By Anandrathi

Healthy order inflows have improved revenue visibility. Considering all the opportunities, orders are expected to be healthy. In H2FY19 the company expects to generate Rs 7 bn, with profitability at 14-15%. A 15-20% revenue CAGR, and improving profitability make valuations attractive. Past orders are on the verge of completion, while orders yet to be executed carry higher margins. Hence, we upgrade our rating to a Hold, with a revised TP of Rs 39 (10x FY21e earnings).

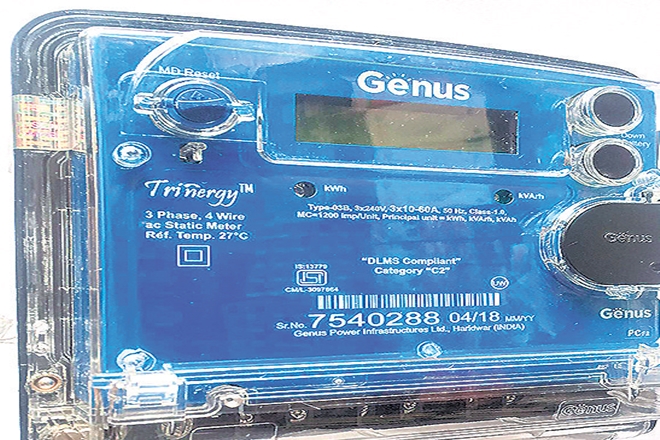

Robust order book: Genus has received a smart-meter order from EESL (Rs 4.5 bn) for 1,350,000 meters and from AMI (Rs 3.1 bn) for 431,000 meters. With a healthy, Rs 14 bn, order book and with further large orders expected in “smart” metering solutions, the company expects to keep the order book strong.

Better execution than competition: Of the EESL order (5 m smart meters) awarded to Genus Power, Ketonic and ITI, only the former has executed its portion. Another order, of Tata’s, given to Chinese players was handed over to Genus for re-execution. Hence, it has built goodwill and established a brand image in the industry.

Valuation: Governing bodies such as EESL are focusing on containing prices. This may lead to a squeeze on profitability. Mounting competition too would lead to working capital pressure. Prospects, however are very bright and likely to see healthy order inflows. Risk: Adverse currency movements and raw material costs.