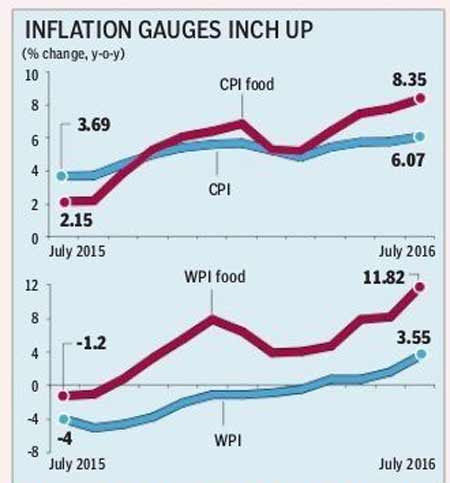

Wholesale price inflation hit a 23-month high of 3.55% in July, as primary food inflation scaled a 30-month peak and price pressure in manufactured items advanced at the fastest pace in 20 months.

Also, the base remained unfavourable (wholesale price inflation was -4% in July 2015), and even a deflation in fuel products narrowed sharply in July to -1%, the lowest deflation in 21 months, showed official data released on Tuesday.

Manufactured items in the wholesale price index (WPI) rose 1.82% in July, compared with 1.17% in the previous month, as inflation in manufactured food products touched a 45-month high of 10.19%. Inflation in sugar, which touched a 76-month high in July, remained a major driver of food product inflation and also added 76 basis points to the overall manufactured item inflation. Some analysts blamed a lagged impact of a rise in global commodity prices in May and June for the spurt in WPI inflation in July.

Shubhada Rao, chief economist at Yes Bank, said manufacturing-heavy WPI index would emerge as a clear beneficiary under the GST regime, compared with the consumer price index (CPI), given the expected lower rate of GST on manufactured products vis-à-vis current rates of excise duties. Manufactured items account for almost 65% of the WPI, while in the CPI, food (including some manufactured items) and fuel products dominate and make up for more than a half of it.

Coming on the back of a spike in retail inflation to a 23-month high of 6.07% in July from 5.77% in the previous month, the latest WPI data serves to project elevated price pressure. However, analysts say the inflationary pressure seems to have been exacerbated by seasonal effects on the food articles. RBI will closely monitor the progress of

monsoon before resorting to further monetary easing, they added.

Core inflation, or the price rise in non-food manufacturing segment, returned to the positive territory after a gap of 16 months, though it stood at a subdued 0.1% in July, against -0.3% in the previous month. WPI inflation for May has been revised up to 1.24% from 0.79%, thanks to upward revision across board. Better domestic demand drove up prices of manufactured items. However, viewing the recovery of demand-side pressures as broad-based could be premature, as only seven of over a dozen core item segments witnessed a rise.

Within the primary food article segment, inflation in vegetable touched 28.05%, in pulses 35.76% and potato 58.78%.

“Going forward, while expected disinflation in food products amid recent correction in commodity prices would help to contain the sequential build-up in headline inflation, adverse base effect amid recovery in domestic demand leading to improved pricing power could cap the downside,” said Rao. She expects headline WPI inflation to exceed 4% in coming months in contrast with the trend in CPI inflation.

Aditi Nayar, senior economist at ICRA, said: “Emerging trends regarding the ongoing kharif sowing suggest an imminent cooling of food inflation in the coming months. In contrast, we expect core WPI inflation to continue to rise, pushing up headline inflation, which would considerably narrow the gap between wholesale and retail inflation in the second half of this fiscal.”