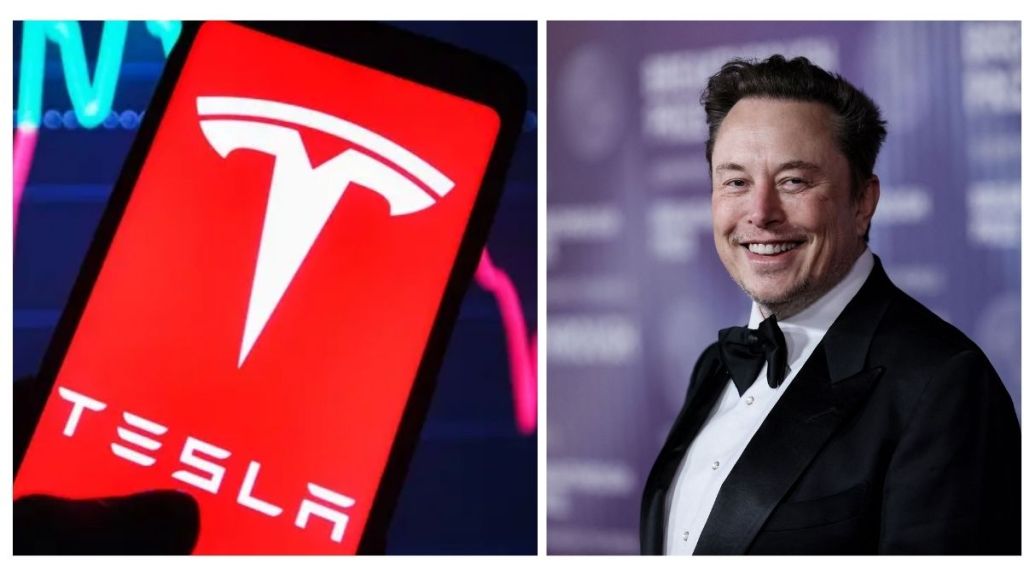

Tesla Inc. shares saw a steep decline in early hours of trading on Monday, July 7, 2025, after Tesla CEO Elon Musk announced the creation of a new political party, “The America Party.” The move, which comes just days after the US Congress passed President Donald Trump’s “One Big Beautiful Bill,” triggered concerns among investors about Musk’s growing involvement in politics and its potential impact on Tesla’s future.

Shares of the electric vehicle giant dropped nearly 7% to $291.96 in the early hours of trading at 4:01 a.m. EDT on the Nasdaq. By 6:29 a.m., Tesla shares were still down 6.23% at $294.59, compared to their previous closing price of $315.35 on Friday, July 4. The dip comes amid increased market volatility surrounding Musk’s political moves, which many investors view as a potential distraction from Tesla’s core business operations.

Musk’s announcement came via a series of posts on X, where he criticised the existing two-party system in the US and positioned his new party as an alternative to what he called the “Republican/Democrat Uniparty.”

“The America Party is needed to fight the Republican/Democrat Uniparty,” Musk wrote on Monday. Over the weekend, he conducted polls and shared updates indicating his serious intent to move forward with the new political formation. In a Sunday post, he declared: “By a factor of 2 to 1, you want a new political party and you shall have it! When it comes to bankrupting our country with waste & graft, we live in a one-party system, not a democracy. Today, the America Party is formed to give you back your freedom.”

Though this is not the first time Musk has hinted at forming a political movement, the clarity and urgency in his latest statements have heightened investor anxiety. The market reaction was swift, with Tesla shares tumbling the moment US premarket trading began.

Tesla had closed slightly lower on Friday with a 0.10% dip to $315.35, showing signs of stability before Musk’s weekend announcements. Despite gaining 2.19% over the past month, the stock is now trading 2.79% lower over the past five sessions. According to market data, Tesla’s 52-week high remains at $488.54, while the low is $182. The company’s market capitalization stood at $1.01 trillion in the latest premarket session.

While Musk’s political ambitions have always drawn attention, this latest move into party politics may mark a turning point—not just for US political discourse but also for the perception of Tesla as a company. Analysts warn that Musk’s increasing focus on politics could invite regulatory scrutiny, polarize consumers, and affect the company’s long-term stability. For now, markets are watching closely as Musk’s political venture unfolds alongside his role as one of the most influential CEOs in tech.