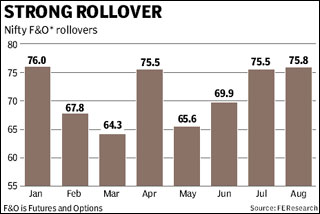

The market witnessed healthy rollovers in the derivatives segment for the near-month August to September contracts on Thursday. Rollovers in Nifty index futures August contracts was about 76%, which was slightly higher than the previous month. These rollover figures were highest since Jan of this year.

?There was a lot of movement in small and mid-caps compared to earlier months, with a high open interest in midcaps,? said Jitendra Panda, senior V-P (business associate group), Motilal Oswal. The rollovers in MiniNifty stood at around 67%.

In continuation with the trend seen in the last three to four months, stock rollovers were robust at 86%, indicating that the action has very much moved away from index futures to stock futures. The near-month contract August accounted for 40% of the open interest.

Among sectoral indices, rollover in CNXIT was 47.51 and that in BANKNIFTY was 73.23. Healthy rollovers were witnessed in sectors like real estate, FMCG, sugar and media. ?With the start of the festive season, investors are expecting businesses from realty and FMCG sectors to perform better,? said Panda.

Sectors like pharma and banking, on the other hand, witnessed comparatively lower rollovers as investors were seen booking profits and exiting positions. ?Valuations are no longer looking cheap in the banking sector and investors have chosen not to roll over long positions in some of them,? said Siddarth Bhamre, head?derivatives, Angel Broking. Rollovers were high for oil stocks like Cairn (86%), IOC (91%) and BPCL (82%).

Market participants expect Nifty to be rangebound going forward, with a target of 5,200 on the downside and 5,600 on the upside. ?The 5600 level will be difficult to cross. The market will look to consolidate and we are likely to see more of downside than upside,? said Panda of Motilal Oswal. The volatility in the September series is likely to be greater than the August series, reckon experts.

Market participants expect Nifty to be rangebound going forward, with a target of 5,200 on the downside and 5,600 on the upside. ?The 5600 level will be difficult to cross. The market will look to consolidate and we are likely to see more of downside than upside,? said Panda of Motilal Oswal. The volatility in the September series is likely to be greater than the August series, reckon experts.

Rollover happens when one squares off the positions in the current month and takes up a new position in the near month?s contract. A high rollover percentage indicates that there is enough risk appetite among traders.