-

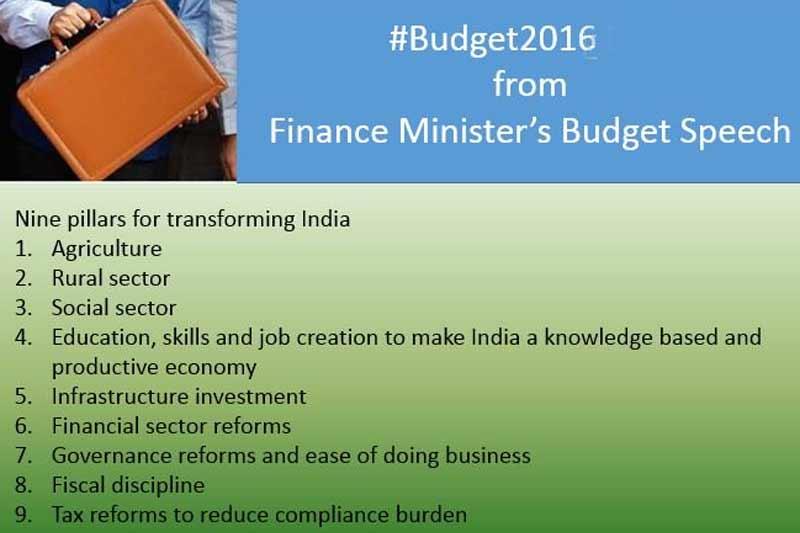

Budget 2016 Highlights: Arun Jaitley's speech highlighted the fact that his Budget 2016 proposals are built on a transformative 9 pillars agenda: (i) Agriculture and Farmers’ Welfare: with focus on doubling farmers’ income in five years; (ii) Rural Sector: with emphasis on rural employment and infrastructure; (iii) Social Sector including Healthcare: to cover all under welfare and health services; (iv) Education, Skills and Job Creation: to make India a knowledge based and productive society; (v) Infrastructure and Investment: to enhance efficiency and quality of life; (vi) Financial Sector Reforms: to bring transparency and stability; (vii) Governance and Ease of Doing Business: to enable the people to realise their full potential; (viii) Fiscal Discipline: prudent management of Government finances and delivery of benefits to the needy; and (ix) Tax Reforms: to reduce compliance burden with faith in the citizenry: Here is what Finance Minister Arun Jaitley revealed in speech: (Image Source: Finance Ministry)

-

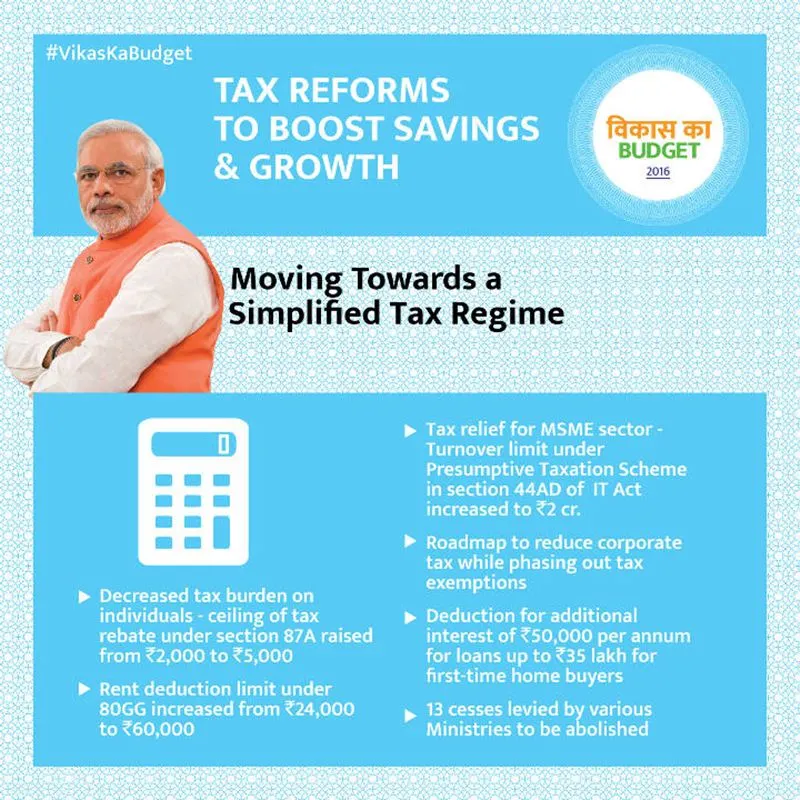

Budget 2016 Highlights: 1. Tax Reforms: In order to lessen tax burden on individuals with income not exceeding Rs 5 lakhs, I propose to raise the ceiling of tax rebate under section 87A from Rs 2,000 to Rs 5,000. There are 2 crore tax payers in this category who will get a relief of Rs 3,000 in their tax liability. The people who do not have any house of their own and also do not get any house rent allowance from any employer today get a deduction of Rs 24,000 per annum from their income to compensate them for the rent they pay. I propose to increase the limit of deduction in respect of rent paid under section 80GG from Rs 24,000 per annum to Rs 60,000 per annum, which should provide relief to those who live in rented houses. Presumptive taxation scheme under section 44AD of the Income Tax Act is available for small and medium enterprises i.e non corporate businesses with turnover or gross receipts not exceeding one crore rupees. For the ‘first – home buyers’, I propose to give deduction for additional interest of Rs 50,000 per annum for loans up to Rs 35 lakh sanctioned during the next financial year, provided the value of the house does not exceed Rs 50 lakh. (Image Source: Finance Ministry)

-

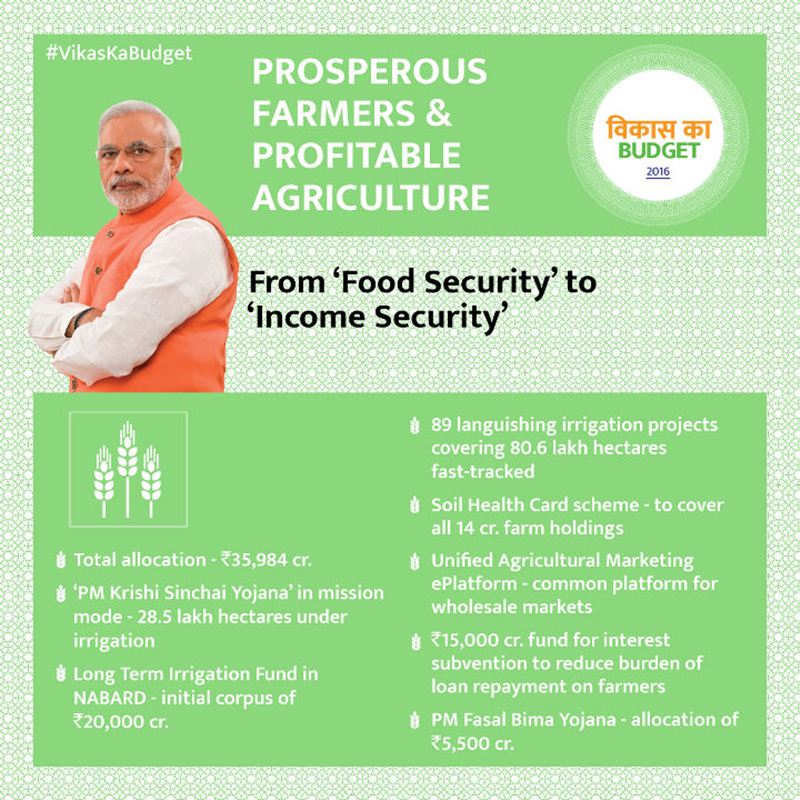

Budget 2016 Highlights: 2. Agriculture and Farmers' Welfare: Total allocation for Agriculture and Farmers’ welfare is Rs 35,984 crore. The ‘Pradhan Mantri Krishi Sinchai Yojana’ has been strengthened and will be implemented in mission mode. Implementation of 89 irrigation projects under AIBP will be fast tracked. This will help to irrigate 80.6 lakh hectares. These projects require Rs 17,000 crore next year and Rs 86,500 crore in the next five years. We will ensure that 23 of these projects are completed before 31st March, 2017. A dedicated Long Term Irrigation Fund will be created in NABARD with an initial corpus of about Rs 20,000 crore. Simultaneously a major programme for sustainable management of ground water resources has been prepared with an estimated cost of Rs 6,000 crore and proposed for multilateral funding. To ensure that the benefit of MSP reaches farmers in all parts of the country. Three specific initiatives will be taken up in 2016-17 for this. First, the remaining States will be encouraged to take up decentralized procurement. Second, an online Procurement System will be undertaken through the Food Corporation of India. This will usher in transparency and convenience to the farmers through prior registration and monitoring of actual procurement. Third, effective arrangements have been made for pulses procurement. (Image Source: Finance Ministry)

-

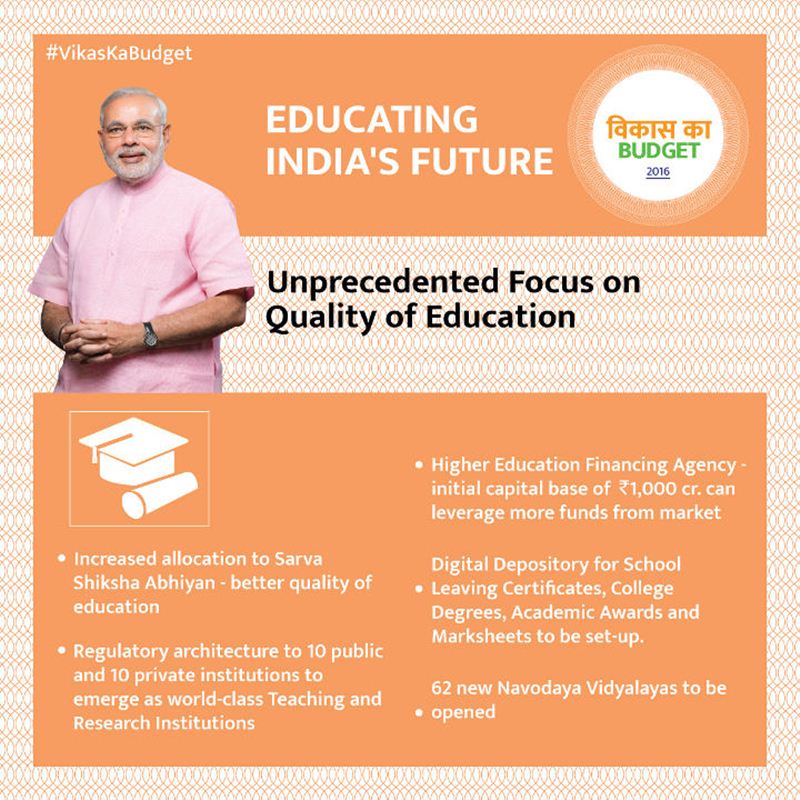

Budget 2016 Highlights: 3. Education, Skills and Job Creation: After universalisation of primary education throughout the country, we want to take the next big step forward by focusing on the quality of education. An increasing share of allocation under Sarva Shiksha Abhiyan will be allocated for this. Further, 62 new Navodaya Vidyalayas will be opened in the remaining uncovered districts over the next two years. Higher Education Financing Agency (HEFA) with an initial capital base of Rs 1,000 crores will be set up. The HEFA will be a 12 not-for-profit organisation that will leverage funds from the market and supplement them with donations and CSR funds. These funds will be used to finance improvement in infrastructure in our top institutions and will be serviced through internal accruals. Entrepreneurship Education and Training will be provided in 2200 colleges, 300 schools, 500 Government ITIs and 50 Vocational Training Centres through Massive Open Online Courses. Aspiring entrepreneurs, particularly those from remote parts of the country, will be connected to mentors and credit markets. Entrepreneurship Education and Training will be provided in 2200 colleges, 300 schools, 500 Government ITIs and 50 Vocational Training Centres through Massive Open Online Courses. Aspiring entrepreneurs, particularly those from remote parts of the country, will be connected to mentors and credit markets. (Image Source: Finance Ministry)

-

Budget 2016 Highlights: 4. Rural Sector: For rural development as a whole, I have allocated Rs 87,765 crore in the Budget for 2016-17. A sum of Rs 2.87 lakh crore will be given as Grant in Aid to Gram Panchayats and Municipalities as per the recommendations of the 14th Finance Commission. This is a quantum jump of 228% compared to the previous five year period. The funds now allocated, translate to an average assistance of over Rs 80 lakh per Gram Panchayat and over Rs 21 crore per Urban Local Body. These enhanced allocations are capable of transforming villages and small towns. Ministry of Panchayati Raj will work with the States and evolve guidelines to actualise this. A sum of Rs 38,500 crore has been allocated for MGNREGS in 2016-17. a new Digital Literacy Mission Scheme for rural India will be launched to cover around 6 crore additional households within the next 3 years. Details of this scheme will be spelt out separately. (Image Source: Finance Ministry)

-

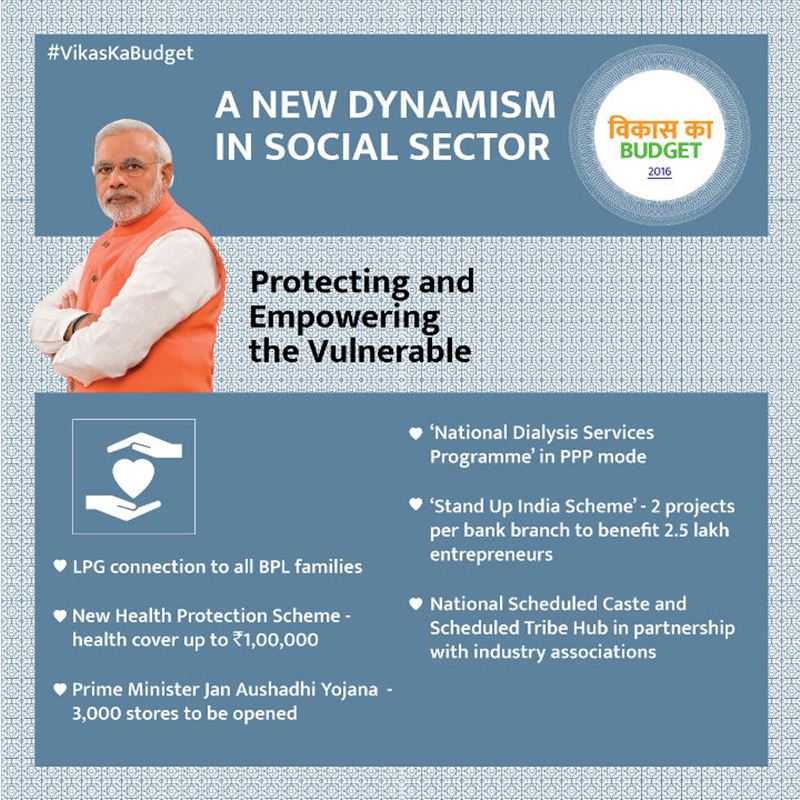

Budget 2016 Highlights: 5. Social Sector including Health Care: A sum of Rs 2,000 crore in this year’s Budget to meet the initial cost of providing these LPG connections. This will benefit about 1 crore 50 lakh households below the poverty line in 2016-17. The Scheme will be continued for at least two more years to cover a total of 5 crore BPL households. Government will launch a new health protection scheme which will provide health cover up to Rs.One lakh per family. For senior citizens of age 60 years and above belonging to this category, an additional top-up package up to Rs 30,000 will be provided. Union Cabinet has approved the “Stand Up India Scheme” to promote entrepreneurship among SC/ST and women. Rs 500 crore has been provided for this purpose. The schemes for welfare and skill development for Minorities such as Multi-sectoral Development Programme and USTAAD shall be implemented effectively. (Image Source: Finance Ministry)

-

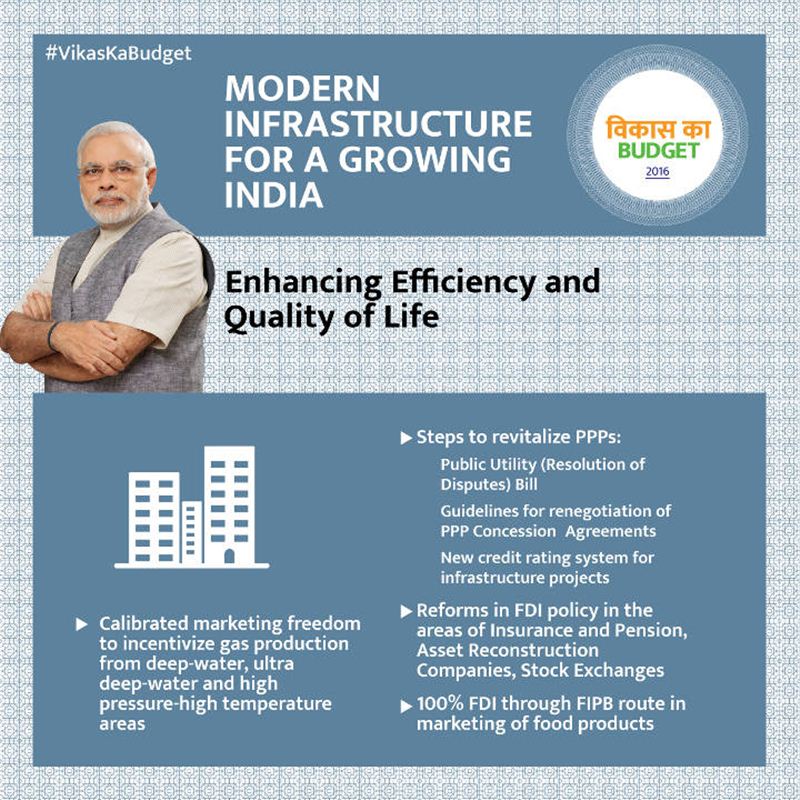

Budget 2016 Highlights: 6. Infrastructure and Investment: The fifth support pillar of the Budget theme ‘Transform India’ is infrastructure and investment. An allocation of Rs 55,000 crore has been made in the Budget for Roads and Highways. This will be further topped up by additional Rs 15,000 crore to be raised by NHAI through bonds. Thus the total investment in the road sector, including PMGSY allocation, would be Rs 97,000 crore during 2016-17. Together with the capital expenditure of the Railways, the total outlay on roads and railways will be Rs 2,18,000 crore in 2016-17. In the civil aviation sector, the Government is drawing up an action plan for revival of unserved and underserved airports. There are about 160 airports and air strips with State Governments which can be revived at an indicative cost of Rs 50 crore to Rs 100 crore each. The Department of Disinvestment is being re-named as the “Department of Investment and Public Asset Management (DIPAM)”. (Image Source: Finance Ministry)

-

Budget 2016 Highlights: 7. Financial Sector Reforms: The Banks are putting in special efforts to effect recoveries, with a focus on reviving stalled projects. To support the Banks in these efforts as well as to support credit growth, an allocation of Rs 25,000 crore has been proposed in BE 2016-17 towards recapitalisation of Public Sector Banks. To provide better access to financial services, especially in rural areas, we will undertake a massive nationwide rollout of ATMs and Micro ATMs in Post Offices over the next three years. Public shareholding in Government-owned companies is a means of ensuring higher levels of transparency and accountability. To promote this objective, the general insurance companies owned by the Government will be listed in the stock exchanges. (Image Source: Finance Ministry)

-

Budget 2016 Highlights: 8. Governance and Ease of Doing Business: “Ek Bharat Shreshtha Bharat” programme will be launched to link States and Districts in an annual programme that connects people through exchanges in areas of language, trade, culture, travel and tourism. To remove the difficulties and impediments to ease of doing business, we will introduce a bill to amend the Companies Act, 2013 in the current Budget Session of the Parliament. The Bill would also improve the enabling environment for start-ups. The registration of companies will also be done in one day. Monitoring of prices of essential commodities is a key element of good governance. A number of measures have been taken to deal with the problem of abrupt increase in prices of pulses. Government has approved creation of buffer stock of pulses through procurement at Minimum Support Price and at market price through Price Stabilisation Fund. This Fund has been provided with a corpus of Rs 900 crore to support market interventions. (Image Source: Finance Ministry)

-

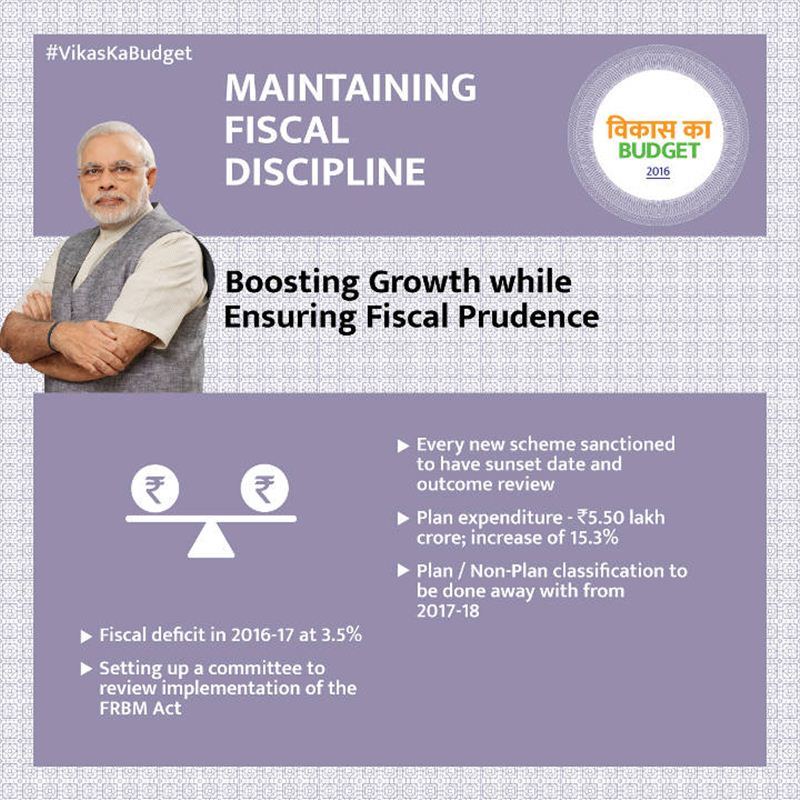

Budget 2016 Highlights: 9. Fiscal Discipline: The total expenditure in the Budget for 2016-17 has been projected at Rs 19.78 lakh crore, consisting of Rs 5.50 lakh crore under Plan and Rs 14.28 lakh crore under Non-Plan. The increase in Plan expenditure is in the order of 15.3% over current year BE. Continuing with the policy of higher empowering States, the total resources being transferred to States are Rs 99,681 crore more over RE 2015-16 and Rs 2,46,024 crore more over Actuals of 2014-15. Initial sums of Rs 100 crore have been allocated each for celebrating the Birth Centenary of Pandit Deen Dayal Upadhyay and the 350th Birth Anniversary of Guru Gobind Singh. (Image Source: Finance Ministry)

Will alcohol get costlier after new GST rates? Govt clarifies