Tariff this, tariff that.

Ever since Donald Trump assumed office, there were fears of a potential tariff hike on countries, including India.

Now, it’s official… Trump has fulfilled his campaign promise of implementing tariffs and many of these policies could hit Indian exports and corporate earnings.

The end result of Trump’s announcements, however, was the Indian rupee tumbling to record lows while retail investors rushed to buy beaten-down assets amid the dip.

After disappointing earnings in Q1 and Q2, only a tepid recovery is visible in Q3 so far, with a rebound likely pushed to Q4.

While all this is happening, two famous Indian fund managers are going head-to-head over social media platforms, divided over their views on the Indian stock market.

The first one is Sankaran Naren of ICICI Prudential. He joined ICIC Prudential mutual fund in 2004 and became the chief investment officer in 2011.

The seasoned practitioner of contrarian and value investing is getting a little uncomfortable with the Indian stock market, especially smallcaps and midcaps.

Last month on the 25th January, at an event organised by IFA Galaxy, an association of mutual fund distributors, Naren advised investors to avoid systematic investment plans (SIPs) in small cap and mid cap mutual funds right now and even consider redeeming their investments in such funds as valuations are ‘absurd’.

His cautious stance, backed by valuation concerns and liquidity risks in these stocks, have stirred the entire industry.

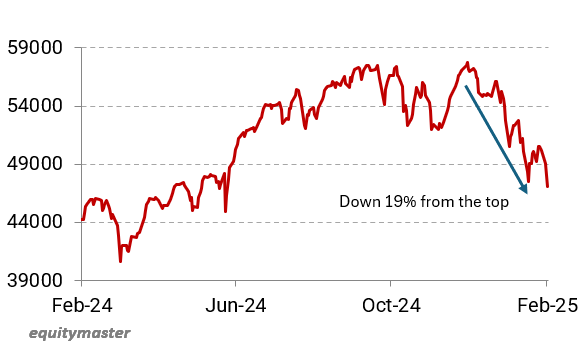

The smallcap index is very close to entering the bear market territory.

Smallcap Index Close to Bear Market Territory

Source: Equitymaster

On the other side of this we have Radhika Gupta, CEO of Edelweiss Mutual Fund.

Amid the debate around Naren’s comments on small and mid-cap valuations and risks with SIPs, Radhika Gupta said “do not fall for the fear-mongering 10-day debates,” on X and LinkedIn.

Gupta said in her social media posts that SIPs are meant to be a simple savings investment instrument for the common person. In her actual words, it is “a fill it, shut it, forget it (kind) because most people struggle with markets, market caps, and SIPs.”

That brings us to the next important point…

If the margin of safety is low and if Indian markets (especially small and mid-caps) have become highly speculative in nature, how should one go about investing?

In this article, we look at some important metrics that should help you decide what should be your next step.

Grab a cup of coffee for this one… this is one of our most in-depth editorials.

Digging into India Inc’s Exceptionalism

The greatness of India lies not in being more enlightened than any other nation, but rather in the country’s ability to repair its faults.

Since its birth as a nation 78 years ago, India has seemed poised on the edge of two very different futures.

Through the ups and downs though, India has always emerged stronger. It has become clear now that as a new world order emerges, the world is looking towards India with hope.

In a report we published a few weeks back, we covered three worrying trends that all pointed towards an overvalued Indian market.

But are we looking at this the wrong way, considering India Inc’s massive infra expansion, modernisation of things, and the country getting at the heart of the AI and green energy revolutions?

Is an expensive market the new normal?

For example, if you just look at the price-to-forward earnings ratio of India’s benchmark index, the BSE Sensex, it’s almost double (21.2) that of the UK (11).

But when you dig deeper, you realize it’s not an ideal comparison. Tech companies make up only 1% of the UK market, whereas the share is much more in India or the US.

Fancy technology companies usually command a higher valuation due to their higher growth prospects.

As we move forward with this editorial, we’ll try to dig into why India will continue to outperform, whether the current market valuation across Indian marketcaps is justified, and whether we can expect the same level of stock market performance going forward.

Advantage India

Historically, China attracted significant foreign investment thanks to its rapid economic growth and dominance in manufacturing.

However, doubts about its long-term outlook have now reduced FDI inflows to nearly zero.

That’s where India comes in…

Even the harshest critic will admit that India’s economic juggernaut has been unstoppable in recent decades.

We’re already the fifth largest economy, by GDP, in the world… up from the 11th place a decade ago.

We’re the world’s fastest-growing big economy… with an impressive 8.2% GDP growth rate in FY24.

Add to that the Indian government’s heightened focus on manufacturing, and you’ll get a clear picture of the future.

While all this may seem rosy, it does not mean we are in the clear when it comes to valuations.

The Big Problem with Valuations

This is probably the most important risk for the Indian stock market.

We believe, the main reason for a correction in the market was the bull market that preceded it.

Barring the brief Covid crash, the market has not faced any significant correction in the last few years.

You see, the higher the market rises, beyond what is justified by earnings growth, the riskier it becomes to have money in the market. This is measured by the humble PE ratio.

Benchmarks – Sensex and Nifty‘s PE were close to 25 at the start of the correction. Market veterans know this is a good thumb rule for thinking about risk in the Indian stock market.

It’s not surprising that the market reversed direction from that particular valuation.

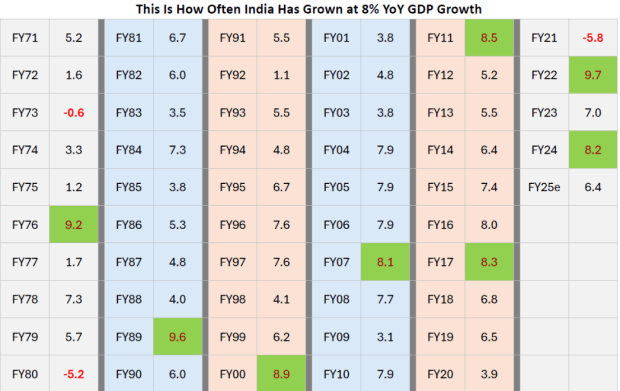

A slowdown in corporate earnings and sustained FII outflows have only added to worries. And it’s not easy to grow at 8% every year.

The below image by DSP Mutual Fund shows how India hasn’t seen two consecutive years of 8% GDP growth since 1971.

Data Source: DSP Mutual Fund

Another Metric Pointing to Overvaluation

While investors usually look at the price to earnings multiple for gauging undervalued and overvalued territories, an overlooked ratio is the CAPE ratio.

The acronym CAPE stands for cyclically adjusted price-to-earnings ratio.

Investopedia defines the CAPE ratio as a valuation measure that uses real earnings per share (EPS) over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of a business cycle.

So, where does the Indian stock market stand when it comes to CAPE ratio?

According to a report, the CAPE for Indian equity market stood at around 43 a couple of months ago.

This figure is quite high compared to a 20-year average of 25.2 and 10-year average of 24.2.

The CAPE ratio is currently at one of the highest points it’s been at since the dot-com bubble.

If you would have taken a look at this ratio during the peak of the dot-com bubble, you could have avoided the subsequent crash.

Don’t be mistaken though. Investing solely based on one metric can be a bad idea sometimes.

With that big picture for India out of the way, let’s look at different segments of the Indian stock market.

Large-cap Stocks

Large, established businesses have fallen the lowest amid the current market correction due to these three factors:

- Concerns about higher valuation in both global and domestic stock markets, which could potentially nosedive on the slightest hint of crisis.

- Significant technological or geopolitical uncertainties.

- Disappointment over the earnings performance in recent quarter compared to market consensus.

None of these factors are structural and they do not call for a permanent change in the earnings estimates for certain quality businesses.

Rather, the recent correction is an ideal opportunity to buy the dip in bluechip stocks that are offering substantial margin of safety in valuations.

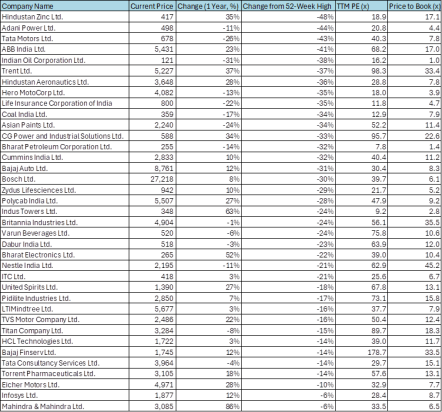

Here’s a table showing the performance of some of the large-cap stocks in India and how much they have corrected from the top.

Source: Equitymaster

To filter out some names from the entire list of largecap stocks (100), we put some filters like minimum ROE and ROCE of >20, and a debt-to-equity ratio of <1.

Mid-cap Stocks

A mixed bag of high valuations, lower than expected economic growth, currency depreciation and other factors, have led investors to book some profits and cash in on the gains made in the past few years.

Thus, there has been a correction in mid-cap stocks across the board.

Investors and traders in the stock market are currently unsure about the direction the market could take in the short term. They have good reason to be cautious about making big bets at the moment.

While the correction in midcaps has been severe, the beauty of investing in them is that they sit between the stable but slow growing largecaps and the high return but risky smallcaps.

Mid-cap stocks are the ones that are currently growing… passing through the initial uncertain growth phase… and evolving into large powerhouses.

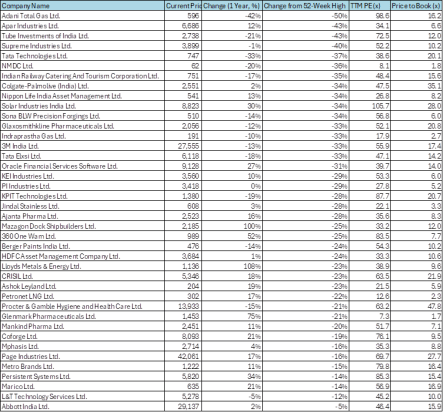

Out of the entire universe of midcaps (150 stocks), these are the ones that have return ratios in excess of 20% and a debt-to-equity ratio below 1.

Source: Equitymaster

Small-cap Stocks

For smallcaps, the possibility of a further correction cannot be ruled out.

Our editors have been warning about the froth in smallcap valuations for some time now.

One aspect of investing in smallcaps that has become popular in recent months is thematic investing.

Green energy, EVs, AI, semiconductors, smart meters… with a bit of creative storytelling, any stock you pick can be made to fit a theme. But it does not, by default, deserve a space in your portfolio.

As such, it would make sense to stick to your asset allocation guidelines and avoid any kind of over exposure to smallcaps.

Caution in stock selection and a conservative, staggered approach to buying and selling will be critical for protecting capital and navigating market uncertainty.

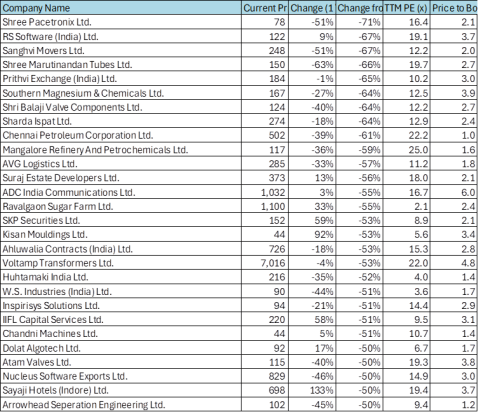

Similar to how we highlighted the beaten-down stocks from the largecap and midcap spaces, here’s how the table looks like when we consider smallcaps.

Source: Equitymaster

Out of the 4,767 actively traded smallcaps, only 419 manage to make it past our filters of ROE, ROCE and debt to equity. We also put valuation filters like PE<25.

Out of 419, the ones highlighted in the table above have corrected more than 50% from their 52-week highs.

The Ultimate Question – How Much Risk Can You Handle?

Let’s go all the way back to the global financial crisis of 2008 where the meltdown caught out those entrusted with guiding others.

In 2011, a financial advisor going by the name of Carl Richards, ended up losing his home in the wake of the crisis.

His downfall was rooted in a common miscalculation. Like many at the time, he assumed that the housing market’s upward trend would persist, leading him to overextend by purchasing an expensive home.

When the crisis hit, it was a particularly hard blow since his business model depended on assets under management – while, at the same time, his expenses for health insurance, property taxes, and mortgage payments surged.

Unable to meet these increased financial demands, he was forced to sell his home in a short sale.

This serves as a powerful reminder of the importance of risk management. While many of us are confident in our ability to manage the risks within our investment portfolios, historical evidence suggests that underestimating these risks can lead to severe consequences.

Ultimately, selling in a panic and attempting to time the market during turbulent periods often stem from assuming risks that exceed one’s comfort level.

For example, take a look at the chart below which shows the performance of BSE 500 index in India.

As you can see, the general trend of the markets has been up following the 2008 crash. This may have given investors an illusory feeling of security, nudging them toward increasingly high-risk portfolios.

Ultimately, the level of risk you assume should mirror both your personal tolerance for uncertainty and the specific returns needed to reach your financial targets.

Co-head of Research at Equitymaster Rahul Shah sums this equation up beautifully. Here’s what he wrote in one of his editorials about how to invest in a speculative market…

Well, the solution is quite simple to be honest. You need to buy stock market insurance.

You see, you buy normal insurance policies to protect your family, your assets and yourself from financial risk/losses.

Likewise, you also need to buy a stock market insurance to protect yourself against a stock market crash.

And this insurance is nothing but the amount of money you want to set aside as cash or in the form of bonds or fixed deposits.

This proportion of bonds or fixed deposits will depend on how speculative you think the market has become.

If the market is highly speculative and there is no margin of safety, then you can be as much as 40-50% in bonds or fixed deposits or even higher.

If you feel that there is low risk to the market and the market will keep going up, then maybe you can be 75% in stocks and only 25% in bonds. However, keep the bond amount meaningful at all times.

No businesses are spared. Megacaps, largecaps, midcaps, smallcaps, microcaps – all stocks fall in a market crash. Hence, insurance is a must, especially during current times when speculative activity is at its peak.

Final Words

Given the exceptional run of the Indian stock market after the Covid crash, the obvious question is how sustainable is the current growth rate?

India is going through a massive transformation and becoming a major centre of power.

We are locked in a global competition for supremacy across trends including AI, semiconductors, renewable energy, etc.

Our country has the talent, capital, and the regulatory support from the government. If we accomplish what we are capable of, there should be an explosion of economic activity and stocks will go much, much higher.

Betting against the Indian economy during a golden age has never played out well. There is no reason to believe it will work this time either…

But as is the case with any stock, you must allocate sufficient time to do the necessary due diligence. This is true both, before and after buying.

Also consider corporate governance as a key part of your due diligence on the stocks in your portfolio.

Before we leave you with your thoughts, here’s an episode we recorded with S Naren on finding the right stocks to own.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.