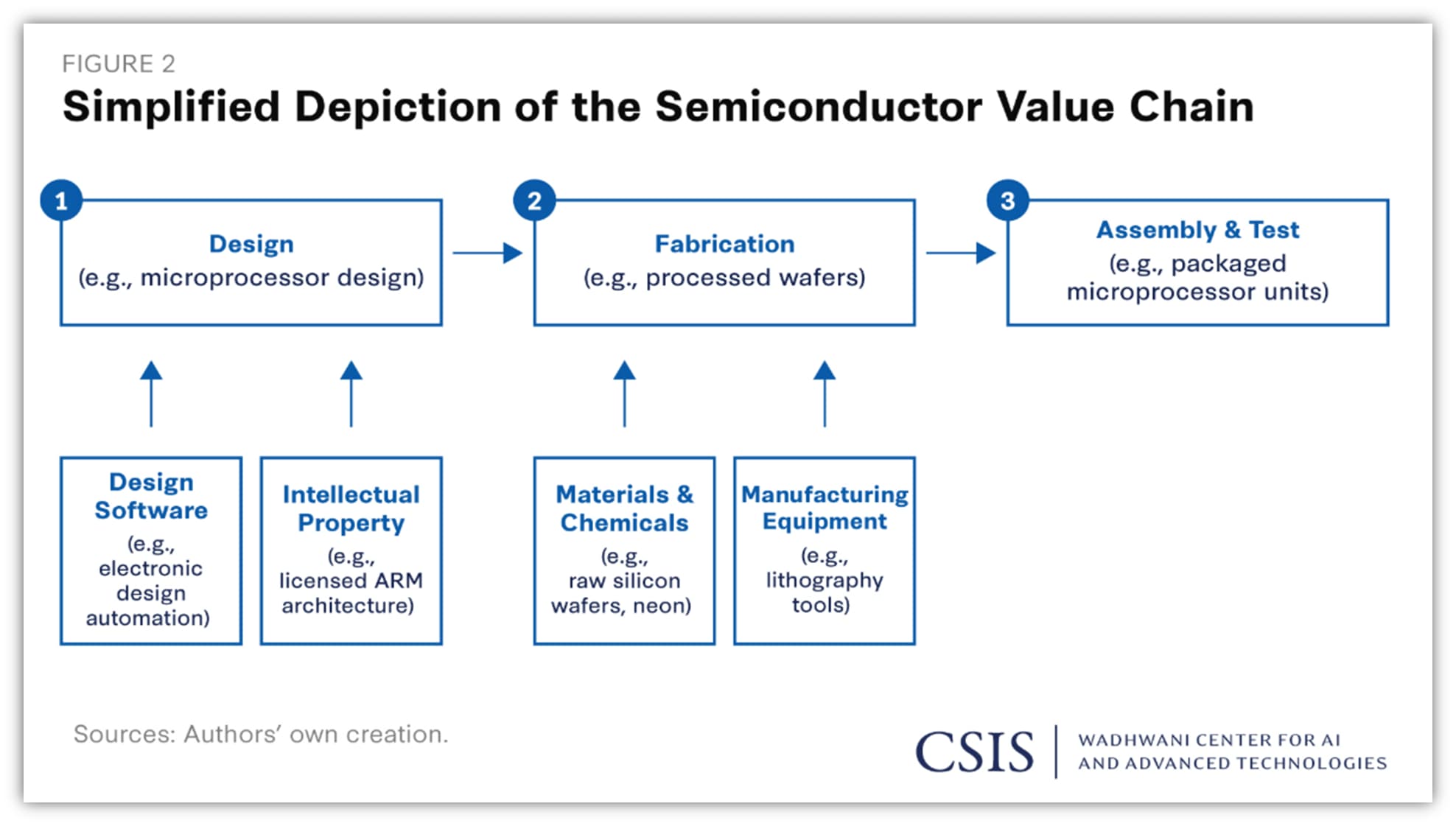

Semiconductor Value Chain

Therefore, here are three early-mover semiconductor stocks worth watching…

#1 Kaynes Technology India: Powering India’s Move From EMS to Semiconductors

Kaynes Technologies provides design, process, engineering, integrated manufacturing, and life-cycle support to original equipment manufacturers. It is a leading integrated, Internet of Things (IoT)-enabled solutions provider with capabilities across the entire spectrum of Electronic System Design & Manufacturing (ESDM).

The company caters to multiple industry verticals, including automotive, aerospace, defence, and railways. It is transforming from a pure EMS provider to an integrated ESDM company. Towards this end, it has several ongoing projects.

The OSAT Bet Driving a 47% Revenue Surge

The company is also entering into the Outsourced Semiconductor Assembly and Test (OSAT) and High-Density Interconnect (HDI) Printed Circuit Boards (PCB) businesses. It received approval last September to establish an OSAT facility in Gujarat, with an investment of ₹33 billion.

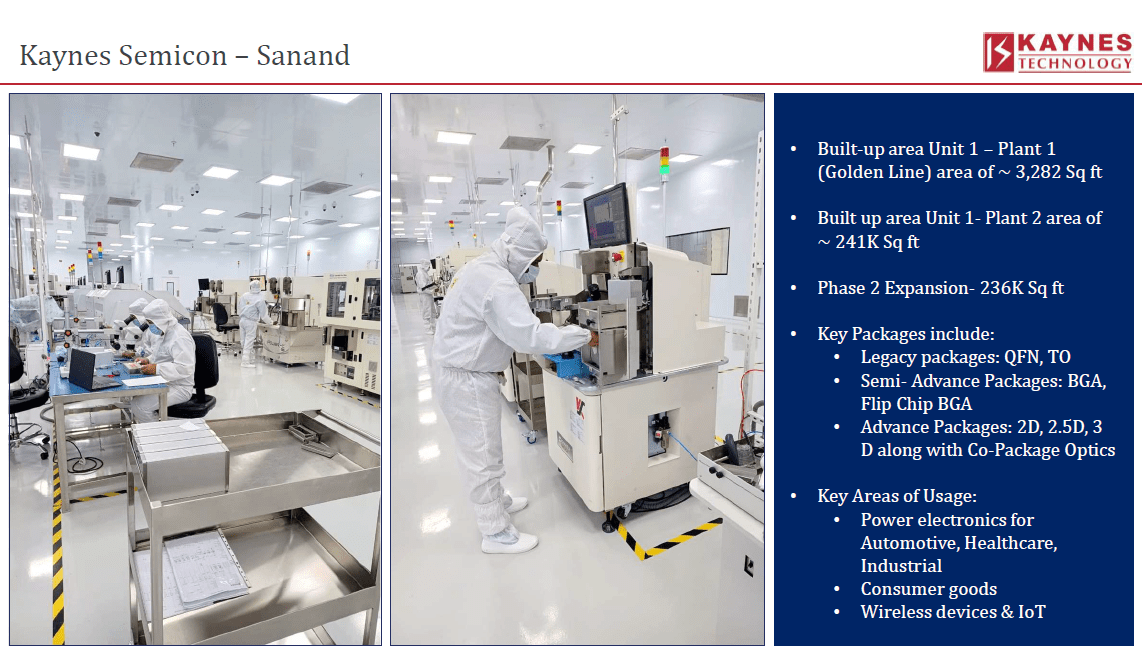

Kaynes Semiconductor Facility at Sanand

The central government will contribute 50% of the investment, the Gujarat government 20%, and the company 30%. The facility is expected to deliver 6 million chips per day. Kaynes has already delivered India’s first commercially manufactured multichip module, IPM5, during the second quarter of FY26.

Almost 60% of the OSAT capacity is already committed by large players, providing immediate capacity scale-up. This facility is now operational and is ramping up capacity, with mass production of the commercial multichip module (IPM5) scheduled nationwide for January 2026.

The facility handles several packages, including legacy packages (QFN, TO), semi-advanced packages (BGA, Flip Chip BGA), and advanced packages (2D, 2.5D, and 3D). These packages are intended for use in power electronics for Automotive, Healthcare, and Industrial applications, as well as Consumer goods and Wireless devices & IoT.

Kaynes is also implementing backward integration into high-density interconnection (HDI) PCB manufacturing and parallel integration into OSAT and semiconductor packaging. Customers with commitment include Alpha & Omega Semiconductor, Larsen & Toubro Semiconductor, and Infineon.

Healthy revenue mix and margin improvement

Regarding its financials, revenue increased 47% year-on-year to ₹15.8 billion in H1 FY26. EBITDA (Earnings before Interest, Tax, Depreciation, and Amortisation) margin expanded by 270 basis points to 16.5%, driven by operating leverage. Consequently, Profit after tax (PAT) rose 77% to ₹1.9 billion.

It gets 48% of its revenue from Printed Circuit Board Assembly (PCBA), 30% from product engineering and IoT solutions, and 22% from box build. In the revenue mix, the Industrial and EV segments contribute 59% to revenue, followed by automotive (24%), IoT (6%), and railways (7%).

As of 30 September 2025, its order book stood at ₹81 billion, providing revenue visibility over 3 years. The company plans to reach US$ 1 billion in revenue (₹88.5 billion approx.) by FY28. Kaynes expects profitability trends, including sustained high gross margins and blended profitability driven by operating leverage, to continue in H2 FY26.

#2 RIR Power: A “Silicon Carbide” Moat in Power Electronics

RIR Power manufactures traditional semiconductor devices, including bridges, power modules, diodes, rectifiers, and thyristors. The company has continually brought advanced semiconductor technologies to India through collaborations with USA-based International Rectifier and Silicon Power Corporation.

Semiconductors and Power Equipment at the Core

RIR operates through two synergistic verticals: Semiconductor Devices and Power Equipment. It also has a presence in Green Hydrogen solutions and next-generation Silicon Carbide (SiC) technologies. RIR’s products serve critical sectors, including defence, railways, renewables, and energy. It is also expanding into emerging domains, such as electric vehicles (EVs).

Within the semiconductor industry, it designs and manufactures devices for rectification, control, and switching applications, including phase-control thyristors, inverter-grade thyristors, standard-recovery diodes, fast-recovery diodes, diode-bridge rectifiers, high-voltage modules, diode-bridge modules, and IGBT modules (StarPower Products).

Leveraging its semiconductor expertise, it designs and manufactures robust power devices for industrial and infrastructure applications, including power rectifiers, battery chargers, high-power stacks and assemblies, AC voltage regulators, and universal control cards (UCCs). It also provides a stable DC supply, precise voltage control, and green hydrogen.

Odisha SiC Project Positions RIR for Next Phase of Growth

RIR is setting up India’s first SiC manufacturing plant in Odisha to produce advanced SiC wafers and devices. It plans to reduce its dependence on imports and strengthen domestic capabilities. That is why it aims to avoid the highly competitive 1200-volt market, dominated by Chinese manufacturers, and to focus on automotive applications.

While it will start at 1,200 volts, the company is focused on 3.3 kV, 6.5 kV, and as high as 10 kV for metal-oxide-semiconductor field-effect transistors– a type of power semiconductor device widely used for switching and controlling electrical signals. RIR is targeting applications requiring high-performance power electronics, including Indian Railways, defence, grid infrastructure, and renewable energy.

RIR is investing ₹6.2 billion in the project, with a 50% commitment expected from the state of Odisha. The balance is expected to be funded by a preferential issue and debt. The company is also seeking a technology partner for silicon Insulated Gate Bipolar Transistors (IGBTs) as part of their future planning.

Its entire manufacturing line is designed for 150-millimetre wafers, with an 85% yield. This means that 85% of all chips produced are usable, and 15% are lost due to defects. RIR says this efficiency is very competitive compared to global competitors. At 90% capacity utilisation, the facility is expected to generate revenues of ₹6 billion based on an asset turnover ratio of around one times.

The overall project is divided into three main parts: Epitaxy, the Device Fab, and Packaging. The Epitaxy portion of the facility is anticipated to come online in January 2026. The total capital expenditure (capex) for the epitaxy and packaging processes combined is about ₹2.2 billion. It will take about 2.5 years for the entire ecosystem to be fully online.

Strong First Half Show

From a financial standpoint, total revenue increased by 17% year-on-year to ₹466.5 million in the first half of FY26. Increased demand across semiconductor devices, power equipment, and export segments supported this growth. PAT rose by 64.8% to ₹61.0 million, driven by an increase in operating profit margin.

RIR Power Electronics Share Price

#3 MosChip: The “Fabless” Play on Indigenous Design

Moschip is recognised as India’s first Fabless Semiconductor company. Its focus is encapsulated by the motto: “Silicon | Software | Systems- Connecting the World”. It has several key business units, including Semiconductors, Software, System Design, and Product Engineering (Embedded Software, Digital Engineering).

Indigenous Innovation and HPC Projects to Drive Future

MosChip views itself as a global engineering partner specialising in two complementary domains: silicon engineering and product engineering. Its strategic direction focuses on diversification and high-growth areas. MosChip provides semiconductor design services.

The company plans to continue growing its design services offerings, aiming to deepen and stabilise its engagement. It also intends to maintain its position among the top global semiconductor companies (10 of the top 20 are current customers). Moship plans to add emulation to the semiconductor service portfolio.

MosChip is developing an indigenous Smart Energy Meter IC under the Government of India’s Design Linked Incentive (DLI) Scheme. This product will cater to both the domestic and global markets. The market for smart energy meter ICs in India is expected to reach about 60 million units, and the overseas market 2 billion units by 2028.

It is also co-developing the AUM processor (an Indigenous HPC SoC) with C-DAC on TSMC 5 nm technology, which is part of India’s National Supercomputing Mission. This project is expected to create significant opportunities in both domestic and international markets for complex tasks, such as AI and scientific simulations.

MosChip Delivers Broad-Based Growth in H1 FY26

Moschip’s revenue grew 37.4% to ₹2.8 billion in the first half of FY26, driven by strong performance across both business segments. Silicon Engineering Solutions’ business revenue grew 38.2% to ₹2.2 billion, while Product Engineering Solutions’ business revenue grew 33.7% to ₹618.5 million. PAT surged by 35.3% to ₹230 million in the first half of FY26.

Moscip Technologies Share Price

Valuation at Exponential Level

RIR Power and MosChip have both seen their valuations surge to levels that look very steep. Valuations remain high even after the recent correction. The excitement mainly stems from their move into the semiconductor space, which has sparked early opportunity and euphoria. But the core execution challenge remains.

Kaynes has also established itself in electronic contract manufacturing, and it has customer orders, so execution won’t be a problem. However, how long-term execution will play out remains to be seen. That said, Kaynes valuation is pretty high at 103 times, which leaves little room for any error.

Valuation Comparison (X)

| Company | P/E Multiple | 10-Year Median | Industry |

| Kaynes | 103 | 119.9 (3-Year) | 34.3 |

| RIR Power | 172 | 118.9 | 34.7 |

| MosChip | 95.4 | 184.5 | 22.3 |

It’s still too early to know how well they will scale, deliver on technology, or build a sustainable semiconductor business. For now, the valuations reflect expectations more than proven performance. That said, the semiconductor industry in India is still in its early stages, but the pace of development is accelerating rapidly. Government incentives, industry push, and the growing demand for chips across sectors are gradually setting the stage for domestic players to scale.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.