Last week, the Hindustan Unilever (HUL) stock lost more than 7%, closing at Rs 219.65 on the National Stock Exchange. That?s almost a one-year low for the blue-chip counter; last May the stock had hit Rs 215. Between January 8, 2010 when the stock was trading at Rs 266, and now, the stock has come off 17%. For about three weeks now the Rs 16,699 crore firm has been locked in an advertising war with rival Procter and Gamble (P&G), in the Kolkata High Court with P&G asking the court to stop HUL from airing a particular campaign.

But, it?s not the advertising spat in the media that analysts are concerned about. It?s the renewed price war emerging in the detergents category and what that could do to HUL?s bottom line. ?HUL heading for an earnings decline in 2010-11, estimates cut 11-16%? said brokerage Bank of America Merrill Lynch (BoAML) in a report. Explaining the situation, the analyst added that BoAML expected P&G?s price cuts to make it tough for HUL to see a pick-up in volume growth and induce sharp price cuts in Wheel.

That combined with price cuts in Rin and bars, the analyst has pointed out, implied a 17% weighted average cut in the price of detergents, unlikely to be made up by increased volume growth. As the analyst explains, HUL has taken an approximately 30% price cut for Rin and a 20% price cut for detergent bars. Indeed, the soap wars of 2004, seem to be playing out all over again. It was in March 2004, that the first major price war between HUL and P&G broke out. P&G, which had launched Tide in India in late nineties, slashed prices of both Ariel and Tide by 20-50%, compelling HUL to retaliate with a cut in prices of Surf and Surf Excel Blue. P&G brought down the price of Ariel to Rs 50 from Rs 70 for smaller packs, making it more affordable to a larger universe of consumers; the price cuts for larger packs were even bigger.

The Cincinati-headquartered multinational was also effectively repositioning Tide in the popular segment. Since P&G?s market share, in most of the categories that it had a presence in, was less than 10%?it was little over that in detergents?it had little to lose by unleashing a price war. On the other hand, for a market leader like HUL, which had all along commanded a share of 50% of the detergents market, it meant coming down the price ladder, cutting prices by almost 20% and taking a hit on margins unless it wanted to risk market share and volumes. Of course, HUL had little choice but to lower prices.

This time around, P&G has effected an across-the-board cut of 20% and Tide is priced at Rs 56/kg, down from Rs 70/kg and Tide Naturals will now cost Rs 40/kg, down 20% from Rs 50/kg. In UP, Madhya Pradesh and Rajasthan, where cheaper local brands pose some competition, Tide Naturals will be priced even lower. That would understandably make life difficult for HUL whose bestselling Wheel could be hurt somewhat. Market watchers expect HUL to raise the grammage for Wheel from 650 gms to somewhere between 800-850 gms to maintain the pricing gap with mid-end brands such as Tide Naturals.

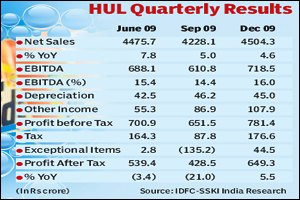

The weighted average price cut of between 15% and 17% in the prices of detergents could result in a fall in the top line of the detergents business of 10%, with the company gaining some volumes. That implies a top line growth of about 1% for the soaps and detergents piece. Also margins for this business could be hit by about 400 basis points, says BoAML, even though the company might benefit from savings from lower advertising and promotion (a&p) spends. In the December 2009 quarter, the soaps and detergents business reported a drop in ebit (earnings before interest and tax) of around 300 basis points.

A 400 basis points fall in margins for soaps and detergents would translate into a hit of nearly 200 basis points for HUL, since the soaps and detergents piece contributes half of HUL?s profits. Margins could recover subsequently in 2011-12 if prices start to move up again. In the December 2009 quarter, the soaps and detergents business had seen a fall of 2.4% to Rs 2,072 crore. While the business has all along accounted for the largest chunk of HUL?s revenues of around 49-50%, the share could come off by about 300 basis points next year.

The cost of gaining market share is becoming increasingly high; as IDFC SSKI points out that it takes a 70% increase in ad spends to gain additional volumes of 5%. Indeed, the brokerage points out that HUL?s strategy of vacating the mass segments in categories such as soaps has resulted in its losing market share, regaining which would become difficult. In the December 2009 quarter, the company reported a 5% growth in volumes, somewhat better than the 2% reported in the previous quarters.

Historically, growth in a category like soaps has always been price-led but that can hardly work when price warriors like Godrej are around. Recently HUL has reduced the grammage of its Lux brand of soaps, thereby raising the price slightly. The Lux 100 grams Stock Keeping Unit grammage was reduced to 90 grams while the price remained unchanged. The management points out that the move was initiated before the excise duties were hiked but refrained from commenting otherwise. While the company does need to watch out for its profitability, the market is fiercely competitive and HUL simply cannot afford to lose out on volumes.