The finances of the state-owned Solar Energy Corporation of India (SECI) has seen a steady and rapid improvement in recent years, with it playing a crucial catalytic role in India’s massive renewable energy drive. Though SECI’s name figured in the US’s department of justice’s indictment of Adani group executives unsealed lately, no specific charge of wrongdoing was made with regard to the firm.

SECI’s revenue from operations grew significantly to Rs 13,035 crore in FY24, up 181.8% from Rs 4,626 crore in FY20. In last five years to FY24, the company saw a jump of 119.8% in its net profit to Rs 510.92 crore.

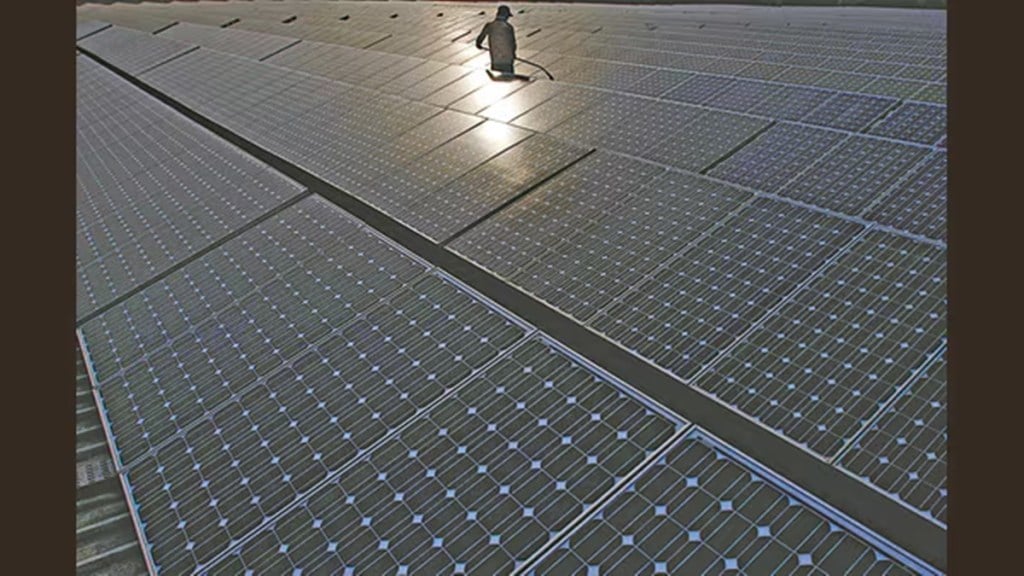

SECI, the nodal agency for implementing RE projects in the country, over the years have come out with tenders for assorted green energy projects including solar, wind, energy storage, green hydrogen, and hybrid technologies.

The agency is responsible for developing these projects as part of the country’s Nationally Determined Contributions (NDCs). It releases tenders for selection of RE developers for establishment of solar projects and other RE projects on pan-India or state-specific bases. The selection process for successful bidders is conducted by following a tariff-based competitive e-bidding procedure.

Once a bidder is selected, SECI enters into a 25-year Power Purchase Agreement (PPA) with it for procurement of power.

Further, SECI also establishes back-to-back 25-year Power Sale Agreements (PSA) with the electricity distribution companies or buying entities for sale of the procured power from the chosen developers.

The agency signs PSAs at a fixed trading margin of 7 paise per unit, which is its revenue stream. For instance, if the discovered tariff under the bidding process is Rs 2.5 per unit, SECI sells it at Rs 2.57 per unit to the discom.

“It (SECI) is a debt-free company with a growing scale because of increasing (RE) capacity. The company’s profitability has increased and it is on a strong footing,” said an analyst who did not wish to be identified.

SECI has come out with a number of RE project tenders in the last few years with companies like NTPC, Reliance, JSW Energy, ReNew, Avaada winning some of the latest contracts.

For instance, JSW Neo Energy and Reliance Power both won SECI’s tender to set up a 1,000 MW/2,000 MWh standalone battery energy storage project under tariff based competitive bidding. Avaada, ReNew, and NTPC Renewable Energy have also bagged contracts to set 1,500 MW ISTS-connected solar power projects by SECI.

Earlier in September, the company had revealed its plans to go public within one or two years. It had said that it aims to tender 20 giga watt (GW) of projects in the current fiscal. SECI tendered a total capacity of 20.11 GW in FY24 (including solar and non-solar).

The agency has not yet received any formal notice from the US court on the indictment of Adani group in the bribery scheme related to a contract it gave out. It is unclear whether the corporation would cancel its power purchase agreements (PPAs) with Adani Green and Azure Power, then two firms in the centre of the controversy.

Under the terms of the bid document, SECI expected to enter into PPAs with the winning bidders, i.e., Adani Green and Azure, within 90 days of issuing the Letters of Award. However, that did not happen. “Instead, the PPAs took more than 18 months and were executed by SECI only after Adani Green’s senior executives, Gautam Adani and Sagar Adani, undertook a massive bribery scheme to incentivize Indian state government officials to enter into contracts with SECI to buy energy at above market rates,” read US Securities and Exchange Commission complaint.

The price for energy capacity that SECI had tentatively agreed to pay under the Letters of Award turned out to be too high. So, when SECI attempted to contract with the Indian state governments and Discoms to offload power at prices consistent with the Letters of Award, the states refused, it said.

Analysts say that the tariff discovered under Adani Green’s solar power project of 8 GW capacity , which is now under scrutiny, was not higher than the tariffs discovered during the period.

The government has set a target to triple RE capacity by 2030, in line with its commitment to reduce emission intensity of the gross domestic product, and massive investments are lined up by the private and public sector companies.