Traditionally, the last three months of the financial year, are considered as the tax planning season, wherein individuals focus on making certain tax-saving investments.

However, ever since the New Tax Regime was introduced in the Union Budget 2020-21, the income tax slab structure under it was made attractive over the years to encourage many individual assessees, and then the New Tax Regime made the default tax regime from Assessment Year 2024-25 onwards, the obligation to make tax-saving investments has reduced. Take the case of Equity Linked Saving Schemes (ELSS)…

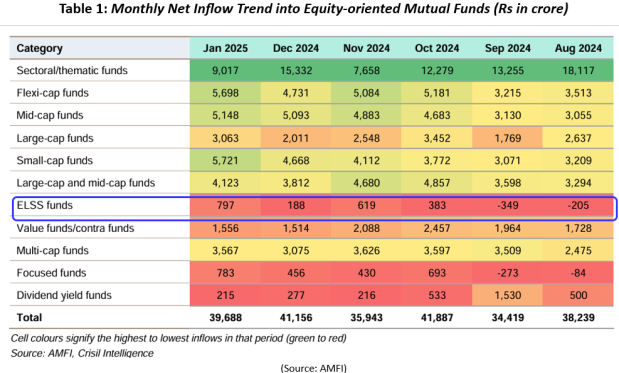

The AMFI data reveals that net inflows into ELSS have reduced significantly compared to other sub-categories of equity-oriented mutual funds.

The key reason behind this is possibly that the New Tax Regime is beneficial for a large section of India’s taxpayers even though it is devoid of many exemptions and deductions, which are available under the Old Tax Regime.

As per the CBDT Chairman, Mr Ravi Agarwal, about 74% of the 8.0-8.5 crore individual taxpayers have already adopted the New Tax Regime. Going forward, he sees around 95-97% of these taxpayers joining the New Tax Regime.

In addition to the benefit due to slab rate reduction, the limit for Section 87A rebate has been increased over the years, proving to be a sweetener for many individual taxpayers.

That being said, notwithstanding the above, some wise investors are still adding ELSS (also known as tax-saving mutual funds) into their investment portfolios. Perhaps they are approaching ELSS not just for tax saving but even to build wealth over the long term.

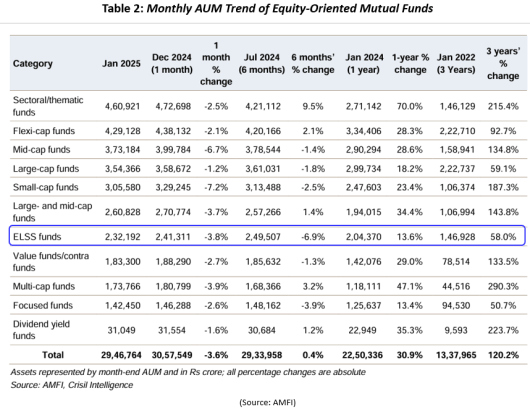

The Assets Under Management (AUM) of the ELSS category is worth Rs 2.32 lakh crore as of January 2025, 13.6% more compared to January last year. ELSS sub-category has a folio count of 1.7 crore as of January 2025.

Return Potential of ELSS

ELSS are mandated to invest a minimum of 80% of their total assets in equity and equity-related instruments in accordance with the equity-linked savings scheme 2005, as notified by the Ministry of Finance.

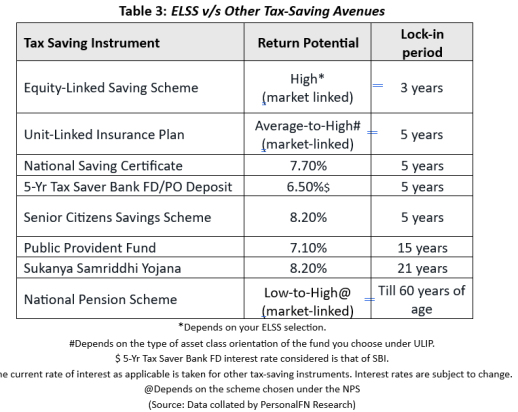

ELSS come with a 3-year lock-in period, and although the returns are market-linked, they have demonstrated the ability to create wealth for investors.

The 3-year category average returns of ELSS are 14.6% CAGR (under the Direct Plan), 160 basis points higher than the returns clocked by their benchmark index during the same period. Similarly, over 5 years, the category average returns of ELSS are 17.7% CAGR (under the Direct Plan), 0.59 basis points higher than the benchmark index. Even over a longer period of 10 years, the compounded annualised return clocked by ELSS on an average is 13.0%, which is 71 basis points higher than the benchmark index. In these periods, certain ELSS or tax-saving mutual funds have even outperformed their category peers and benchmark. If a prudent selection is made, decent capital appreciation can be expected.

Even now while the Indian equity markets are currently volatile, the key point is that if you hold on to your investments for the long term, it can be a rewarding experience and help mitigate the risks in the short term. All it needs is patience and necessary investment discipline.

Note that as a strategy, a majority of the ELSS or tax-saving mutual funds invest flexibly across market capitalisations (large-cap, mid-cap, and small-caps) and sectors. The fund manager takes the call based on the valuations of the market cap segments and a host of other factors. Plus, an ELSS could pursue a growth or value style of investing depending on the market conditions and opportunities.

Currently, most ELSS funds are holding a predominant portion of their portfolio in large-caps considering valuations. As an investor, you could potentially benefit from the diverse portfolio of ELSS.

The table above shows that compared to some of the traditional tax-saving avenues, ELSS is an attractive avenue. The lock-in period is shorter — which means better liquidity — and you potentially stand to benefit with better returns. ELSS facilitates tax efficiency and wealth creation. Conceivably clocking better returns with ELSS, may help you build the required corpus to accomplish the envisioned financial goal/s. But in a volatile time, as at present, you need to give enough time for your investment to grow; keep a longer investment horizon.

Who Should Opt for ELSS or Tax Saving Mutual Funds?

If you are a high-risk investor, who does not mind market-linked returns, is ready to assume market volatility, have an investment horizon of 3-5 years or more to earn a decent real return (also known as inflation-adjusted returns), ELSS could be a worthwhile fit in your investment portfolio.

Under the Old Tax Regime investment regime, an investment made in ELSS will entitle you to a deduction under Section 80C of up to Rs 1.50 lakh in the financial year.

Keeping in mind that taxable income is high (over Rs 20 lakh) and are paying home loan EMIs, and insurance premiums for self and dependants, it might still be beneficial to stay in the Old Tax Regime. In such a case, investing in ELSS (recognising your risk profile) and other tax-saving avenues may still be worthwhile.

Should You Invest Lump Sum or Take the SIP Route?

To invest in ELSS you may take the lump sum or the SIP route, but in the case of the latter keep in mind keep in mind that every SIP instalment will be subject to a lock-in of three years.

Similarly, as you are looking for mainly capital appreciation over the long term (3-5 years horizon or more), choosing the Growth Option over the IDCW Option would be sensible.

Further, I suggest opting for the Direct Plan over the Regular Plan, as the lower expense ratio under the Direct Plan may help you clock slightly higher returns than the Regular Plan.

Tax Implications of Investing in ELSS

The capital gain made at the time of redemption (post the 3-year lock-in period) from ELSS or Tax Saving Mutual Funds will be subject to Long Term Capital Gain (LTCG) tax @12.5%, as applicable for all equity mutual funds.

Be thoughtful in your approach and reach out to your investment advisor and tax consultant.

“In this world nothing is certain but death and taxes” – Benjamin Franklin

Happy Tax Planning!

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.