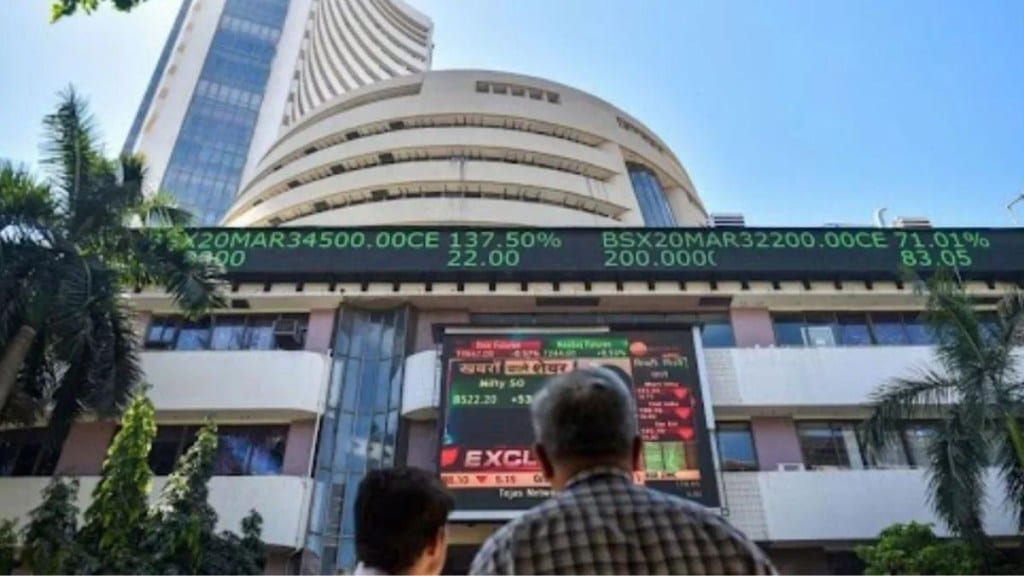

Domestic benchmark equity indices opened flat on Thursday, ie, weekly F&O expiry. The BSE Sensex fell 141.16 pts or 0.23% to 60,206.93 and NSE Nifty 50 dipped 37.90 pts or 0.21% to 17,716.50. Bank Nifty plunged 77.20 pts 0.19% to 41,499.90. The top gainers on Nifty 50 were Apollo Hospital (up 2.42%), Tata Steel (up 2.02%), Hindalco (up 1.69%), JSW Steel (up 1.20%) and Axis Bank (up 1.16%) while Adani Enterprises (down 2.49%), SBI Life (down 1.27%), Reliance (down 1.20%), Adani Ports (down 1.02%) and ICICI Bank (down 0.96%).

Adani stocks in focus today

Three Adani group shares have been replaced under the additional surveillance measure by the National Stock Exchange of India (NSE). This update comes days after the group’s flagship firm Adani Enterprises was removed from the short-term additional surveillance framework. Adani Enterprises shares fell 44.65 pts or 2.19% to 1995.00, Adani Power shares rose 2.70% to 191.80 and Adani Wilmar shares climbed 3.64% to Rs 477.95.

Sectoral Indices

The sectoral indices were trading mostly in red. Bank Nifty fell 0.19%, PSU Bank dropped 0.03%, Nifty IT was down 0.19%, Nifty Auto was down 0.47%, Nifty FMCG was down 0.40% while Nifty Pharma rose 0.22%.

Asian and US stock markets

Asian markets were trading mixed with China’s Shanghai Composite index rising 0.04%, Japan’s Nikkei 225 climbed 0.58% while Hong Kong’s Hang Seng fell 0.06% and South Korea’s KOSPI dipped 0.14%.

The US market also ended the overnight session on a mixed note with Dow Jones Industrial Average falling 0.18%, the tech-heavy Nasdaq rising 0.40% and S&P 500 climbing 0.15%.

FII and DII data

Foreign institutional investors (FII) net bought shares worth Rs 3,671.56 crore, while domestic institutional investors (DII) net sold equities worth Rs 937.8 crore on 8 March, according to the provisional data available on the NSE.

NSE F&O Ban

The National Stock Exchange has Balrampur Chini on its F&O ban list for 9 March. According to the NSE, stocks are prohibited in the F&O sector when they have exceeded 95% of the market-wide position limit (MWPL). During the F&O ban period, no new positions are permitted for F&O contracts in that stock.