After years of being written off, a clutch of Anil Ambani Group stocks is suddenly back in the spotlight. Shares of companies like Reliance Power and Reliance Infrastructure have surged sharply recently, drawing interest from retail investors. The rally comes on the back of a series of positive developments, including withdrawals from insolvency proceedings, debt reduction, earnings boosts, and a push for clean energy.

But what’s the complete story behind the rally, and will it sustain? Let’s find out..

#1 Reliance Infrastructure

Reliance Infrastructure is an Anil Dhirubhai Ambani Group Company. It is an infrastructure company that develops projects through various Special Purpose Vehicles (SPVs) across sectors, including power, roads, metro rail, airports, and defense.

The company also operates in the utility sector with a presence across the power value chain, including generation, transmission, distribution, and power trading.

Insolvency Relief

A series of positive developments has driven the recent surge in Reliance Infrastructure’s share price. IDBI Trusteeship had initiated insolvency proceedings against the company over outstanding dues of ₹930 million.

However, the company cleared all dues, removing a key overhang. The National Company Law Appellate Tribunal (NCLAT) has since suspended the insolvency proceedings.

Defence Bets Begin to Take Shape

Separately, the company is also gaining traction in the defence and aerospace segments. It became the first private player to undertake an aircraft upgrade programme worth ₹50 billion independently. The project is expected to be executed over the next 7 to 10 years.

Its subsidiary, Reliance Defence, has signed a partnership with Diehl Defence to supply Vulcan 155 mm precision-guided munitions to the Indian armed forces. Reliance Defence will act as the prime contractor for this project. It aims to generate ₹100 billion in revenue from this partnership.

Additionally, a greenfield manufacturing facility is being set up at the Watad Industrial Area in Ratnagiri, Maharashtra. The plant will have the capacity to produce 200,000 artillery shells, 10,000 tonnes of explosives, and 2,000 tonnes of propellants annually.

The company has also entered jet manufacturing through a partnership with Dassault Aviation. Under this agreement, Falcon 2000 jets will be manufactured in India for both domestic and global markets, marking the first time Dassault is producing Falcon jets outside France.

The first Make in India Falcon 2000 is expected to be delivered by 2028 for both corporate and military use. Dassault will also transfer the front-section assembly of Falcon 8X and 6X jets, along with the complete fuselage and wing assembly of Falcon 2000, to DRAL.

The company is also targeting defence orders worth ₹100 billion from the Ministry of Defence, along with another ₹100 billion in exports over the next decade.

Additionally, Reliance Infra’s metro rail subsidiary, Mumbai Metro One, recently secured an arbitration award worth ₹11.7 billion against the Mumbai Metropolitan Region Development Authority (MMRDA). The proceeds will help reduce Mumbai Metro One’s debt.

Extraordinary Income Boosts Profitability

There has also been progress on the financial front. Revenue rose 32% to ₹300 billion in FY25, led mainly by the power business, which contributed about 94% to overall revenue. The power segment’s revenue grew 36% to ₹281 billion. However, revenue from the engineering and infrastructure segment declined.

The company turned profitable, reporting a net profit of ₹43.9 billion compared to a loss of ₹32.9 billion in the previous year. The profit includes ₹64 billion in regulatory income.

It also reduced debt meaningfully. During FY25, standalone net debt from banks and financial institutions fell by ₹33 billion to zero.. As a result, the external net debt-to-equity ratio improved to 0.28x, from 0.78x in FY24.

The debt reduction has positioned the company for future growth in its core infrastructure business. To fuel growth, it has also raised ₹3 billion by allotting 1.25 crore shares to the promoter entity at ₹240 per share on warrant conversion. Cash and cash equivalents also stood firm at ₹24 billion.

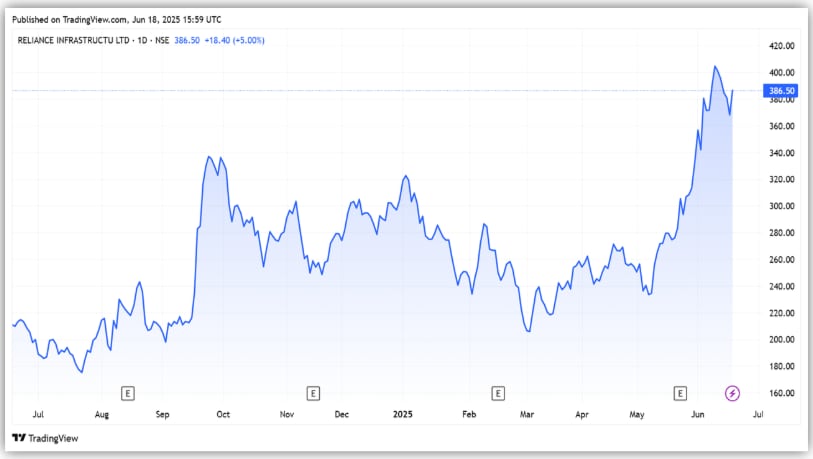

In summary, there have been numerous positive developments for Reliance Infrastructure. The recent surge in the stock price factors in these developments. However, given its checkered past, execution and performance remain key. It trades at a price-to-equity multiple of 3.6x, a 50% discount to the 10-year median of 7.2x.

Reliance Infrastructure Share Price

#2 Reliance Power

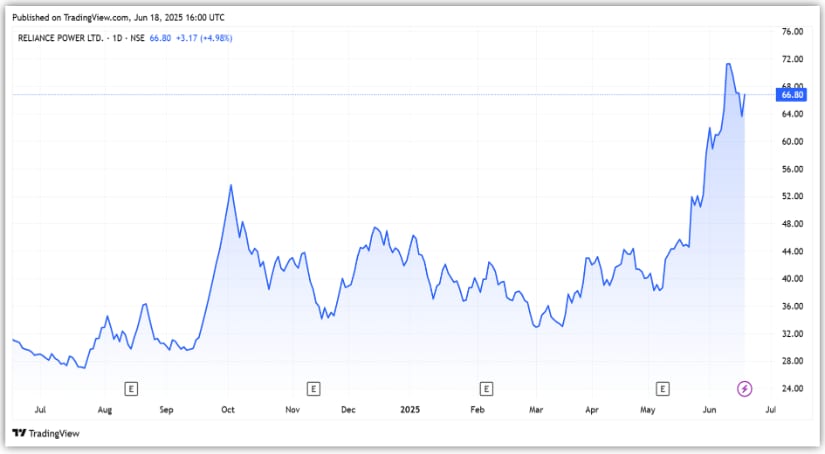

Meanwhile, Reliance Power’s share price has surged nearly 50% over the past month.

Reliance Power is a leading power generation company in India, with a portfolio of 5,305 megawatts (MW). This includes the 3,960 MW Ultra Mega Power Project at Sasan, Madhya Pradesh, currently the world’s largest integrated thermal power plant.

Fund Raising

What’s fueling this rally is the company’s renewable energy ambition and recent order wins. It raised ₹3.5 billion through a preferential allotment at ₹33 per share. The funds will help accelerate its growth in the renewable energy space. This follows an earlier capital raise of ₹15.3 billion through warrants in October last year.

Order Wins in Renewable Energy Portfolio

A key trigger has been the signing of a 25-year power purchase agreement (PPA) by its subsidiary, Reliance NU Suntech, with SECI. The deal is Asia’s largest single-location solar and battery energy storage system (BESS) project, with a total investment of ₹100 billion.

The project includes 930 MW of solar capacity and a 465 MW / 1,860 MWh BESS.

Another subsidiary, Reliance NU Energies, has secured a 350 MW solar-plus-BESS order from SJVN. In addition, the company has signed a term sheet with Bhutan’s Druk Holding and Investments to co-develop Bhutan’s largest solar project, with a fixed tariff of ₹3.33/kWh for 25 years.

Despite these developments, revenue has remained essentially flat over the years. In FY25, the company turned profitable, driven by an exceptional gain of ₹32.3 billion. Revenue came in at ₹75.8 billion, down 4% year-on-year.

It posted a net profit of ₹29.5 billion, reversing a loss of ₹20.7 billion last year. Reliance Power also reported zero bank debt, improving its financial profile. Of course, the company has won orders and reduced debt, which sounds positive, but execution remains key.

Conclusion

According to Forbes, Anil Ambani was once the sixth richest person in the world, with a net worth of $42 billion. After that, his net worth fell to zero, but now it has risen again to $530 million. Both companies, Reliance Infrastructure and Reliance Power, are emerging from the brink of collapse, and investors have noticed it too.

But will it last, or will it become another pump-and-dump scheme? For the stock price to sustain itself, the company’s financials must improve, not through extraordinary income, but through real business.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.