Why don?t you read the Parliamentary Standing Committee (PSC) report on gas pricing, says a senior BJP leader in response to the query as to why some of his party colleagues are casting AAP-style allegations about the gas price hike, and saying the Rangarajan formula-based price hikes need to be thoroughly reviewed. Though the BJP is pro-development, he says, it is not going to sit around and watch a scam in the making. Indeed, in response to Prashant Bhushan?s petition, even the Supreme Court has asked the government to explain the Rangarajan formula as well as the other Bhushan chestnut, that if Reliance Industries Ltd?s (RIL) partner Niko sells gas in Bangladesh at $2.34 per mmBtu, why does RIL want 3.5 times that.

The PSC makes points that, on their face, seem reasonable. So, it would like the domestic costs of production to be factored into the Rangarajan formula, for prices to be rupee-denominated instead of in dollars, for Russian gas export prices ($8.77 per mmBtu) to be included in the formula instead of Japanese import prices ($14-16). Presumably, this is what the government did since it took over a year to notify the Rangarajan formula, but given that doubts still persist?in even the likely ruling party?it is worth re-examining the PSC points.

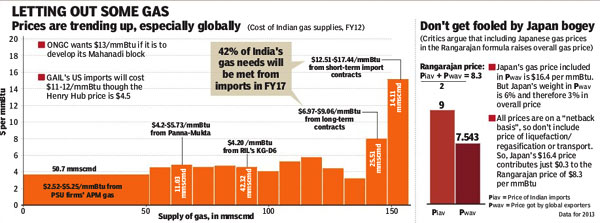

At the outset (see graphic), there is no one price of gas, not just globally, but even in India?Indian prices varied from $2.52 to $17.44 per mmBtu in FY12. So, if someone turns around and says that, at the likely Rangarajan price of $8.2, RIL is getting 3.5 times the Bangladesh price, it can turn around and say that India imports gas at more than double what it is to be paid. RIL is not the biggest beneficiary of the hike; the government gets the most by way of royalties, taxes and cesses, and it is ONGC after that since it produces 5 times what RIL does. But let?s ignore this inconvenient truth since it takes the sting out of the allegations.

Let?s take the PSC?s point about domestic costs first. RIL quotes a report by consulting firm IHS CERA as saying over 85% of India?s natural gas reserves are viable only at prices upwards of $10 per mmBtu. But forget RIL, ONGC has said, according to a government press release, it needs at least $7 to make gas exploration viable?a recent press report says the PSU wants $13 to explore for gas in its Mahanadi block. Short point is, the costs of gas depend on whether the fields are onshore or offshore, whether they have a lot of gas or little, whether the water is deep or very deep. While that pretty much answers the point about including domestic costs, the reason why Rangarajan has only looked at global prices is that gas is a tradable commodity?India imports 40% of its gas needs and there is nothing to stop firms from exporting their gas if the Indian price is low.

Moving gas prices to rupees is a great idea, if it can fly. The firms spend in dollars to explore for gas and, in any case, if ONGC and Cairn get paid for their crude in dollar prices, why single out gas?

What of India?s strategic ally Russia? More so since, if it turns off gas supplies to Europe, it will have so much to spare. The PSC says Russian gas costs $8.77, which is expensive, though a lot cheaper than the Japanese gas. Of course, the most obvious question that arises from the PSC is why we simply don?t shrug off the Khobragade angst, and just ask the US to supply us more gas?as opposed to Japan?s $14-16 and Europe?s $8-10, the US Henry Hub price is a mere $2.5-3.5.

The problem is Henry Hub prices apply to supplies in the US. To get to India?PSU firm GAIL has signed a few contracts for gas at Henry Hub prices?the gas needs to be transported to a liquefaction plant (this costs $0.5), it needs to be liquefied ($3), transported to India ($1), regasified ($0.5) ? by the time you add all this, and GAIL?s margins, the gas costs around $11 or so.

What of Japanese prices, the last real issue raised by the PSC? Put a high number and it makes the overall Rangarajan price go up. Rangarajan has two formulas?Piav and Pwav (see graphic)?one is the price at which India imports, the other the price global producers get; it is in the latter that Japanese prices get plugged in. Based on the proportion of imports in 2013, Japan?s weight is just 3% in the eventual formula. And since the price used is the one the seller gets?not what Japan pays for gas?this removes the cost of transport, liquefaction and regasification. All told, in the Rangarajan $8.3 price, Japan?s entry makes a difference of just $0.3.

Hopefully, this is something BJP prime ministerial candidate Narendra Modi will take into account before just taking his colleagues?, and the PSC?s, word on how unfair the Rangarajan formula is.

sunil.jain@expressindia.com