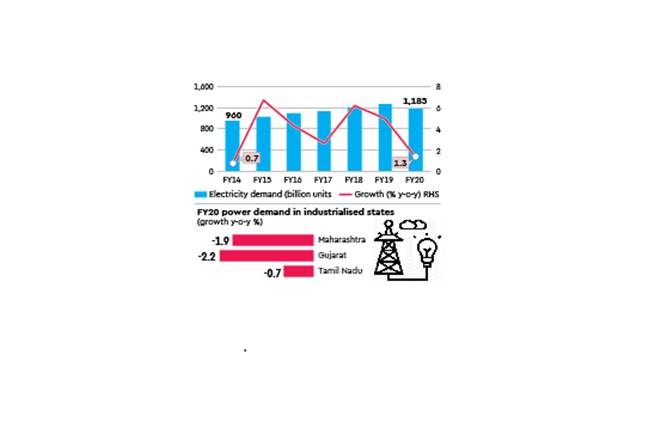

Power consumed by highly industrialised states like Gujarat, Maharashtra and Tamil Nadu in FY20 was lower than their respective volumes in FY19.

The three states are among the top five electricity users (other two being Uttar Pradesh and Rajasthan) and fall in power consumption in these places dragged down the country’s annual demand growth to a six-year low of 1.3%.

Since most of the revenue of the state-run power distribution companies (discoms) come from industrial and commercial customers, lower usage by these categories mean additional pressure on these already distressed entities.

While Maharashtra’s power usage dropped 1.9% year-on-year to 155.2 billion units (BU) of electricity in FY20, the same in Gujarat fell 2.2% to 113.9 BU and in Tamil Nadu slipped 0.7% to 108.7 BU. According to information available in the latest tariff orders of these states, industrial and commercial consumers contribute about 55% of the discoms’ revenue in Gujarat, 73% in Tamil Nadu and 54% in Maharashtra. Though the household and agricultural sectors consume about half of electricity supplies, they are cross-subsidised by industrial and commercial users. Tariffs on domestic consumers is on an average around 40% lower than that for industrial users of power.

“Industries in these (aforementioned) states are scaling down output in response to global and local economic pressures,” Deepak Sriram Krishnan, associate director for World Resources Institute’s India energy program, told FE.

Manufacturing of motor vehicles, textiles and petroleum products—a lot of these hubs are present in these three states—have been on the decline in FY20 due to lower demand and rising competition from other countries.

Lower FY20 income clashes with discoms facing revenue shortage with rising difficulties in meter reading exercises and payment collection amid the country-wide lockdown to contain the outbreak of the coronavirus.

Amid revenue shortfall, the current crisis has also raised uncertainties regarding subsidy releases by states and payments of other government dues. In the wake of such developments, the Union power ministry is deliberating on a plan to infuse liquidity in stressed through Centre-run PFC-REC, though the monetary value of the relief has not been ascertained yet. However, PFC and REC are likely to seek state government guarantees against the additional loans that would be given to discoms.