At times like today’s when each news headline makes the market swing big and investors are all about those short-term gains, being patient is rare. Charlie Munger once said, “The big money is not in the buying and selling, but in the waiting.” This whole idea of being smart and patient could be the reason a couple of government-run businesses are turning heads in the middle of all this chaos the Trump tariffs are stirring up.

Two strong Indian state-run firms are selling at big discounts now, which reminds us of what Benjamin Graham termed the “margin of safety.” That’s the comfortable gap between the price you pay and the value you get providing protection for investors and the chance for serious growth. Are we looking at hidden gems ready to shoot up in value, or is this just proof of rock-solid belief in a company’s lasting competitive edge?

The great thing is, these enterprises run by the government, which are highly cash efficient now have their stocks trading at over 40% discount from their all-time high price they once hit. Let’s take a closer look at these shares to figure out whether they deserve a spot in your portfolio or watchlist

First up is the single largest coal producing company in the world and one of the largest corporate employers, Coal India Ltd.

Coal India was incorporated in 1973 as Coal Mines Authority Ltd after the nationalization of the coal sector. It is a ‘Maharatna’ company under the Ministry of Coal, Government of India with headquarters at Kolkata, West Bengal

With a market cap of Rs 2,32,522 cr, CIL leads the country’s coal production contributing to around 80% of the Nation’s entire coal output.

The company has proven it time and again that it is a master of cash efficiency. Currently, Coal India boasts of a ROCE (Return on Capital Employed) of around 64%. Which simply means that the company makes Rs 64 on every Rs 100 it uses as capital.

The company’s sales were at Rs 99,586 cr for FY19 which jumped to Rs 142,324 cr for FY24, which is a compounded growth of 7% in 5 years.

The results for the last quarter of FY25 are expected soon, but for the preceding 9MFY25, April to December 2024, the company has already recorded sales of Rs 1,02,918 cr.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Coal India was Rs 25,007 cr in FY19 and saw compound growth of about 14% as it went to Rs 47,971 cr in FY24. And between April and December 2024, it is already at Rs 35,273 cr.

When it comes to net profits, Coal India has logged in profits of Rs 17,464 cr in FY19 which grew at a compounded rate of 16% to Rs 37,369 cr inn FY24. And for 9MFY25, the profits are already at Rs 25,710 cr

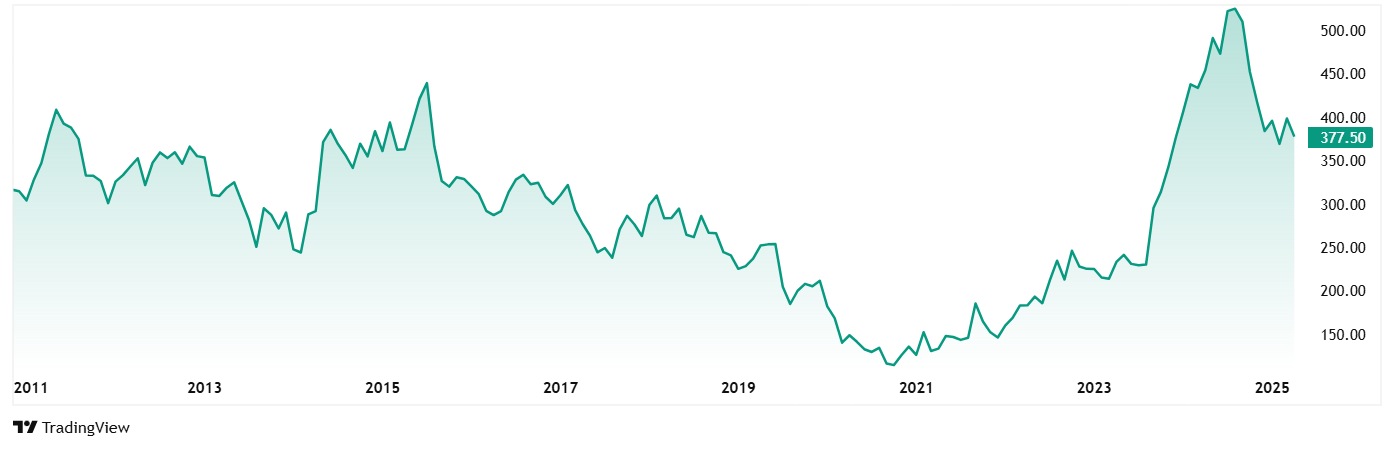

The share price of Coal India went from around Rs 140 in April 2020 to its price as on closing on 7th April 2025, which is Rs 378. That’s a jump of about 170% in just 5 years.

The current price of Rs 378 is in fact a crash induced one and hence over a 30% discount on its all-time high price of Rs 545.

The company’s share is trading at a current PE of 7x, while the industry median is 15x. The 10-year median PE for CIL is also close to 8x, while the industry median for the same period is 16x.

What’s particularly interesting about Coal India is its dividend yield – currently standing at 6.75%. As Buffett would say, this is akin to “a bird in hand” – real cash returns flowing to shareholders regardless of market sentiment.

CIL has declared 29 dividends since Feb. 18, 2011. In the past 12 months, the company has declared an equity dividend amounting to Rs 26.35 per share.

CIL is also currently eyeing a Lithium mining joint venture with Argentina’s YPF (Formerly Yacimientos Petrolíferos Fiscales), the due diligence for which is underway in Australia.

Indian Railway Catering & Tourism Corporation Ltd (IRCTC)

Incorporated in 1999 and listed in 2019, IRCTC possesses what Charlie Munger would call “the power of monopoly” – it’s the only entity authorized to manage catering services and online ticket booking for the Indian Railways, which serves over 23 million passengers daily.

With a market cap of Rs 55,804 cr, IRCTC operates in four segments: Internet Ticketing, Catering, Packaged Drinking Water, and Travel & Tourism. Each segment benefits from the company’s relationship with Indian Railways, creating what could be called “a toll bridge” – a business that customers must use, providing steady, predictable cash flows.

As for the financials, the company’s sales grew from Rs 1,870 cr in FY19 to Rs 4,270 cr in FY24, logging a compound annual growth rate of 18%. For the period between April and December 2024, the company logged sales of Rs 3,407 cr.

EBITDA grew from Rs 383 cr in FY19 to Rs 1,466 cr in FY24, which is a compounded growth of 31%. For the first three quarters of FY25, it has recorded Rs 1,165 cr in EBITDA.

IRCTC’s net profit expanded from Rs 309 cr in FY19 to Rs 1,111 cr in FY24, delivering a compounded growth of 32%.

The profit margins are a strong point that would likely appeal to value investors looking for capital-light, cash-generating businesses.

IRCTC boasts an astounding 54% return on capital employed – the kind of figure value investors are always looking for.

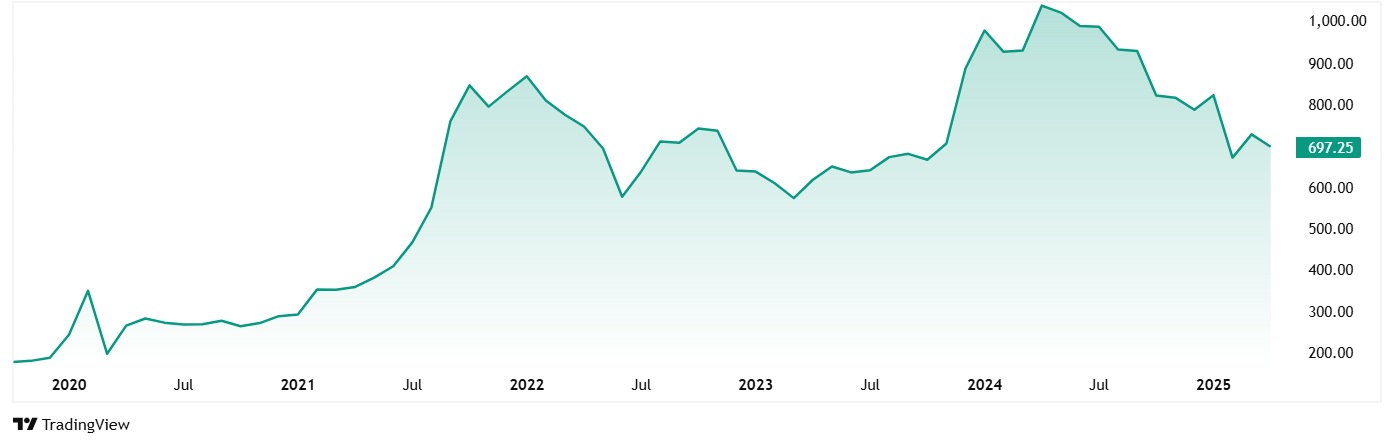

IRCTC’s share price was around Rs 250 in April 2020, which has grown to its current price of Rs 697 (as of closing on 7th April 2025). This represents a jump of 179%.

At the current price of Rs 697, the company’s share is trading at a discount of around 45% from its all-time high of Rs 1,279.

The stock currently trades at a PE of 45x which has no companies to be compared with, given its monopoly status.

The most interesting aspect of IRCTC is its almost debt-free balance sheet combined with substantial cash reserves. As Munger often emphasized, “The first rule of compounding is to never interrupt it unnecessarily” – and IRCTC’s fortress balance sheet ensures it can weather economic storms while continuing to compound shareholder wealth.

IRCTC has a dividend yield of 1% and is maintaining a healthy dividend payout ratio of 44%. Indian Railway Catering & Tourism Corporation Ltd. has declared 11 dividends since February 24, 2020. In the past 12 months, IRCTC. has declared an equity dividend amounting to Rs 11 per share.

In March 2025, IRCTC was granted the Navratna Status, moving it up from the Mini Ratna status it had previously.

Value Traps or Buffett-Style Bargains?

Coal India and IRCTC’s value right now is pretty much a real-world lesson in what Benjamin Graham meant by “price versus value.” Both are selling for way less than their all-time peaks, but they’re still strong when it comes to business operations.

When you look at their financials, they both have persuasive stories to tell. Coal India is doing a solid job making steady cash and they’re all about sharing the wealth through big dividends. IRCTC, on the other hand, is super good at making money without having to put much back into the company. The big puzzle for investors looking to invest is figuring out if these government-run businesses can keep up their edge while the world moves to the next technology.

Having said that, given the strong financials, adding these stocks to your watchlist would be a good idea.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.