As of 20 May 2025, the BSE Sensex is now down only 5.6% since the all-time high of 85,978.25 recorded on 27 September 2024.

Currently, the 12-month trailing price to earnings (PE) multiple – which shows how expensive or cheap the markets are – is around 23. Historically a PE ratio below 20 is seen as a reasonable investment opportunity.

This means the Indian equity market cannot be considered cheap or reasonable currently. Compared to other emerging markets, the Indian equity markets are expensive.

In such times you ought to approach equity mutual funds thoughtfully.

When the market is near its all-time high and volatility cannot be ruled out, it makes sense to consider Systematic Transfer Plans (STPs) when investing in equity mutual funds.

What is a Systematic Transfer Plan (STP)?

STP is a mode of investing in mutual funds. Under STP, you gradually shift your investments from one type of mutual fund scheme to another within the same fund house.

Typically, STP is done from a liquid fund into some of the best equity funds over a period of time, which could be 6 months, 1 year, 2 years, etc.

Systematic transfers can be made at a regular frequency, such as weekly, monthly, quarterly, etc. over the STP tenure.

So, STP serves as an investment strategy. Instead of holding back on investing because the markets are near the all-time high and valuations look expensive, you can first invest in a liquid fund and then do an STP to one of the best equity mutual fund schemes.

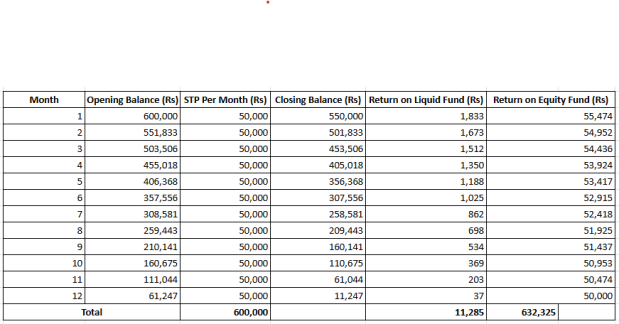

Say you want to invest Rs 6 lakh systematically over a 12-month period in an equity mutual fund scheme.

Here Rs 6 lakh can first invest in a liquid fund and do an STP by transferring Rs 50,000 per month over 12 months into the best equity mutual fund.

Assuming expected growth on equities at 12% p.a. and in a liquid fund at 4% p.a., here’s how the STP investment might work in your favour:

Expected growth on equities assumed at 12% p.a. and in a liquid fund at 4% p.a

This allows you to have exposure to two asset classes – debt and equity – and gain from diversification. The STP strategy can be followed by both, seasoned and new investors.

To get an insight into how the equity and debt portion of your investments will grow, you can use this online STP calculator.

Some Details About STP You Should Know

You have a choice of a fixed or flexible STP.

In a fixed STP you transfer a fixed sum at regular intervals. In a flexible STP, you can choose how much to transfer based on market conditions or personal preferences.

Most mutual fund houses set a minimum investment, often around Rs 12,000, to be eligible for an STP scheme.

In addition, for STP you are required to commit at least 6 transfers from the transferor scheme (i.e. the scheme from where systematic transfers are made) to the transferee/target scheme (i.e. the scheme to which the money is systematically transferred).

Why STP Makes Sense Now?

The Indian equity market is hovering near its all-time high. While there are challenges and opportunities, the wealth creation path through equities would be full of ups and downs.

Trade tariffs, geopolitics, capital flows, and sovereign rating among other factors would have their impact on the economy and market. Volatility is likely to increase.

In such times, investing in equity mutual funds gradually in a staggered manner through the STP route would be meaningful as against making a lump sum investment.

Which Type of Equity Mutual Fund May be Considered?

Considering the market conditions at present, for STP from a liquid fund, the following categories of equity mutual funds are some of the best…

- Large Cap Funds

- Flexi Cap Funds

- Value Funds

- Contra Funds

- Aggressive Hybrid Funds

- Mid Cap Funds

Having said that, it is important to choose equity mutual fund schemes that align well with your personal risk profile, investment objective, your financial goals, and the time in hand to achieve those goals.

When you invest in these equity mutual funds, make sure you have a horizon of 5-7 years or more.

The Benefits of STP

- It keeps away the emotional bias. When the market is scaling near its peak, investors tend to be greedy. But with STP, there is a sense of discipline, allowing you to make systematic investments keeping emotional triggers away.

- It helps you average out the cost of purchasing equity mutual fund units with systematic transfers. This is because of rupee-cost averaging, wherein buy more units of a scheme when the market is down and fewer units when it is rising.

- It makes timing the market irrelevant. With STP, the money will be systematically transferred from a liquid fund into the equity fund of your choice. This will help you focus on the ‘time in the market’ instead.

- Helps to gradually increase exposure to equities. This, to an extent, helps manage the risk when the market is near an all-time high and volatility is expected to increase.

- You have exposure to debt and equity. At the start of the STP tenure, the debt allocation is high and thereafter the allocation to equities goes up.

Tax Implications of STP

While STP has several benefits, be mindful of the fact that each transfer will be treated as a redemption or exit. Hence, there may be capital tax implications on STP.

In the case of debt funds, the capital gains are taxed as per your income-tax slab.

As regards, equity mutual funds, if the units are held for a period of less than 12 months, the capital gains will be subject to a Short Term Capital Gain Tax (STCG) at the rate of 20%.

For equity mutual fund units held for 12 months or more, the capital gains will be subject to a Long Term Capital Gain Tax at 12.5% for gains in excess of Rs 1.25 lakh in a financial year.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary