Ashish Kacholia, rightly so called as the Big Whale of the Indian Markets, was once a student and then partner of Rakesh Jhunjhunwala at Hungama Digital. He also founded Lucky Securities in 1995. No introduction is needed for him.

But soon, he will all eyes on his portfolio. As Q1FY26 ends and the exchange filings are made, investors across board are very excited to know which way his portfolio will move. After all, in the last quarter shook his portfolio with 8 Fresh stakes, 3 additional buys and stake reductions in 7 existing ones.

And right now, 2 of his favourite stocks are trading near 52-week lows. What will Kacholia do with these stocks? The bigger question is what will you do if you own these stocks?

NIIT Learning Systems Ltd

Incorporated in 2001, NIIT Learning Systems Ltd helps leading companies across 30 countries transform their learning ecosystems while increasing the business value of learning.

With a market cap of Rs 4,774 cr, the company is trusted by the world’s leading companies, for providing high impact managed learning solutions that weave together the best of learning theory, technology, operations, and services to enable a thriving workforce.

Ashish Kacholia has held around a 2% stake in the company since July 2023, which at the end of the quarter closing in March 2025 was worth around Rs 96.5 cr.

The company’s sales have grown from Rs 1,132 cr in FY22 to Rs 1,653 cr in FY25, which is a compound growth rate of 13% in the last 3 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for NIIT Learning was Rs 297 cr in FY22. And for FY25, it grew to Rs 355 cr, logging in a compound growth rate of about 6%.

The net profits grew from Rs 202 cr in FY22 to Rs 228 cr in FY25, which is a compound growth of 5%.

The share price of NIIT Learning Systems Ltd was around Rs 375 at listing in August 2023 and as of 19th June 2025 it had dropped to Rs 350, which is close to its 52-week and all-time low price of Rs 323.

And at this current price, the stock is trading at a discount of 35% from its all-time high of Rs 542.

The company’s share is trading at a current PE of a modest 20x, while industry median is 37x. The 10-year median PE for NIIT Learning Systems is 27x, while the industry median for the same period is a 25x.

The company is almost debt free and boasts of a ROCE (Return on Capital Employed) of almost 28%. No wonder it does not shy away from paying back to its investors. With an enviable dividend yield of 1.49%, NIIT Learning System maintains a healthy payout ratio of 17%.

Stove Kraft Ltd

Incorporated in 1999, Stove Kraft Ltd manufactures a wide range of kitchen solutions under Pigeon (value), Gilma (semi-premium) brands and acts as an exclusive partner for kitchen appliances of the BLACK + DECKER (premium) brand.

With a market cap of Rs 1,930 cr, the company is one of the leading brands for home and kitchen appliances in India, a dominant player for pressure cookers, and among the market leaders in standing hobs, cooktops, and nonstick cookware. It has the 3rd largest market share of 12% in non-stick cookware by volume.

Kacholia has been holding a stake in the company since March 2022 and as of the quarter ending March 2025, he held a 1.7% stake worth Rs 34 cr.

The company’s sales jumped from Rs 670 cr in FY20 to Rs 1,450 cr in FY25, logging in a compound growth of 17% in the last 5 years.

EBITDA for Stove Kraft has jumped from Rs 34 cr in FY20 to Rs 151 cr in FY25, which is a compound growth of 35%.

As for the net profits, Stove Kraft saw a compound growth of 65% between Rs 3 cr in FY20 and Rs 39 cr in FY25.

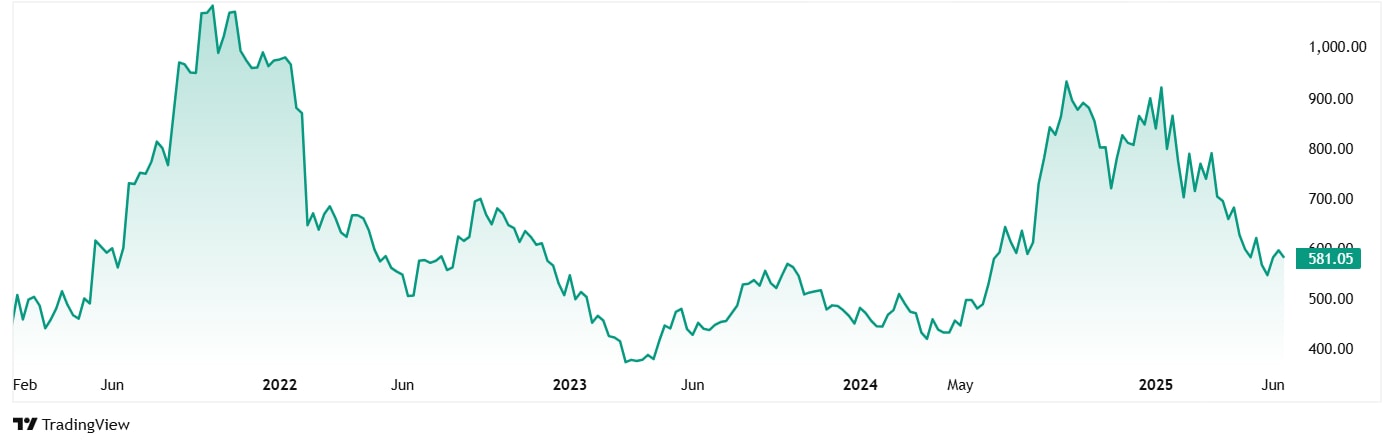

The share price of Stove Kraft was around Rs 445 at listing in February 2021. As of 19th May 2025, the price was Rs 583, which is closer to its 52-week low price of Rs 525.

At the current price of Rs 583, the company’s share is trading at a discount of almost 49% from its all-time high of Rs 1,135.

The share is trading at a PE of 50x, while the industry median is 52x. The 10-year median PE of Stove Kraft is 48x while industry median for the same period is 52x.

Apart from Kacholia, Vanaja Iyer and Dolly Khanna also hold 1.1% and 1.3% stakes respectively in the company.

Big Changes from Big Whale?

For an average investor, it means panic to see his or her holdings hit lows. Mostly followed by panic driven rash decisions. But in case of Ashish Kacholia, who is also one of the Warren Buffetts of India, it is not the same. Strategies and vision of the Warren Buffetts of India are only known to them.

Both stocks we saw today have been held by Kacholia for a few years now and have shown sustained sales and profits. However, when it comes to the share prices, both are on shaky grounds. Is this an opportunity for Kacholia to buy more of them at such low values or will he tap out?

We will have to wait for his exchange filings which will start coming in July 2025, so soon. But for now, adding these stocks to a Watchlist and following them is a promising idea.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.