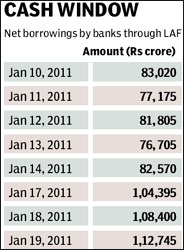

Banks? borrowings from the Reserve Bank of India?s (RBI) repo windows on Wednesday further rose to Rs 1,12,745 crore compared to Rs 1.08 lakh crore on Tuesday. After banks? daily borrowings from the RBI dropped to Rs 70,000-80,000 crore in the recent past, the daily borrowings have exceeded Rs 1 lakh crore mark for the third consecutive day.

R V Sridhar, president and treasury head, global markets, Axis Bank, ?Our sense is that the liquidity situation may not change much. At the beginning of a fresh fortnight, banks may be building up their products to maintain their cash reserve ratio. Hence, they are borrowing more. It would come down next week.?

He however observed that banks are holding excess SLR to the tune of 4% to 4.5% in addition to 24%. They are using them as collateral to borrow money through LAF. There is nothing wrong with it.?

Meanwhile, resources raised through commercial papers (CPs) by companies, certificate of deposits (CDs) by banks were priced at a higher rate. The three month CP was priced at 9.66% as against 9.64% recorded on Tuesday. The costs for six month and one year CPs were at 9.90% and 10.24% compared with 9.85% and 10.19% respectively on Tuesday.

The three month CD on Wednesday was priced at 9.23% as against 9.18% on Tuesday. Similarly the cost of six month CD rose marginally to 6.63% from 9.60% on Tuesday while one year CD moved up to 9.82% compared with 9.76 % on Tuesday. The issuance of CPs have fallen to Rs 360.30 crore on Wednesday. According to Sridhar, banks might be raising funds through CDs market to expand their advances as deposit growth remains sluggish.

Said Manish Sarraf, head ?treasury, Dhanlaxmi Bank, ?Banks may be front-loading their borrowings in anticipation of policy rate hikes to be announced by RBI in its monetary policy review on January 25. A rate hike will lead to increase in the cost of borrowings by banks.?

Said Manish Sarraf, head ?treasury, Dhanlaxmi Bank, ?Banks may be front-loading their borrowings in anticipation of policy rate hikes to be announced by RBI in its monetary policy review on January 25. A rate hike will lead to increase in the cost of borrowings by banks.?

The central bank raised the repurchase auction rate, at which it lends to banks, by 150 basis points last year to 6.25%.