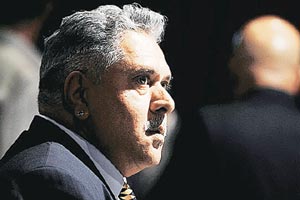

With the UK government expressing inability to deport loan defaulter Vijay Mallya, and Indian authorities left with the option of going in for a long extradition process, former top bankers are of the view that bank consortium that had extended loans to Kingfisher Airlines should initiate recovery measures by working on Mallya’s Rs 6,000 crore repayment offer made before the Supreme Court (SC).

“I am of the firm opinion that leader of the consortium, State Bank of India, should convene a meeting of the consortium and decide how to progress on the repayment offer. I fail to fathom why the banking system is refusing to accept the offer. After all, it was made in the Supreme Court and not as some empty promise,” S C Gupta, former chairman and managing director, Punjab National Bank (PNB) told FeMoney.

Vijay Mallya had offered to pay as much as Rs 6,000 crore as settlement out of the Rs 9,000 crore he owed to banks in dues for the now-defunct Kingfisher Airlines. The offer was made through his lawyers to the SC. Mallya had left the country on March 2 after the loan default case was hotting up and probe agencies were planning to get after him as a ‘wilful’ defaulter.

However, banks have refused to accept the the Rs 6,000 crore offer.

Stating that “it was not wise for banks to reject the offer”, Gupta said that a clear assessment should be done by lenders to assess what was recoverable and accept the deal if it leads to substantial recovery. “The consortium should sit down and assess what the down payment would be and how Mallya would repay the rest after taking stock of his assets. If I was there I would have jumped at the opportunity,” he said.

Rajiv Madhok, former executive director, Bank of Maharashtra, agrees. “Banks should settle the issue and do it on their terms. They should sit together and figure out how to get the maximum possible dues. It should be a reasonable figure that they can recover. I doubt Mallya would pay the entire amount,” Madhok said.

He felt that if banks keep deferring the issue, they might be left without anything. “Unless recovered the assets will not give any return. There is a possibility of being left high and dry. Ultimately such a loan default has to be settled. The aim should be to come out of the problem and not drag it too far,” Madhok said.

The UK government has informed India that under its immigration laws, an individual (in this case Mallya) does not require a valid passport to remain in UK as long as their passport was valid when leave to remain or enter the UK was conferred.

Mallya’s passport was recently cancelled by Indian authorities which had requested UK to deport him. UK has agreed to assist the Indian government on the matter. Extradition, however, is a long-drawn legal process where the accused may take recourse to provisions in treaties to ensure not to be extradited.

Mallya, who has been categorised as a ‘wilful defaulter’ by Indian banks, meanwhile, had in a recent interview to Financial Times said he is ‘ready to settle’ the loan default and is in ‘forced exile’.

Other than SBI, banks which extended loans to Mallya include Axis Bank, Bank of Baroda, Corporation Bank, Federal Bank Ltd, IDBI Bank, Indian Overseas Bank, Jammu and Kashmir Bank Ltd, Punjab and Sind Bank, Punjab National Bank, State Bank of Mysore, UCO Bank and United Bank of India.