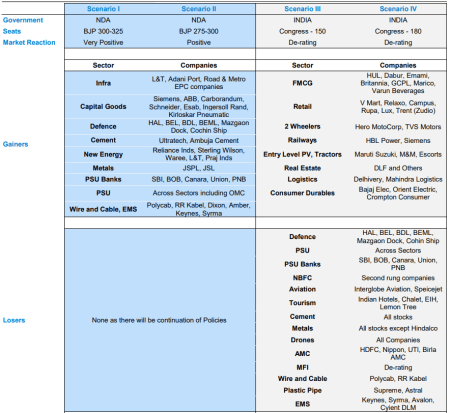

As India completes the fourth phase of its hotly contested Lok Sabha elections, Prabhudas Lilladher (PL), in its latest India Strategy Report – Mandate 2024, Brace of Volatility, zeroed in on the sectors that will do well in case of INDIA alliance coming to power, sectors that will perform in the event of NDA coming back to power and on the sectors that will perform well irrespective of election results.

The narrative along NDA falling short of a majority or INDIA alliance coming to power are raising their head, at least in social media and global press. Fear around a repeat of UPA victory in 2004 is making markets nervous as the unexpected event had resulted in a 15 per cent cut in Sensex in a single day, stated a report by Prabhudas Lilladher.

Per the report, irrespective of the regime that comes at the centre, sectors such as FMCG, auto, healthcare, IT services, private banks and capital goods are expected to perform well and cited as prudent defensive hedge against election results.

If NDA comes back to power, it added, there will be continuation of policy and themes around infrastructure, defence, CG, new energy, tourism, etc. will continue to do well. Consumer, 2-wheelers and tractors can get a boost from green shoots in rural demand and expectations of normal monsoons.

However, it added, if unexpectedly, INDIA alliance comes to power, it will lead to de-rating in markets and specific sectors like defence, capital goods, tourism, PSUs (including Banks), drones, AMC, wires and cables, plastic pipes and EMS. “We believe sectors like FMCG, Retail, 2W, PV (entry level), Tractors, Real Estate, Logistics (Ecom centric) and consumer durables will benefit from expected policies,” said Amnish Aggarwal, Head – Research, Prabhudas Lilladher Pvt Ltd. “We believe sectors like FMCG, retail, 2W, PV (entry level), tractors, real estate, logistics (Ecom centric) and consumer durables will benefit from expected policies.”

Here is a list of sectors and stocks which will do well irrespective of the regime in power:

FMCG: Rural demand revival will get a boost if supplemented by freebies. Key stocks – HUL, Dabur, Emami, Marico, GCPL, Britannia, Varun Beverages.

Auto: 2-wheeler, tractor and entry level cars will benefit. Key stocks – Hero MotoCorp, Maruti and M&M.

Healthcare: Perfect defensive with Sun Pharma, Cipla, Max Health and Jupiter as key stocks

IT services: More of a global play with very limited impact. Key stocks – TCS, LTI Mind tree, HCL tech, Cyient, and Tata Tech.

Private Banks: Expect de-rating of all PSUs including banks. Focus may shift to top rung private banks, which are already trading at a significant discount to their last 10-year P/ABV. Key stocks – HDFC Bank, Kotak Mahindra Bank, Axis Bank, ICICI Bank.

Capital Goods: While many segments in EPC, defence, new energy are at risk, PL believes global technology leaders like Siemens, ABB, Schneider, Honeywell, Elantas Beck, GE T&D, Hitachi Energy, Timken, Schaffler, etc. are likely to suffer much less impact.

Furthermore, it added that Hindalco, Havells India and telecom companies like Bharti Airtel will not be impacted.

After two and a half years, Prabhudas Lilladher is “Overweight” on consumer goods as it increases weight behind HUL, ITC, Britannia and Titan Industries, adds Delhivery in the model portfolio as a proxy to consumer demand. PL turns overweight on auto and adds Hero MotoCorp in the model portfolio even as it increases weight on Maruti and M&M. Further, PL believes Consumer and Auto (PV, 2W and Tractor) provide a good hedge as it will benefit from green shoots in rural demand if the current Government continues. “The scenario will further improve if INDIA comes to power and doles out freebies to a large section of population,” stated the report.