Removing prepayment fee on floating rate home loans will make it easier for customers to shift to other banks

Those who have taken home loans with floating interest rates have something to cheer about. Not only are the interest rates expected to come down, banks will not charge any penalty for prepayment of loans linked to floating rate of interest, where rates move up or down according to the base rate. Around 80% of the outstanding home loans given out by banks are on floating rate basis and banks are increasingly focusing on floating rate schemes to protect themselves from interest rate fluctuations.

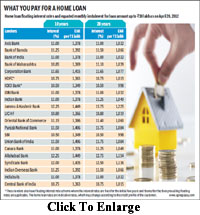

The Reserve Bank of India in its annual monetary policy reduced its key policy rate by 50 basis points and banks like ICICI Bank, IDBI Bank, Punjab National Bank and Syndicate Bank have already reduced their prime lending rates by 25 basis points each. The central bank has said it will not permit banks to levy foreclosure charges, commonly known as prepayment penalties, on home loans taken on a floating interest rate basis. The RBI will issue detailed guidelines separately. However, for fixed-rate loans, banks will continue to charge prepayment penalty.

The Reserve Bank of India in its annual monetary policy reduced its key policy rate by 50 basis points and banks like ICICI Bank, IDBI Bank, Punjab National Bank and Syndicate Bank have already reduced their prime lending rates by 25 basis points each. The central bank has said it will not permit banks to levy foreclosure charges, commonly known as prepayment penalties, on home loans taken on a floating interest rate basis. The RBI will issue detailed guidelines separately. However, for fixed-rate loans, banks will continue to charge prepayment penalty.

Last year, a committee headed by former Sebi chief M Damodaran suggested banning the penalty charged by banks on prepayment of loans, something that various consumer groups have in the past urged the central bank to do.

The committee observed that foreclosure charges levied by banks on prepayment of home loans were resented by home loan borrowers across the board, especially since banks were found to be hesitant in passing on the benefits of lower interest rates to existing borrowers when interest rate moves down.

Analysts say foreclosure charges are seen as a restrictive practice deterring borrowers from switching over to cheaper available sources. Currently, banks charge anywhere between 1% and 3% of the principal if customers want to pay back the loan amount before the tenure ends.

The removal of the prepayment penalty will make it easier for customers to shift loans to other banks if they get a better interest rate, and, most importantly, increase competition among banks.

The central bank has underlined that removal of foreclosure charges or prepayment penalty on home loans will lead to a reduction in the discrimination between existing and new borrowers and the competition among banks will result in finer pricing of home loans with floating rates. ?Though many banks have in the recent past voluntarily abolished the prepayment penalties on their floating rate home loans, there is a need for ensuring uniformity across the banking system in this regard,? the RBI policy said.

Bankers, however, say that by charging for prepayment, they manage their asset-liability gaps better and stop borrowers from shifting to other banks. Typically, most banks penalise prepayment and even do not allow prepaying in the first three to five years as it distorts their asset-liability mismatch. However, prepayment beyond this period is free, provided you pay it from your own resources and do not take any loan to prepay the home loan.

At present, some banks do not charge any penalty if the borrower pays from his own source of funds and does not take any fresh loan to prepay the existing loan. In some cases, no prepayment charge is levied on the borrower if he pays up to 25% of the principal outstanding in the first two to three years of taking the loan. Prepayment done above that period attracts a penalty of 1-3%, depending on the bank and the initial clause set up in the agreement.

In fact, in May last year, the government had advised public sector banks, the Indian Banks? Association and the National Housing Bank not to levy prepayment charges when the loan amount is paid by the borrowers out of their own funds. If any prepayment charge is to be imposed on housing loans, it needs to be reasonable and transparent and not out of line with the average cost of providing the services.

Own funds means money generated by the borrower from his personal source and not through borrowing from a bank or a non-banking financial institution.

However, one thing to be kept in mind is that before you prepay the full amount, do calculate the tax benefits you would lose out on. Prepayment would reduce the tax benefits on interest and principal payments. Section 24 (b) of the Income Tax Act, 1961, allows a deduction of interest payment up to R1.5 lakh from the taxable income for self-occupied properties, while under Section 80C, principal payment up to R1 lakh inclusive of other investments can be deducted from the income while calculating the tax liability. So, in such a case, prepayment makes little sense.

Financial planners say partial prepayment of a loan makes sense at a time when interest rates are going up as it will bring down the tenure or even reduce the monthly instalment. They say that prepayment must be done from the borrower?s own funds after setting aside money for emergencies.

As the typical amount of a home loan is large, borrowers tend to prefer to repay in the early years of the loan tenure. But analysts say a home loan is backed by an asset, which sees its price moving up in the long run and the burden to service the loan decreases with the rise in income. It is advisable to wait if you have age on your side, as you cannot claim tax benefits above R1.5 lakh. But if the number of earning years is few, you may be better off repaying the loan as early as possible.