Dolly Khanna is a very well-known investor in the investor circles. Her investments include a diverse range of companies across various sectors, which highlight her ability to identify growth opportunities. Khanna’s investment approach focuses on long-term value creation, often involving extensive research and analysis.

She currently holds 17 stocks with a net worth of Rs 365 cr, as per Trendlyne.com

But she just raised her stakes in 2 stocks she has been holding for some time now. One of them has a high ROCE (Return on Capital Employed) of over 32%, while the other has reduced debt, trading at 0.9 times its book value. But the common thing in both is that they are both trading at crash induced discounts of over 40%.

Why did Dolly raise stakes in this company? Are these the future multibaggers? Let us see if we can find that out.

Prakash Industries Ltd

Prakash Industries Limited was originally established as Prakash Pipes and Industries Limited on July 31, 1980. The company, formerly known as Prakash Industries Limited, now manufactures and sells steel products and generates power.

With a market cap of Rs 2,861 cr, the company has seen a holding by Dolly Khanna since September 2023 (as per data available on Trendlyne.com). As on the quarter ending December 2024, Dolly held a stake of 1.28% in Prakash Industries, which she raised to 2.07%.

The company has reduced its Debt from Rs 661 to Rs 378 cr in the last 5 years as per screener.com

The sales for Prakash Industries have grown at a compound rate of 1% from Rs 3,588 cr in FY 19 to Rs 3,678 cr in FY24. And 9MFY25, the company has logged in sales of Rs 3,170 cr already.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Prakash Industries has seen a fall of about 38% from Rs 788 cr in FY19 to Rs 493 cr in FY24. Also, for the 9MFY25, the EBITDA of Rs 388 cr has been recorded.

Talking about the net profits, it must be viewed differently. It fell form Rs 539 cr in FY19 to Rs 348 cr in FY24. However, this 348 cr is a jump of about 83% from the profits of FY23 which was Rs 190 cr.

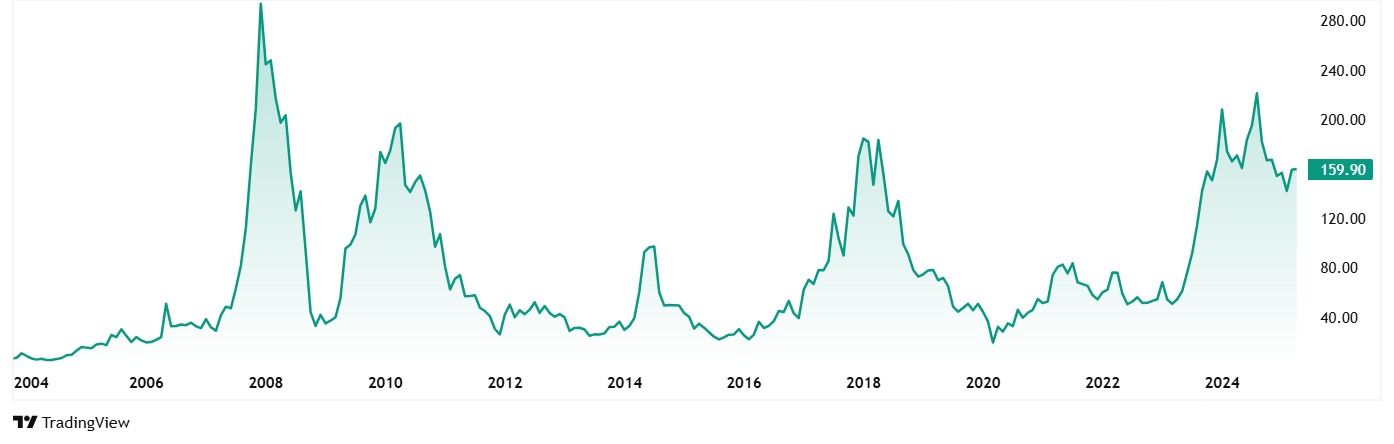

The share price of Prakash Industries saw a jump of around 566% from its 5-year-old price of Rs 24 to its current day price of 160 (as on closing of 9th April 2025).

Currently at Rs 160, the share is trading at a discount of 48% from its all-time high of Rs 310.

The company’s share is trading at a current PE of 8x while the industry median is 22x. The 10-year median for Prakash Industries is 7x and the industry median for the same period is 19x.

The FII (Foreign Institutional Investors) holding for Prakash Industries has slightly grown from 3.69% as of quarter ending in December 2024, to 3.82% for the quarter ending March 2025.

In April 2019, the company demerged its PVC Pipes & Fittings and Flexible packaging business into Prakash Pipes Ltd, which is the next stock that has seen raised stakes by Dolly Khanna.

Prakash Pipes Ltd

Once a part of Prakash Industries Ltd Above, Prakash Pipes Ltd was Incorporated in June 2017 after a demerger from Prakash Industries Ltd.

With a market cap of Rs 914 cr, Prakash Pipes is engaged in the manufacturing of PVC pipes & fittings and packaging products.

Prakash Pipes has also branched out into flexible packaging, building a top-notch plant in Uttarakhand. They are making high-quality films and pouches for everything from food to pharmaceuticals, focusing on cost-effective, innovative solutions.

The company boasts of a ROCE of 32.7%, which means it makes over Rs 32 on ever Rs 100 it spends as Capital. This speaks tons about Prakash Pipes’s capital efficiency.

Dolly Khanna has been holding a stake in the company since December 2021 (as per data on Trendlyne.com). Her current stake has gone from 3.71% in December 2024 to 4.08% for the quarter ending March 2025.

Surprisingly, another warren Buffet of India, Mukul Agarwal has reduced his stake in Prakash Pipes from 2.51% to 2.36%.

The sales for Prakash Pipes have grown at a compounded rate of 14% in the last 5 years.

| FY19 | FY20 | FY21 | FY22 | FY23 | FY24 | 9MFY25 |

| 341 | 385 | 476 | 617 | 709 | 669 | 597 |

EBITDA grew from Rs 39 cr in FY19 to Rs 107 cr in FY24, making it a CAGR of about 23%. Between April to December 2024, Prakash Pipes logged Rs 100 cr in EBITDA.

The profit after tax grew form Rs 29 cr in FY19 to Rs 90 cr in FY24, which means it grew at a compounded rate of 26%. And for 9MFY25, profits of Rs 72 cr have already been recorded.

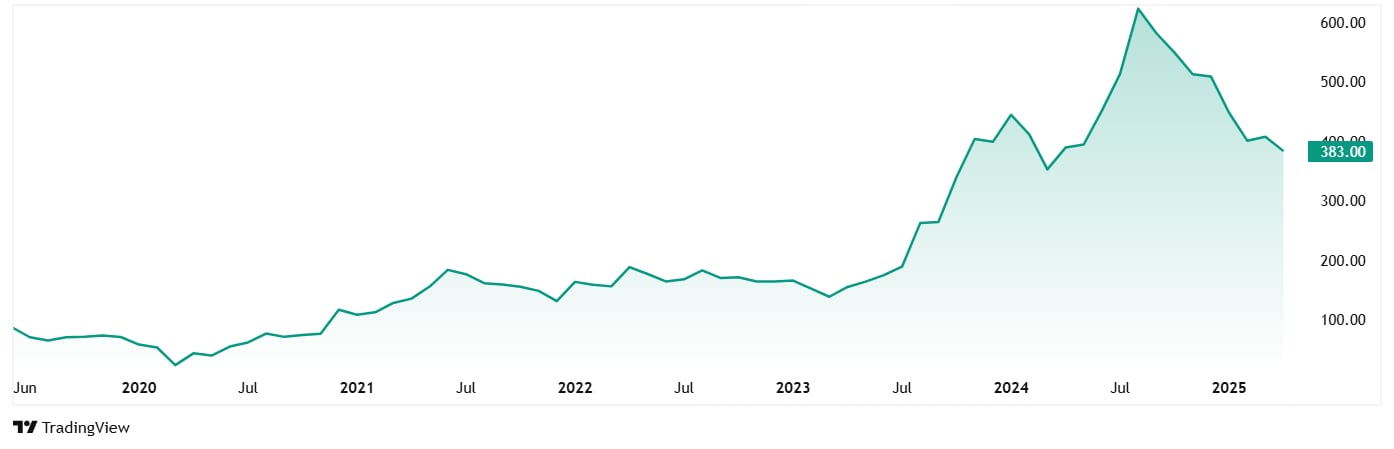

The current share price of Prakash Pipes is Rs 382 as on closing of 9th April 2025, which is a jump of about 1,265% from Rs 28 in the last 5 years.

Even at the current price of Rs 382, the share is trading at a discount of about 43% from its all-time high of Rs 668.

The company’s share is currently trading at a PE multiple of 9x, while the industry median is 25x. The median PE for the last 10 years is 8x, which would once again suggest that the current valuation multiple is at a small premium to its long-term median. The industry median for the decade is 27x.

By FY26, Prakash Pipes aims to expand its packaging capacity to 36,000 MTPA, specializing in extrusion-coated and laminated structures. In addition, Prakash Pipes plans to launch a new line of HDPE drums, which are essential for the pharmaceutical, chemical, and food processing industries.

Timed Bets or Quicksand?

Investors across the board are keenly observing Dolly Khanna’s strategic moves to expand her holdings in Prakash Industries Ltd and Prakash Pipes Ltd. Given her track record for identifying stocks with substantial growth potential, her increased investment in these companies indicates a belief in their significant future prospects.

Both Prakash Industries and Prakash Pipes present intriguing investment narratives. Prakash Industries is focused on reducing its debt and appears to be undervalued by the market, while Prakash Pipes boasts strong financial metrics, such as its ROCE, and is pursuing aggressive expansion initiatives. These factors suggest the potential for substantial returns.

Given that these stocks are currently available at over 40% discounts form their all-time high prices, it would be a good idea to have them under your scanner. Added to your watchlist maybe.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.