After a 20-basis-point spike on Thursday, the yield on the benchmark surged to an intra-day high of 7.88% on Friday before ending the day’s session at 7.76%.The Reserve Bank of India (RBI) cancelled an auction of government securities for an amount of Rs 11,000 crore. This is the fourth time an auction is being cancelled within a period of almost a month.

On Thursday, the yield had closed at 7.80% after the government said the fiscal deficit for 2017-18 would be 3.5% of GDP and not 3.2% of GDP. Moreover, fears of an uptick in inflation following the announcement by the government it would support crop prices if they fell below the minimum support price (MSP) also spooked the market.

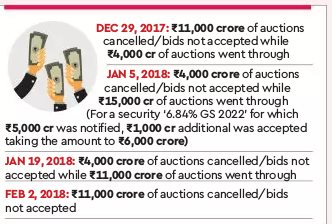

On December 29, the central bank deferred the auction for two securities for an amount of `11,000 crore; while on January 5 and 19, it did not accept bids for an amount of `4,000 crore each.

The old benchmark bonds — 6.79% yielding notes maturing in 2027 — fluctuated 41 basis points during intra-day trade, having moved between 7.47% and 7.88%. The yield, however, ended the session 4 basis points down from Thursday’s close at 7.76%.

The new benchmark bond yield rose to as high as 7.68% before closing 4 basis points down at 7.56%.

Market players said some buying was seen towards noon on reports the central bank might consider open market operation (OMO) purchases. It was soon countered by another report that cited “a source familiar with the Reserve Bank’s thinking” saying the RBI is not in talks with the government to conduct OMO purchases.

Vijay Sharma, executive vice-president for fixed income at PNB Gilts, confirmed that the initial surge in bonds was led by a report suggesting that the government was looking at measures to shore up the bond market. “The next trigger was given by the cancellation of Friday’s auction as the government may have decided not to accept the prices offered by the market participants,” he said.

The RBI had slated the auction of two government securities (GS) — 6.84% GS 2022 and 7.17% GS 2028 — on Friday worth Rs11,000 crore. Dealers indicated that since market participants put in bids (on bond prices) that were significantly lower, the central bank decided not to accept any bids.

This came in as a positive news as withdrawal of the auction meant less supply hitting the market. Sources also indicated that bids on bond prices were so low that the cut-off yield on the new benchmark bonds was expected to be over 7.70%.

Ajay Manglunia, executive vice-president at Edelweiss Securities, said it is very unusual to see the yield fluctuate 41 basis points in a day between both extremes without any rate action. “Even with the withdrawal of the weekly auctions, the yields have not fallen considerably. It seems the market does not have the appetite for more supply which is pushing the yields higher,” he said.

Experts also pointed to the high cut-off on the underwriting commission on Thursday ahead of Friday’s weekly auction. The cut-off for the new benchmark — 7.17% GS 2028 — came in at 5.24 paise. In the underwriting auction on January 24, the cut-off had come in at 1.67 paise. A higher cut-off rate indicates primary dealers are cautious on the auction.

On Thursday, bond markets had witnessed a sell-off after the government’s fiscal deficit projections for FY19 exceeded its previous guidance and expectations of a more hawkish stance by the RBI gained momentum following the decision to increase the MSP for kharif crops. The 10-year benchmark yield had closed 17 basis points higher at 7.60%, hitting a 22-and-a-half-month high.