By Sanjeev Bansal & Ashima Agarwal

Rakesh, a young IT professional, aged 27 years, had recently started investing in the stock market. He came to know about a relatively new company from a colleague and after checking the returns of the last three months, he invested all his savings in that company without studying the stock and the market trends.

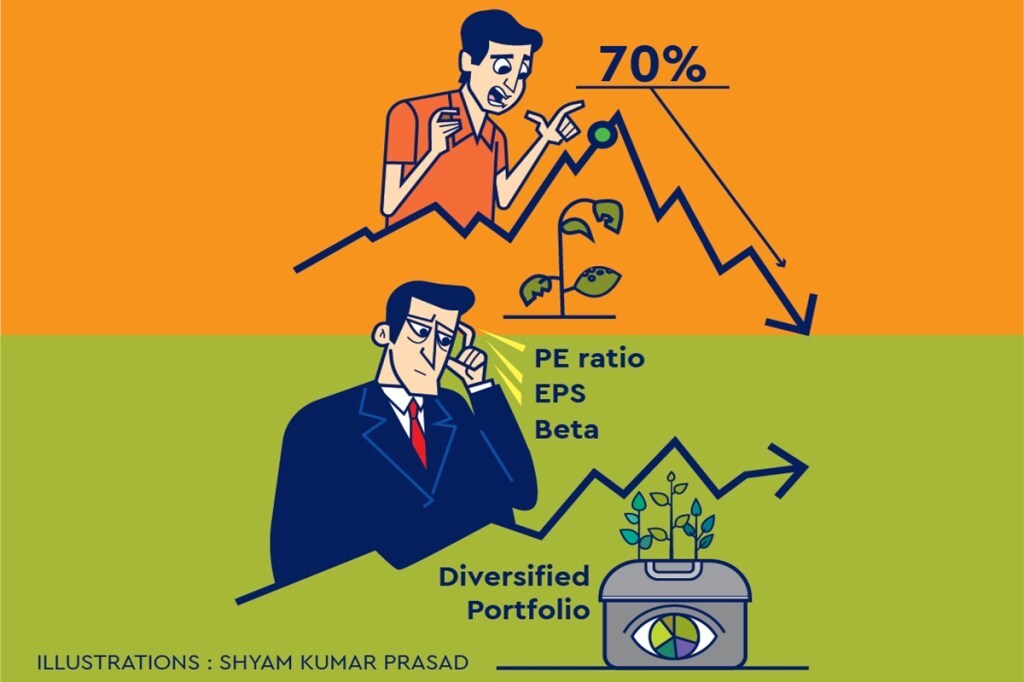

After a few months, there was a small correction in the market and particularly in the area where that particular company was operating. That company was in huge debt and was not able to sustain this correction and share price dropped by 70%. Rakesh lost almost all his savings.

Ramesh, aged 53 years, who had spent his life understanding the market sentiments invested in the stocks where the PE ratio, EPS, long term growth trend, Beta of stock, etc., was favourable and long term sustainability was confirmed. Also, Ramesh invested equitably in a variety of firms with differential returns to average out the returns in totality. During market corrections, Ramesh was able to sustain his portfolio and there was very little impact as he had been diligent in devising a portfolio which was well-diversified so that the loss due to risk was minimised. Also, when the decisions are based on fundamentals, the returns tend to be less volatile.

Basics of stock markets

From the above two examples, it is implied that stock markets are not a cakewalk and investors need to take due care in understanding the basics of stock markets.

Investment decisions should be based upon factors such as investment horizon (short term/ long term), cash flow requirements by investors in the near future, age of the investor, household income, etc. Based on these factors, investors can place their savings in bank FDs, company FDs, capital markets, company bonds, mutual funds, etc. There should be no hurry to earn short-term gains as higher the return in the short term the larger is the risk undertaken. Diversification is the key to investing as it helps to not only average out the risk but also helps to earn a minimum average threshold return thus ensuring the investor of an acceptable and good rate of return. lnvestors should balance their portfolio in such a manner that there should be some low-risk low-return and some high-risk high-return yielding stocks which will help the portfolio yield average returns. The portfolio should also consist of certain good dividend yielding stocks so as to ensure regular annual income from the investment.

Investors need to study the markets carefully and not fall prey to market indicators which are short term. Also the maxim of not putting all eggs in one basket should be adhered to in its complete sense as we are aware that markets are absolutely volatile and to sustain returns in these situations may pose a challenge in itself.

A sapling will only bear fruits when given good care, proper time and patience and the same also holds true for smart investment decision making.

Sanjeev Bansal is dean, FMS and director, Amity Business School and Ashima Agarwal is assistant professor, Amity Business School, Amity University