Our Annual Report analysis of Cipla indicates robust improvement in return ratios over FY18-22. Notably, there had been an improvement in ROE in FY21 (+400bp y-o-y) to 14.1% and it sustained at similar levels in FY22. Over FY18-20, Cipla’s earnings were largely flat. However, the efforts across key geographies aided by limited competition products in the US generics, COVID (FY21), and cost optimisation measures led to 34% earnings CAGR over FY20-22. Further, improved working capital requirement and reduction in debt have enhanced the financial health of the company.

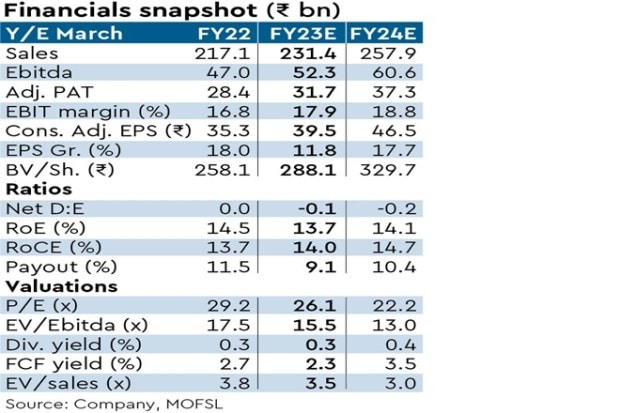

Going forward, we expect 15% earnings CAGR over FY22-24, led by 19%/6%/ 13% sales CAGR in the US/Domestic Formulation (DF)/EU, respectively. We value Cipla on an SOTP basis (23x 12M forward base earnings and add NPV of Rs 40 for g-Revlimid) to arrive at our TP of Rs 950. We maintain our Neutral rating on the stock due to stable return ratios over the next two years. The current valuation adequately factors in the earnings upside over the next couple of years.

Also Read| MCX crude September futures trade below 200-DMA, support seen at Rs 6800/bbl; trend looks bearish

DF/US – key growth drivers; SAGA/EM also catching up in growth terms

Cipla posted 9%/12.6% sales CAGR over FY18-20/FY20-22, respectively. DF/US remained at the forefront of driving growth over FY18-22 with the segments exhibiting sales CAGR of 11%/18%, respectively. In addition to prescription (Rx) portfolio, Cipla gained notable traction in trade generics/ consumer health. While price erosion continued to hurt the base portfolio, new launches reported healthy growth in the US segment. Particularly, respiratory products garnered sales of $169 m in FY22 from just $11m in FY17. The growth was moderate during FY18-20 in SAGA, emerging markets (EMs) and Europe (EU). However, there has been a steady improvement over FY20-22 in EM/SAGA segments.

Efforts continue towards improving capital efficiency

Dupont analysis indicates 410bp improvement in ROE to 14.5% in FY22. This was primarily led by better asset turn and considerable margin expansion. The Ebitda margin was steady over FY18-20.

Increased contribution from niche launches in the US generics, reduction in tender business and better operating leverage augmented Cipla’s profitability over FY20-22. From net debt of Rs 20 bn in FY18, Cipla turned cash surplus (of Rs 41 bn) by end-FY22.