India’s defence shipbuilding sector has seen an upward trajectory in recent years, strengthening the nation’s position in the global maritime defence landscape. With self-reliance as a key focus area, India’s domestic shipbuilding expertise, integration of advanced marine technology and strategic tie-ups continue to drive the sector.

The nation’s private and public defence shipyards are equipped in constructing advanced warships, submarines and aircraft carriers. The government’s “Make in India” initiative continues providing a strong boost to the industry, paving the way for the adoption of cutting-edge innovation and manufacturing practices.

Net Demand Potential

Defence shipbuilding is projected to create 10 million Compensated Gross Tonnes (CGT) of additional load till at least 2030. This load has propelled the indigenous shipbuilding ecosystem of the country. A substantial amount of industrial infrastructure including nuclear power stations is lined up along 200 kilometres of the country’s coastline. The urgency to provide sufficient patrolling of this extensive coastline has necessitated the construction of over 100 naval ships in the past few years.

Focus on Capacity Expansion

As per industry analysts, India is facing an urgency to expand its shipbuilding capacity, as leading foreign players in the other Asian nations like China, South Korea, and Japan are inundated for the next few years. Indian shipyards are currently focused on securing contracts for defence ships from the government and that of green vessels from global fleet owning companies. In order to align with the Maritime India Vision 2030, domestic shipbuilding capacity in India is required to increase from 0.072 million gross tons (GT) to 0.33 million GT by 2030 and further to 11.31 million GT by 2047.

Industry Opportunity

The Indian shipbuilding sector is anticipated to grow sharply to INR 70,478 crore by 2033, from INR 9,866 crore in 2024. While India currently occupies less than 1% share of the global shipbuilding market, it aims to crack a spot amongst the top 10 by 2030 and the top 5 by 2047.

India’s naval shipbuilding sector received a major impetus with allocation of the Maritime Development Fund (MDF) in Budget 2025. The finance ministry has announced INR 25,000 crore for the financing of shipping, shipbuilding, and port infrastructure sectors. The policy also aims for an investment influx of up to INR 1.5 lakh crore by 2030.

The Indian Navy has a pipeline of 180 vessels to be added to its fleet by 2030, bolstering the naval defence manufacturing sector of the country. In August 2025, the Indian Navy commissioned the latest cutting-edge Project 17A stealth frigates, namely Udaygiri and Himgiri, at Naval Base in Visakhapatnam. The Indian Navy is also set to commission its second Anti-Submarine Warfare Shallow Watercraft (ASW-SWC), Androth, at the Naval Dockyard in Visakhapatnam in October this year.

Here we take a look at 3 defence shipbuilding companies in India, which are expected to be cashing in on the long-term growth potential of the sector.

#1 Mazagon Dock Shipbuilders Ltd

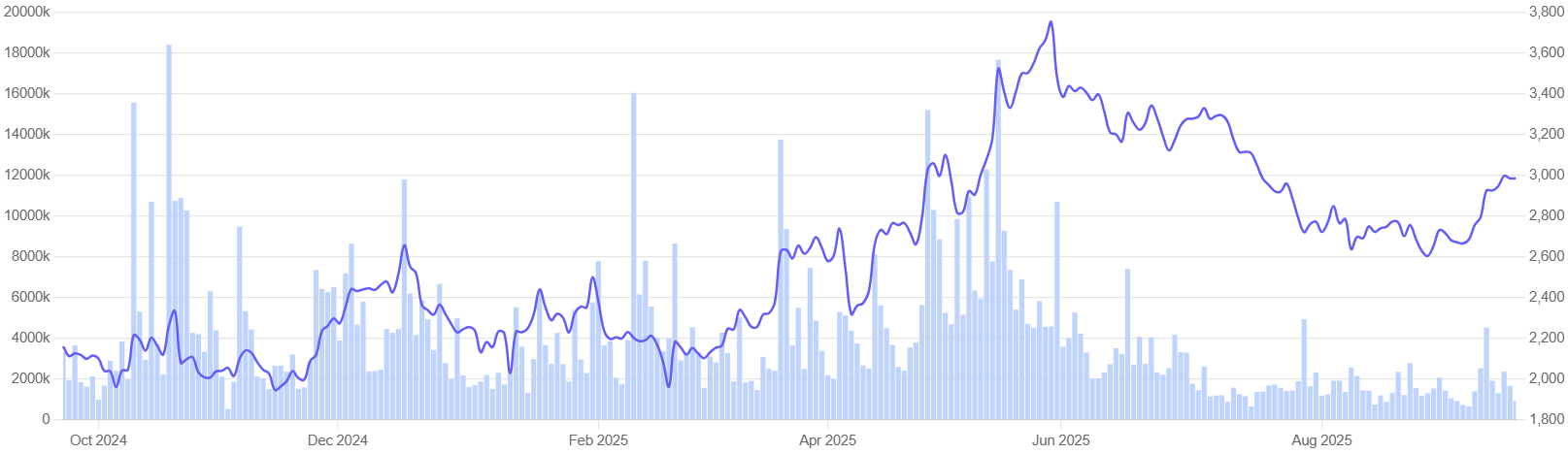

Valued at a market cap of INR 1,20,409 crore Mazagon Dock Shipbuilders (MDL) stock has returned approximately 38% in the past one year.

Founded in 1774, MDL is one of the oldest and most prominent shipyards in India. Since 1960, it has built over 801 vessels which comprise advanced warships, destroyers, frigates, missile boats and submarines for the Indian Navy and Coast Guard.

It is the only Indian shipyard to that holds the recognition of being awarded the Navratna status. It is among the first shipyards to produce Veer and Khukri-class corvette. The company boasts a capacity to manufacture 11 submarines and 10 warships simultaneously.

In December 2024, the Mumbai-based company completed the deliveries of the INS Nilgiri, the inaugural Project 17A class stealth frigate and the INS Surat, the fourth among the batch of the Project 15B class guided missile destroyers. While the INS Nilgiri is equipped with state-of-the-art design that ensures top-notch stealth capabilities, the INS Surat has been designed with advanced weaponry systems.

Moreover, in early January 2025, MDL delivered the INS Vagsheer to the Indian Navy. The Vagsheer submarine has been manufactured under Project-75 in partnership with France’s Naval Group. This sixth and final Kalvari-class submarine has been tailored for a wide array of missions including “anti-surface warfare and intelligence gathering”.

In December 2024, the company was awarded a contract worth INR 1,990 crore by the MoD to manufacture and integrate an Air Independent Propulsion (AIP) Plug for submarines. It is designed to augment the durability of the Scorpene-class submarines operated by the Indian Navy. The deal focuses on sharpening the company’s indigenous submarine design capabilities. In FY25, it also exported hybrid vessels worth above INR 701 crore to Europe.

As of the end of FY 2025, the company registered a cumulative order book worth INR 32,260 crore. The order bulk mostly consists of contracts for pending deliveries of P17A Frigates, P15B Destroyers and Kalvari Submarines to the Ministry of Defence. Its revenues for the fiscal came in at INR 11,432 crore, a YoY growth of 21%.

The stock is currently trading at a trailing price-to-earnings multiple of 55.5. The stock currently has an EV/EBITDA ratio of 36.5, as compared to the industry median of 28.9.

Mazagon Share Price Return: 1 year

#2 Swan Defence and Heavy Industries Ltd

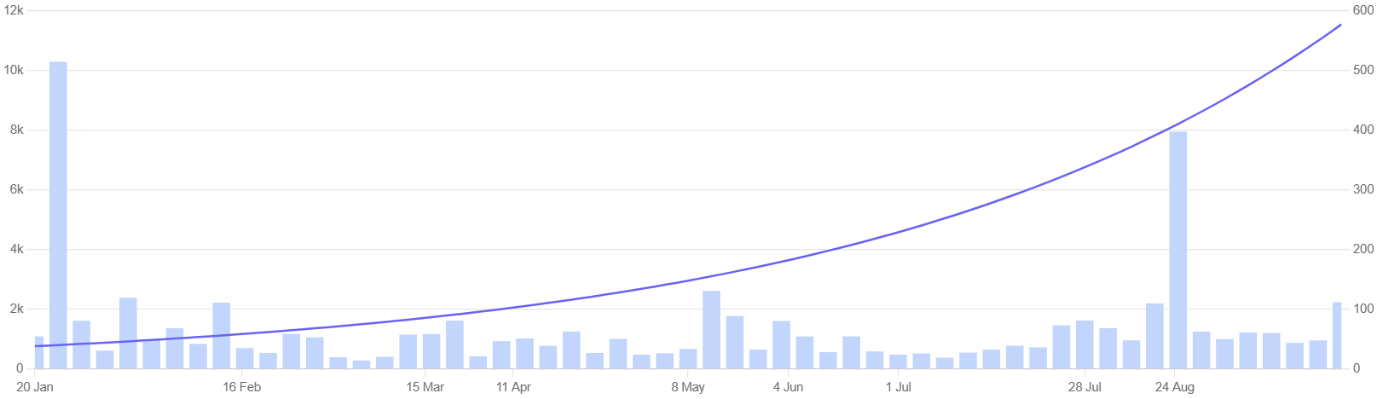

Valued at a market cap of INR 2,896 crore Swan Defence and Heavy Industries (SDHI) stock has returned approximately 1,427% in the past one year.

Founded in 1997, Swan Defence specialises in the construction of vessels, repairs and refitting of ships and rigs. With a 662 x 65 m dry dock with a capacity of 4 lakh Deadweight Tonnage (DWT), the company has one of the most expansive shipbuilding infrastructures in the nation.

In August 2024, the company initiated its ship repair operations, with the Indian Coast Guard as its inaugural customer. Two more vessels were also docked in November 2024, further diversifying the company’s service portfolio.

In September 2025, SDHI inked a Memorandum of Understanding (MoU) with Sagarmala Finance Corporation (SMFCL) to build maritime infrastructure projects under the purview of the Maritime-focused Equity Fund (MfEF). Around the same time, the company signed yet another MoU with the Gujarat Maritime Board (GMB) for a landmark investment of INR 4,250 crore. The partnership is aligned with the shipbuilding firm’s goal to upgrade its shipyard infrastructure.

In April 2025, the company signed a MoU with Garden Reach Shipbuilders & Engineers Limited. The partnership caters to the shipbuilding firm’s objective of leveraging opportunities in the arena of commercial vessel and offshore structures construction. The deal is designed to serve both the international markets and domestic maritime objectives.

Going forward, all these partnership deals are slated to give a major boost to the company’s revenues which are generated entirely from the defence shipbuilding and ship repair business.

Due to the operating loss reported by the company, valuing the stock on EV/EBITDA metric will not be meaningful. The profits of the company compounded 24% over a 3-year period.

Swan Defence Share Price Return: 1 year

#3 Cochin Shipyard Ltd

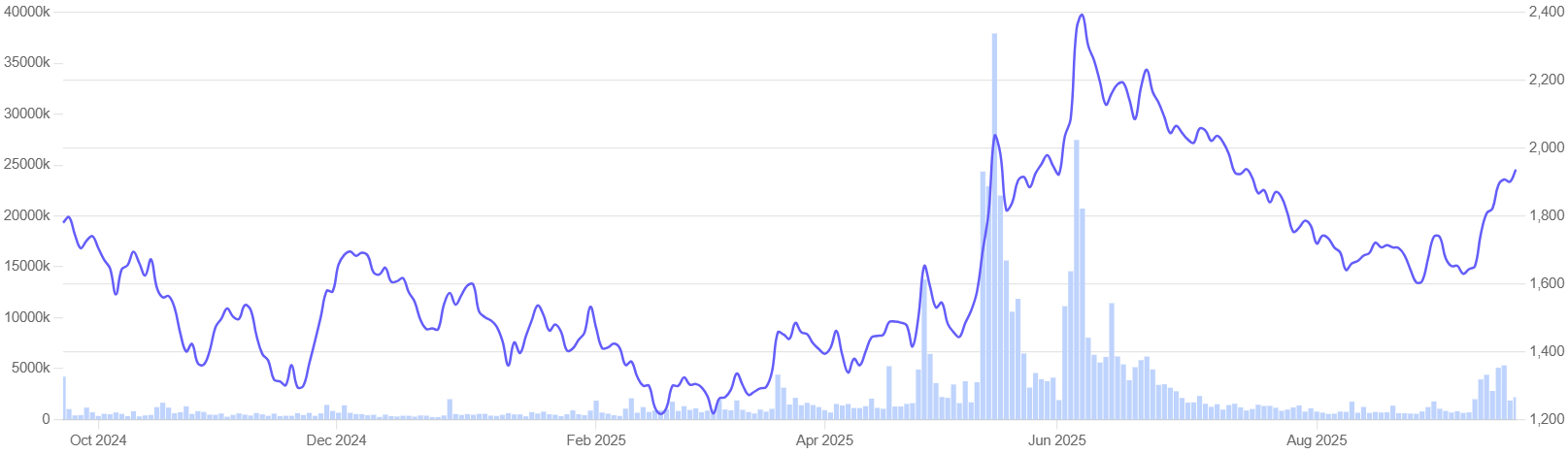

Valued at a market cap of INR 50,006 crore Cochin Shipyard Limited (CSL) stock has returned approximately 8.8% in the past one year.

With its inauguration in 1972, Cochin Shipyard is a front-runner in construction, repair and refitting of a wide variety of vessels. The company specialises inbuilding massive carriers as well as ships like Platform Supply vessels, Anchor Handling Tug Supply Vessels which leverage advanced technology.

In early 2025, the state-operated company announced its plans for capacity expansion by establishing a shipbuilding facility, backed by a foreign partnership, in Cochin Port. In 2024, the company had also inaugurated an international ship repair unit, valued at INR 970 crore and spread over 42 acres of land at Willingdon island in Cochin.. This comes on the heels of the shipyard commissioning its third dry dock worth INR 1,799 crore to support the production of large vessels comprising LNG carriers, Capesize and Suezmax ships, oil rigs, and semi-submersibles.

In July 2025, the shipyard inked a MoU with South Korea’s HD Korea Shipbuilding & Offshore Engineering (KSOE) to explore shipbuilding and maritime collaboration opportunities in the long run. In September 2025, it secured an INR 200 crore contract with ONGC, for the dry docking and pivotal maintenance of one of ONGC’s jack-up rigs. In April 2024, Cochin Shipyard signed the Master Shipyard Repair Agreement (MSRA) with United States Navy.

In June 2024, the companyinked a contract with Norway-based Wilson ASA for design and construction of four 6300 TDW dry cargo vessels. In early 2024, the company secured a contract from a European client, for the design and manufacture of two or more Hybrid Service Operation Vessel (Hybrid SOV). In April, Cochin Shipyard signed the Master Shipyard Repair Agreement (MSRA) with United States Navy.

As of August 2025, the shipyard has registered an order book worth INR 21,000 crore with around INR 13,700 crore worth of contracts coming from the defence sector.

The stock is currently trading at a trailing price-to-earnings multiple of 58.8. The stock currently has an EV/EBITDA ratio of 37.1, as compared to the industry median of 28.9.

Cochin Shipyard Share Price Return: 1 year

Valuation Comparison With Peers

| Company | TTM P/E | ROCE | ROE | EV/EBITDA |

| Mazagon Dock Shipbuilders | 55.5x | 43.2% | 34% | 36.5 |

| Swan Defence | – | -5.8% | -46.3% | NM |

| Cochin Shipyard | 58.8x | 20.4% | 15.8% | 37.1 |

| LaxmiPati Engineering Works | 27.8x | 18.6% | 122% | 22.3 |

| Hariyana Shipbreakers | 36.1x | 3.2% | 1.10% | 14.1 |

| Industry Median | 55.8 | 19.5 | 24.9 | 28.9 |

Here we see that while Mazagon Dock and Cochin Shipyard are currently trading at high P/E and EV/EBITDA multiples, Swan Defence is loss making and hence its valuations metrics are not meaningful. While LaxmiPati reports the highest ROE, Hariyana Shipbreakers registers below industry average-valuations across all metrics. These two companies are however, very small, and are not reflective of the strength of the sector.

Conclusion

Despite an upward growth trajectory, it is to be noted that defence shipbuilding in India is largely dominated by Defence Public Sector Undertakings (DPSUs), with private shipyards occupying a small share of the market. Some of the issues plaguing the sector are high working capital, poor cash flow and failed debt restructuring initiatives. However, the government is well on its track to encourage greater participation of private-sector investors and reduction of foreign import reliance by introducing conducive policy reforms like “Aatmanirbhar Bharat”.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information. A few other sources used for various data points are Press Information Bureau, Ministry of Defence, Indian Navy and research houses like KPMG.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Sriparna Ghosal is an experienced financial writer. She has studied Economics at the Calcutta University. She started her career as a financial writer with Zacks Investment Research. Post that, she moved into consulting firms like Crisil. Her interest extends to global stocks as well.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.