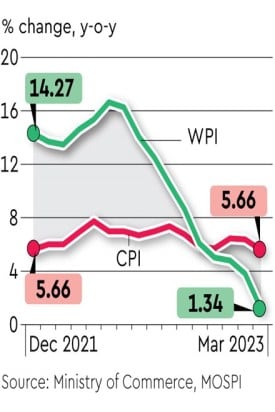

Wholesale price inflation fell to a 29-month low of 1.34% in March aided by a sustained decline in commodity prices and a favourable base effect, according to official data released on Monday.

WPI inflation was 3.85% in the previous month and it was 14.63% in March 2022. Overall, the wholesale inflation at the quarterly level dwindled to a nine-quarter low of 3.3% in Q4FY23, easing the input cost pressures on the corporates amidst weakening global and domestic demand. For FY23, the wholesale inflation averaged 9.4%, moderating from a 30-year high of 13% in FY22.

Rating agencies Icra and India Ratings have projected the headline WPI index to record a deflation after 32 months with the print at –0.5% in April, on a high base of15.4% a year ago.

Also read: Late harvest: MSP wheat purchases 23% less y-o-y

“Going forward, Ind-Ra expects the deflationary phase to kick in from April 2023 onwards on the back of base effect and low commodity prices,” Sunil Sinha, principal economist, India Ratings and Research, said.

According to Care Ratings chief economist Rajani Sinha, the downtrend in WPI is expected to continue, with the inflation remaining below 1% for the next three months, given the favourable base.

In March, the food index rose 2.32% year-on-year compared with 2.76% in February. The fuel and power index rose 8.96%, slowing from 14.82% rate in February.

WPI on manufactured products fell 0.77% in March, compared with a rise of 1.94% in the previous month.

The primary articles’ inflation declined to 2.4% in March from 3.28% in the previous month due to a deflation in crude & petroleum and non-food articles (such as fibres and oilseeds) and a drop in milk & cereals inflation. The crude petroleum prices plunged 23.5% on year in March. The non-food articles inflation, at -4.6% in March, was the lowest since August 2017. The cereals inflation slipped to a nine-month low of 9.5% with the milk inflation moderating to 8.5% in March from 10.3% in February.

“Prices of core items (non-food and non-energy) declined after a gap of 31 months in March 2023 and it stood at negative 0.3%. The core inflation is expected to be around negative 1.5% in April 2023,” Sinha added.

Also read: Explainer: India’s public stockholding dispute

However, inflation witnessed an uptick on some items including pulses at a 14-month high of 3% in March while prices of fruits & vegetables were up 1.1% on-year after being on a decline in the past four months.

The electricity inflation jumped to a five-month high of 22.7% in March from 19.7% in the previous month.

“While a high base and the downtrend in wholesale prices of most essential commodities in early-April 2023 are likely to soften the y-o-y food inflation slightly, the possibility of a heatwave in the ongoing month could impart upward pressures on prices of perishables,” Icra stated.

Retail inflation, measured by the Consumer Price Index (CPI), fell to a 15-month low in March and below the 6% upper tolerance limit of the RBI after remaining above it for two months, as prices of most items, particularly in the food basket, moderated and a base effect came into play. Official data released last week revealed that retail inflation was at 5.66% in March 2023 against 6.95% a year ago.