Vijay Kedia needs no introduction. With a current portfolio of 15 stocks worth almost Rs 1,400 cr, he is a guru figure for many in the investor circles. After all, he started investing at the age of 19, when most people are trying to ensure they have a steady job.

His SMILE strategy is very well known which in his words is “small in size, medium in experience, large in aspiration, and extra-large in market potential’”. His strategies and his trac record have also earned him the title of “Market-Master.”

Currently, two stocks in this market master’s highly followed portfolio, which he has held for more than half a decade are trading at a discount of over 45%. Are these opportunities or traps? Let us see if we can find out.

Affordable Robotic & Automation Ltd

Incorporated in 2009, Affordable Robotic& Automation Ltd is a Turnkey Automation Solution provider for all kind of Industrial Automation.

With a market cap of Rs 506 cr, the company is the 1st robotic BSE-listed company that provides automation solutions for welding lines using robotics and related designing services.

Market Master Vijay Kedia has been holding a stake in Affordable Robotic & Automation Ltd since September 2018 as per Trendlyne.com. Currently he holds almost a 10% stake in the company worth Rs 50 cr.

The company’s sales have grown from Rs 102 cr in FY20 to Rs 163 cr in FY25, which is a compound growth rate of 10% in the last 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) however has taken a huge hit in the last 5 years, from Rs 8 cr in FY20 to a loss of Rs 3 cr in FY25.

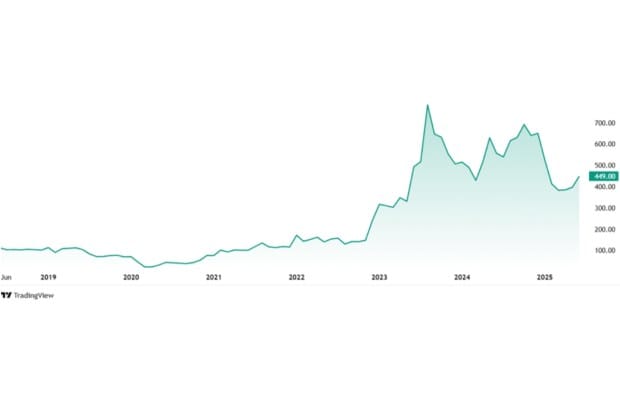

The net profits also are an area for concern for Affordable Robotics, as it when from profits of Rs 3 cr inn FY 20 to losses of Rs 12 cr in FY25.The share price of Affordable Robotic & Automation Ltd was about Rs 42 in June 2020, and as market closing on 27th June 2025 it was Rs 450, which is a 971% jump in just 5 years. Rs 1 lac invested in the stock 5 years ago, would have been close to Rs 10.75 lacs today.

However, even at this appreciated current price, the stock is trading at a discount of a 47% from its all-time high of Rs 851.

The company’s share is trading at a negative PE currently due to the reported losses, while the industry median is 37x. The 10-year median PE for the company is 66x, while industry median is for the same period is a 27x.

Currently, nothing seems to be working in the favour of the company when it comes to financials and operational growth. However, Kedia is still holding the stocks, which raises eyebrows as to if there is a hidden story that Kedia knows and the average investor does not.

Tejas Networks Ltd

Incorporated in 2000, Tejas Networks Ltd designs and manufactures wireline and wireless networking products, with a focus on technology, innovation, and R&D.

With a market cap of Rs 12,689 cr, Tejas Networks Ltd is promoted by Panatone Finvest Limited, a subsidiary of Tata Sons Private Ltd and ranks among the top 10 global suppliers in optical aggregation and fiber broadband.

Vijay Kedia has held a stake in the company since June 2020 as per data on Trendlyne.com. Currently he holds 1.02% stake in the company worth Rs 129 cr.

The company’s sales jumped from Rs 391 cr in FY20 to Rs 8,923 cr in FY25, logging in a compound growth of a big 87% in the last 5 years. The growth was, to a large extent, on account of a very large contract from BSNL which is now coming to an end.

EBITDA for Tejas Networks was a negative Rs 87 in FY20. In FY21, it was at Rs 53 cr which grew to Rs 1,258 cr in FY25, logging in a compound growth of 120% in 4 years.

As for the net profits, the company recorded losses of Rs 237 cr in FY20 and profits of Rs 447 cr in FY25.

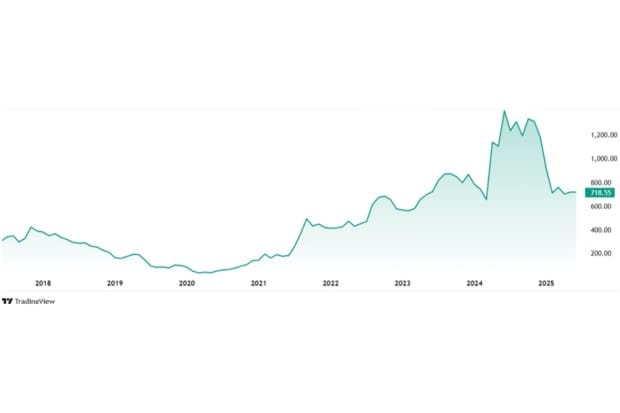

The share price of Tejas Networks Ltd has grown from its five years old price of around Rs 48 in June 2020, to its current price of Rs 718 (as of closing on 27th June 2025), which is a jump of about 1,400%.

Rs 1 lac invested in the stock 5 years ago would be today almost around Rs 15 lacs.

At the current price of Rs 718, the company’s share is trading at a discount of almost 52% from its all-time high of Rs 1,495.

The share is trading at a PE of 28x, while the industry median is 27x. The 10-year median PE of Tejas Networks is 21x which is same as that of the industry median for the same period.

As of FY25, the company has a total order book of Rs 1,019 cr. In FY26, the company expects sturdy growth driven by a significantly expanded product portfolio, including advanced 5G radios, 4G/5G core, enhanced optical solutions and new IP/MPLS routers.

While Tejas Networks’ recent expansion was greatly supported by a significant contract with BSNL, the company may now encounter challenges as this large order finishes. Potential issues include BSNL’s slower project rollout and its financial state, which could impact future business or payment schedules. Moreover, BSNL’s move to a revenue-sharing system for its 5G tender increases financial risk for Tejas, as its profits will depend heavily on BSNL’s market success. This strong reliance on one major state-owned client also exposes Tejas to the specific difficulties associated with such large operators.

Market Master’s Next Move?

The two stocks we looked at today are both telling different stories in terms of financials. While Tejas Networks is probably on the comeback route and logging in strong numbers, Affordable Robotics is struggling in the areas of profits.

But both have two things common in them. Firstly, they are both trading at a discount of over 45% from their all-time high prices. And secondly, market master Vijay Kedia has held them over half a decade and continues to hold even after over 45% decline.

So, as we wait for the quarterly exchange findings to see if Kedia still holds them or books losses and moves on, it would not hurt to keep an eye on these stocks by adding them to a watchlist.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.