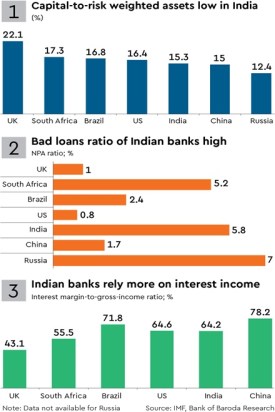

At a time when the Reserve Bank of India insits domestic banks need to shore up their capital base while preparing for future expansion, Indian banks’ regulatory capital-to-risk weighted assets ratio is 15.3, which is low when compared to banks in peer-nations such as South Africa and Brazil.

Also read: Missing the spirit of the IBC

Even the non-performing asset ratio of Indian banks is on the higher side as compared to Brics peers barring Russia. Domestic banks rely more on interest income, indicating greater dependence on the loan book and less on fee income.