In a quarter when Unilever Plc saw a 1.6% decline in sales volumes, its Indian subsidiary, Hindustan Unilever (HUL), stood out with a 4% volume growth.

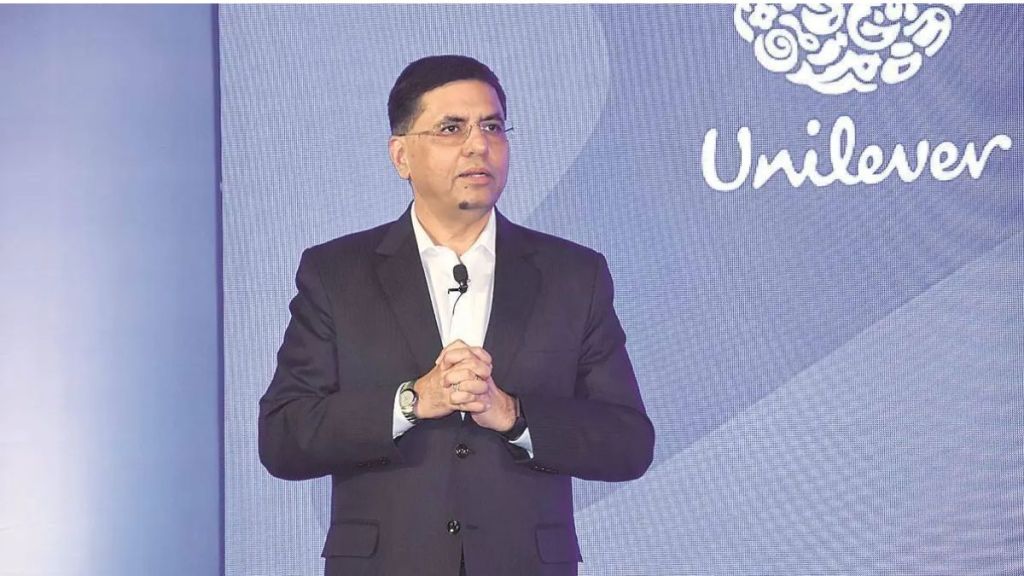

Alan Jope, Unilever’s global CEO, on Thursday said that India showed a strong growth with double-digit pricing and positive volumes during the September quarter. This growth, Jope said, was well supported by HUL’s premium portfolio and innovations at a time when inflation continued to impact demand in all the geographies in which the company sells its products.

Also Read| Shiprocket goes live on government’s e-commerce platform ONDC as its first inter-city logistics provider

Jope told media after announcing Unilever’s September quarter results that HUL’s focus on operation and consistent marketing investment yielded the desired results. HUL contributes around 11% of Unilever’s overall sales.

Unilever posted a sales growth of 10.6% in the September quarter, led by an underlying pricing growth of 12.5%, one of the highest in the last few quarters. But the company’s volumes declined because of inflationary pressures and price hikes because of the spike in commodity prices.

“The commodity pain may continue,” Jope said as there could be further challenges due to high inflation that may persist in 2023.

“Although some commodities have softened from their peaks, we expect cost pressure to carry forward into 2023, driven by currency devaluation, higher raw material costs versus beneficial covers (lower cost of commodities) in the first half of 2022, and higher supplier processing costs from energy and labour inflation,” Jope said.

Unilever is particularly downbeat on consumer sentiment in two of its key markets – Europe and China. In Europe, Jope said, the consumer sentiment was at an all-time low with early signs of demand slowdown due to inflation in basic goods and energy due to the Russia-Ukraine war.

Also Read: Payments infra company Infibeam Avenues gets RBI approval to operate as payment aggregator

HUL’s market capitalisation at $71.87 billion is 63% of Unilever’s market cap of $114.08 billion. The market cap of HUL compared with its parent was at 60% a year ago and just 22% five years ago.