Shares of IT major Infosys touched a record high on Thursday, defying a streak of under-performance it maintained with Tata Consultancy Services (TCS) since 2010. After rallying to a new intraday high of R4,377, Infosys ended the session at a record R4,366.90, up R69.25 or 1.61%.

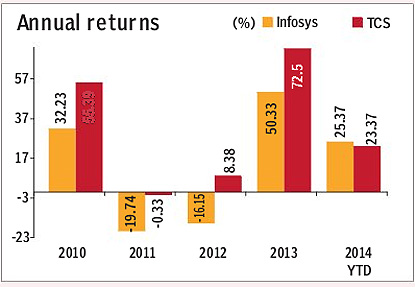

On the back of year-to-date gains of 25%, Infosys has outdone TCS in the year-to-date performance, for the first time in five years. While the appointment of Vishal Sikka as the CEO in mid-June rekindled optimism on Infosys, the decline in the momentum of TCS stock after its September quarter numbers failed to meet street expectations, have also helped the former bridge the gap.

While TCS was boasting year-to-date returns of 27% in early October, better than Sensex gains at the time, post Q2 results the stock gave away some of these gains. While at 3.9%, the sequential constant currency growth reported by Infosys was viewed as healthy, TCS’ q-o-q revenue growth of 4.6% was considered a miss, especially because the latter was consistently beating consensus expectations on the topline. Not surprisingly, foreign brokerages like Deutsche and CIMB upgraded Infosys post Q2 numbers.

While TCS was boasting year-to-date returns of 27% in early October, better than Sensex gains at the time, post Q2 results the stock gave away some of these gains. While at 3.9%, the sequential constant currency growth reported by Infosys was viewed as healthy, TCS’ q-o-q revenue growth of 4.6% was considered a miss, especially because the latter was consistently beating consensus expectations on the topline. Not surprisingly, foreign brokerages like Deutsche and CIMB upgraded Infosys post Q2 numbers.

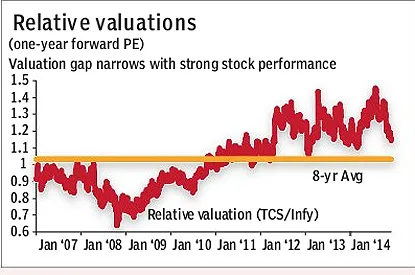

Even as the street expect details of the organization structure and the newly-laid strategy by Sikka, the rally in Infosys stock has narrowed the valuation gap it maintained with TCS to an eight month low. The IT major currently trades at one-year forward price to earnings multiple of 18.86 while TCS commands a PE ratio of 21.52. However, given that Infosys is already trading way above the consensus 12-month target price of R4231.7, a section of the street has started to view it as an expensive counter. Recently Societe General downgraded Infosys to ‘sell’ from ‘hold’.

Even as the street expect details of the organization structure and the newly-laid strategy by Sikka, the rally in Infosys stock has narrowed the valuation gap it maintained with TCS to an eight month low. The IT major currently trades at one-year forward price to earnings multiple of 18.86 while TCS commands a PE ratio of 21.52. However, given that Infosys is already trading way above the consensus 12-month target price of R4231.7, a section of the street has started to view it as an expensive counter. Recently Societe General downgraded Infosys to ‘sell’ from ‘hold’.