-

Narendra Modi government may further tweak the gold monetisation scheme to make it more attractive after low returns and tax worries kept households and temples with about 20,000 tonnes of gold worth over $800 billion away. A low interest rate of up to 2.5 per cent and the penchant of Indians for holding physical gold have drawn lesser people to the scheme, which is part of broader plans to tighten gold imports after the current account deficit swelled to a record in 2013 and the Indian rupee slumped to an all-time low. While the deposits can be for 1-15 years, the banks are free to sell the gold to jewellers, potentially boosting supply. (Express Photo)

Following realisation of just 3 tonnes of gold, Economic Affairs Secretary Shaktikanta Das met with Indian Bullion Association and jewellery representatives to discuss ways to make the programme work better. Tweaking the plan is on the table as it was proposed that changes should be applied retrospectively from the date the scheme started, sources said. "In the long term, the gold monetisation scheme should succeed. We reviewed the difficulties in the gold monetisation scheme and took suggestion and now they are under consideration," Das said today after the meeting. (Express Photo) -

Admitting that gold received under the monetisation scheme was "lower than expected amount", he said temple trusts have "started showing interest in the gold scheme". Prime Minister Narendra Modi on November 5 last year had launched the programme to lure tonnes of gold lying idle with households and temples into the banking system. But low returns and concerns over tax authorities hounding depositors have hampered the scheme, which is aimed at cutting imports. (Express Photo)

-

Jewellers strike: A sizeable section of jewellers, bullion traders and artisans continued their strike for the 22nd day today to protest against the proposed 1 per cent excise duty on non-silver jewellery, even as the government set up a panel to look into their demand. Most jewellery houses in the country including in Delhi are closed since March 2 after FM Arun Jaitley announced the excise duty on non-silver jewellery in the Union Budget 2016. (Express photo)

-

Cash purchase of gold jewellery above Rs 2 Lakh exempted from 1% tax according to reports: Payment in cash for buying goods and services worth more than Rs 2 lakh with the exception of jewellery will attract one per cent tax collected at source (TCS) from Wednesday. The existing TCS of one per cent on cash purchase of over Rs 5 lakh of jewellery and over Rs 2 lakh of bullion will continue, tax officials said. The Income Tax Department has been levying 1 per cent TCS on cash purchase of bullion in excess of Rs 2 lakh and jewellery in excess of Rs 5 lakh since July 1, 2012. (Express photo)<br><a href="https://twitter.com/FinancialXpress" target="_blank">For more business news and analyses, follow us @FinancialXpress </a></br>

-

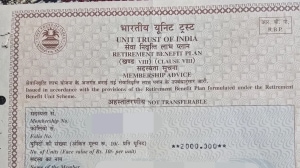

Under the gold monetisation scheme, the investor gets his gold back in form of a bar or coin, with the risk of gold price changes being borne by a gold-reserve fund to be set up by the government. Gold, at 1,000 tonnes a year, is the second-biggest imported commodity in India after crude oil. During April-January, gold imports increased to USD 29.36 billion as against USD 27.42 billion in the first 10 months of 2014-15. (Express Photo)

The man who built IndiGo — and quietly walked away with Rs 40,000 crores