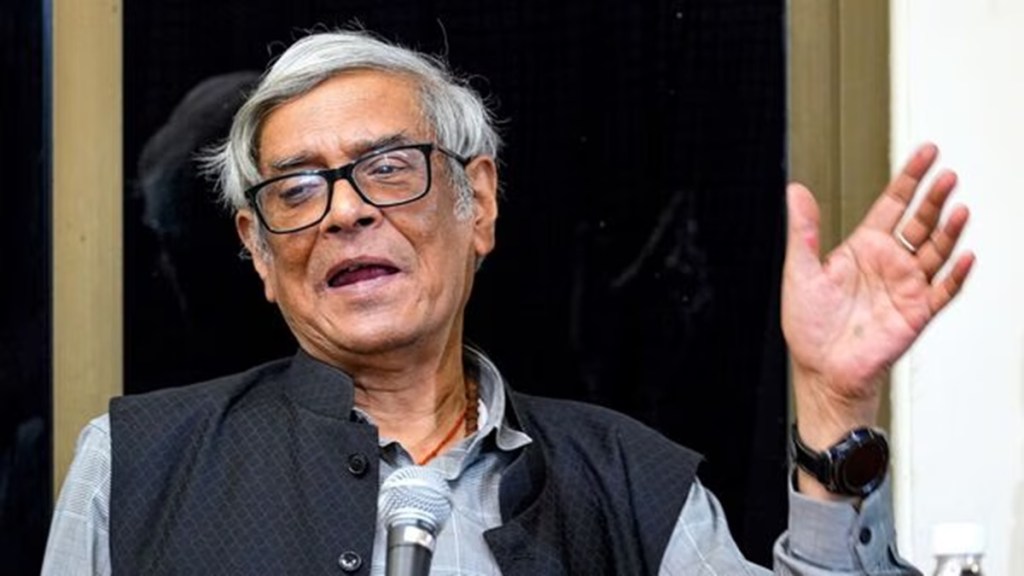

Noted economist Bibek Debroy, who passed away here on Friday at the age of 69, was known for his erudition, forthright views and academic and writing interests spanning a wide spectrum of areas. He boldly advocated taxing of agricultural income, despite the issue being a political hot potato, and even called for a new Constitution, saying that it could help “address many issues the country is facing.”

He also embarked on the task of re-imagining the much-interpreted ancient Indian religious texts Mahabharat, Ramayan and Bhagwat Geeta, and acquitted himself well.

In an over-4-decades career, Debroy held many positions in the industry, academia, government, and was associated with many think tanks, including the Niti Aayog. He became chairman of the Economic Advisory Council to the Prime Minister (EAC-PM) in September 2017, and held that position till his death. The latter period of his life, some would say, has seen a relatively moderate Debroy, maybe because of the compulsions of the office he held.

Prime minister Narendra Modi said on X: “Dr Bibek Debroy Ji was a towering scholar, well-versed in diverse domains like economics, history, culture, politics, spirituality, and more. Through his works, he left an indelible mark on India’s intellectual landscape.”

A regular columnist for Financial Express and The Indian Express for long, Debroy was educated in Ramakrishna Mission School, Narendrapur; Presidency College, Kolkata, Delhi School of Economics and Trinity College, Cambridge. He has worked in Presidency College, Kolkata (1979-83), Gokhale Institute of Politics and Economics, Pune (1983-87); Indian Institute of Foreign Trade, Delhi (1987-93); and as director of a Ministry of Finance/UNDP project on legal reforms (1993-98).

He also worked for Department of Economic Affairs (1994-95): National Council of Applied Economic Research (1995-96); Rajiv Gandhi Institute for Contemporary Studies (1997-2005); PHD Chamber of Commerce and Industry (2005-06); and Centre for Policy Research (2007-2015). Debroy was also a Member of NITI Aayog up to June 5, 2019. He has authored/edited several books, papers and popular articles and has also been a Consulting or Contributing Editor with several newspapers. . He was awarded the Padma Shri in 2015.

In April 2017, as Niti Aayog Member he spoke about on the need to bring agriculture income under the Income Tax net to widen the taxpayer base and plug black money generation. A Niti Aayog report had favoured the imposition of income tax on such income, though it was comparatively ambivalen. When asked to elaborate on the suggestion to tax agricultural income at a press conference, Debroy had said: “The eventual answer to further expand the personal income taxpayer base, besides elimination of exemptions, is also to tax the rural sector, including agricultural income.”

This had created a flutter and had put the BJP government on the back foot on the politically sensitive issue. The then finance minister Arun Jaitley had to clarify that the government had no such plan to alter the tax-free status of agricultural income.

With states complaining that the Centre was taking away their fiscal powers, including with regard to centrally sponsored schemes and borrowings, Debroy in an interview told FE in September 2022 said that India needs a new Constitution to address many of these issues. “If we are talking about going to start the template for the next 25 years (for the nation), I would say that we need to take a re-look at the entire Constitution,” he had said. If something was important enough, it should be a Central Sector scheme with 100% Union government funding, he felt.

He headed a high-level committee on ways to address the huge resource gap faced by Indian Railways (IR), and help it stand largely on its own. The committee offered a set of solutions, including an organsational restructuring of the monolith to ease its hierarchical decision-making process, and eable a shift to commercial accounting. The panel fought shy of proposing “privatisation,” or even “deregulation,” but pitched for substantial “liberalisation.” Some of these recommendations have been acted upon in subsequent years.

Lately, as chairman of the EAC-PM, he underlined the need for a less complex, single-rate GST, and said: “We must either be willing to pay higher taxes or settle for reduced delivery of public goods and services.” Debroy noted the continuing wide gap (8% of GDP) between tax revenues and the requirement of government spending on infrastructure, education, healthcare and defence, would need to resolved without any further delay, and this might also need higher tax rates.