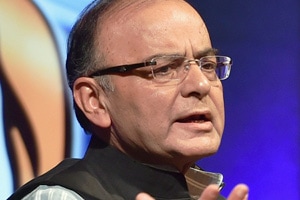

TAKING forward reforms on fuel subsidy, finance minister Arun Jaitley on Friday said that the government is considering removal of subsidy on cooking gas for well-off consumers.

“The next important decision that India has to take is whether people like us should get our LPG subsidy,” he said at the Hindustan Times Leadership Summit. While diesel and petrol prices have already been freed up, consumers at present get 12 cooking gas cylinders every year at a subsidised rate of Rs 414 each (in Delhi). Any requirement beyond this will have to be purchased at the market price of Rs 880 per 14.2-kg cylinder.

“I think the sooner we are able to take these decisions as to who is entitled to these subsidies, of course some people would be, the better it would be for our system. These decisions are all on our agenda,” the finance minister stressed.

Removing the subsidy on cooking gas for better off consumers would help the government lower its spending on unproductive subsidies, giving it much needed space to increase its capital expenditure as well as curb its fiscal deficit.

Jaitley said he had also recently had a meeting with the Expenditure Management Commission, which has been tasked with reviewing government subsidies as well as spending. “I hope they will come out with a strategy…,” he said. The minister’s comments come at a time when the government is trying to meet its fiscal deficit target of 4.1 per cent in 2014-15.

Jaitley also said government would be able to meet the direct tax target, though indirect tax remains a “challenge” as manufacturing sector was a great source of worry.

Meanwhile, listing out reforms that the NDA government is set to take, the minister said he was “almost ready” with the proposal on the Goods and Services Tax and was confident that the Constitution Amendment Bill on it would be introduced in the Winter Session starting Monday.

Referring to long-pending insurance bill, he said “we are on the verge” of opening the sector a little more. The Bill proposes to increase foreign direct investment limit in the insurance sector to 49 per cent from the current 26 per cent.

While refusing to comment on the possibility of a rate cut by the Reserve Bank of India in its next policy review on December 2, the finance minister said, “I have lot of patience.” However, he pointed out that banks have been defensive about lending due to rising bad loans while manufacturing is a source of concern due to factors like cost of capital foreign investors are keen to invest in the country. “My message is obliquely, not directly clear,” he said.