-

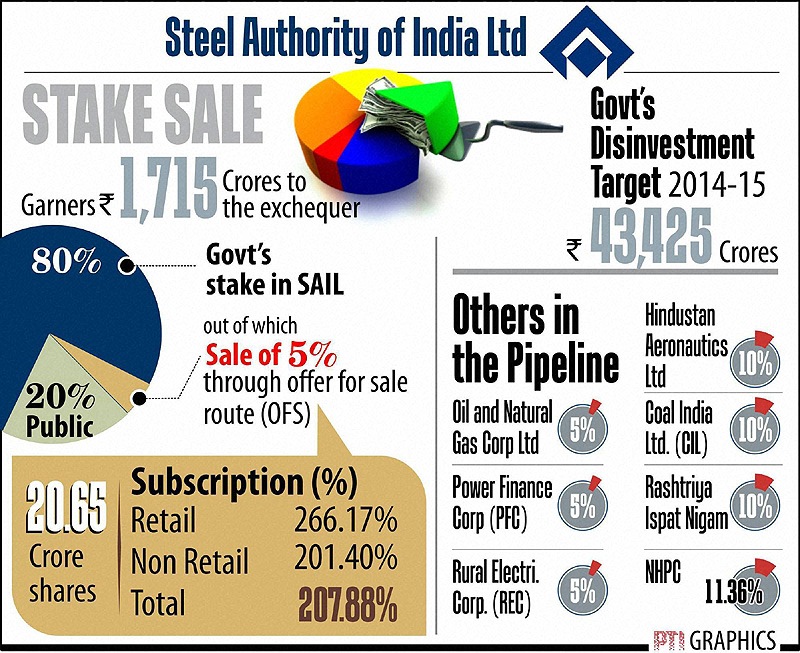

Government's disinvestment drive got a tremendous start today, with steel major SAIL's share sale being subscribed more than two times fetching the exchequer Rs 1,715 crore. Graph: PTI

-

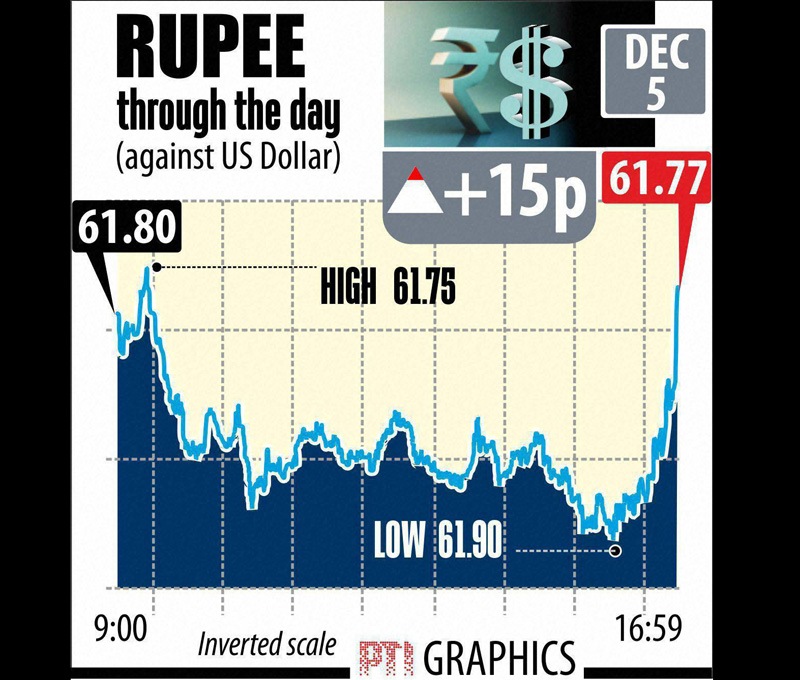

Indian rupee through the day against US dollar. After two days of listless trade, the Indian rupee today rebounded 15 paise to close at two-week high of 61.77 against the Greenback following dollar selling by exporters and some banks amid signs of fund inflows. Graph: PTI

-

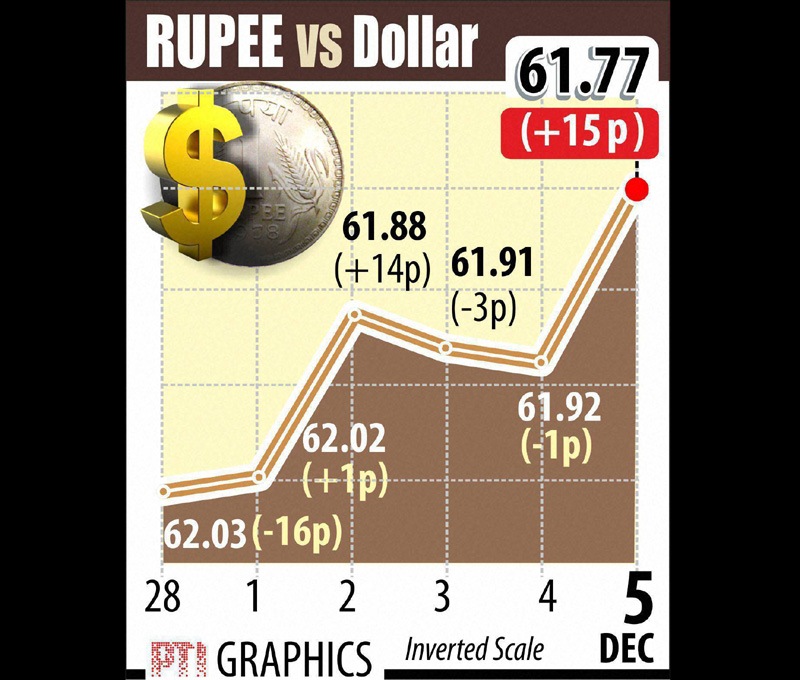

Indian rupee vs US dollar. Dollar selling was so strong that even a weak trend in local equities and a firm dollar overseas could not stem the rupee's rise, forex dealers said. Graph: PTI

-

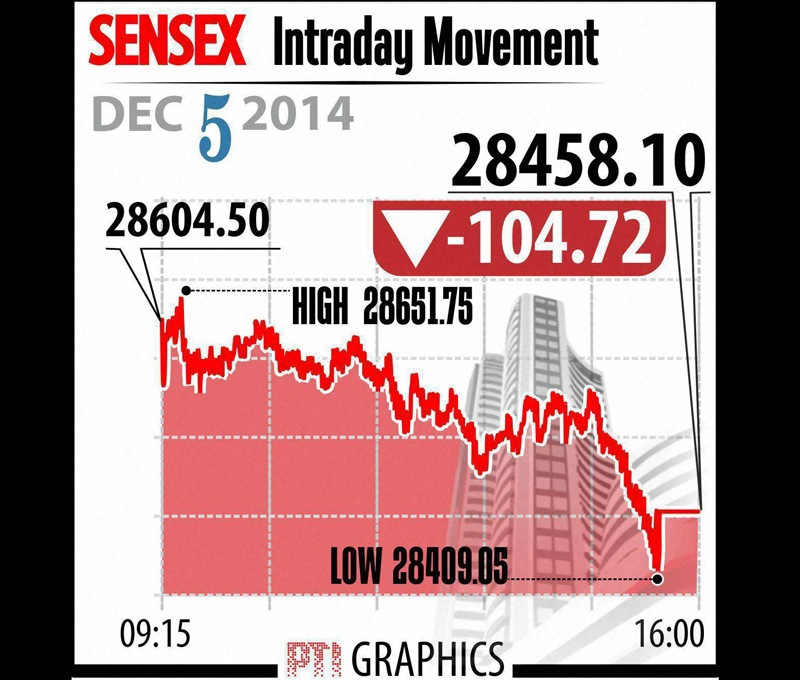

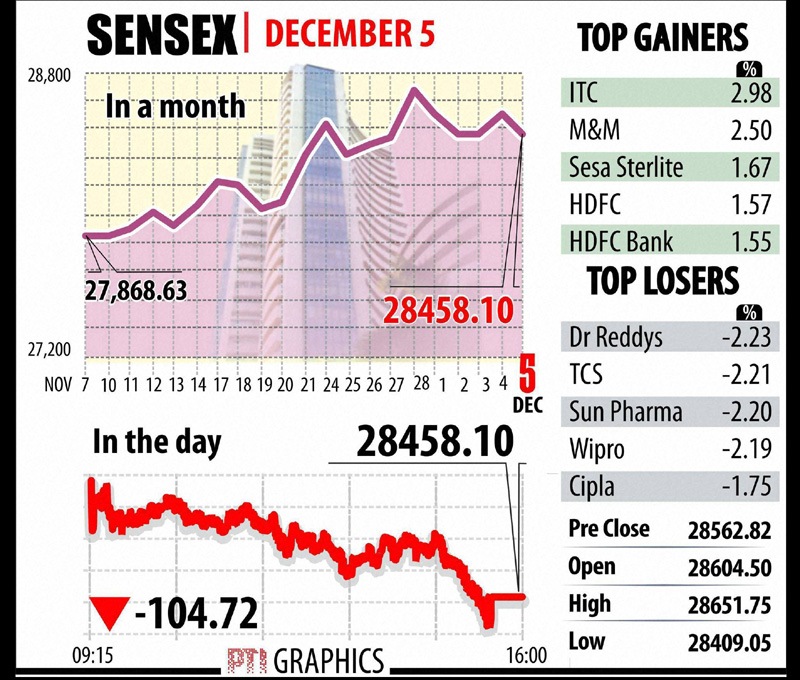

BSE Sensex Intraday Movement. The benchmark Sensex today ended 105 points lower at 28,458.10 and logged its first weekly drop in seven weeks on late profit-booking in IT and pharma shares. Graph: PTI

-

BSE Sensex: Top Gainers, Top Losers. The BSE Sensex appears to be consolidating between 28,000 and 29,000 levels before making any fresh move, brokers said. ITC, M&M and Sesa Sterlite were among the few gainers in 30-share Sensex. The barometer fell on losses led by TCS, Infosys, Wipro, Sun Pharma, Dr Reddy's and Cipla shares. Graph: PTI

-

BSE Sensex and NSE Nifty throughout the day. The BSE 30-share barometer resumed better and improved further to a high of 28,651.75 only to fell back after mid-session. It finally settled at 28,458.10, a fall of 104.72 points or 0.37 per cent. Graph: PTI

-

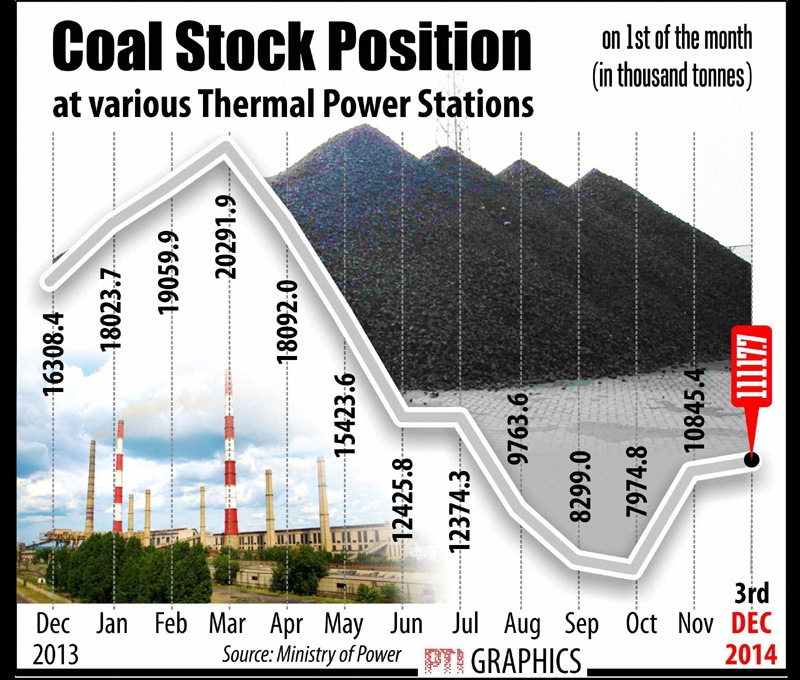

Coal stock position at various thermal power stations. Graph: PTI

-

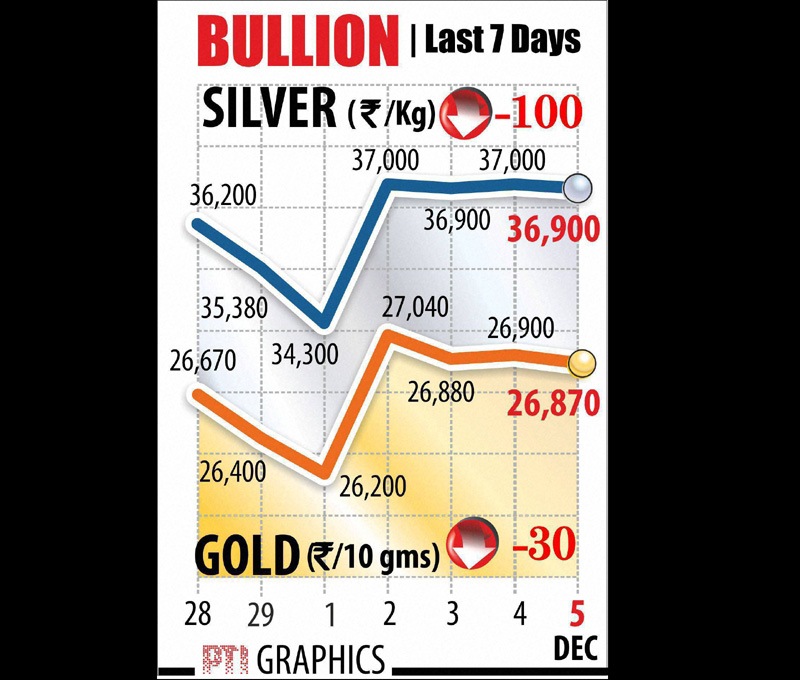

Gold and silver prices. Gold prices advanced further at the domestic bullion market due to sustained demand from stockists as well as good local buying support. Graph: PTI

Not Thailand or Vietnam: This visa-free country with direct flights is the new favourite destination for Indian travellers