A non-linked life insurance policy with higher persistency will see a marginal increase in surrender value from the fourth to the seventh year. However, if it is terminated within three years, the value will remain the same or may even be lower than the existing norms.

The Insurance Regulatory and Development Authority of India (Irdai) has released new regulations related to surrender charges which will be effective from April 1 this year. In December last year, it had proposed to increase the surrender value — the amount that will be paid by the insurer to the policyholder if terminated before maturity date. However, following the apprehensions of insurance companies that higher surrender value could lead to higher short-term exits by policyholders and reduce persistency ratio of policies, it decided to retain the existing norms.

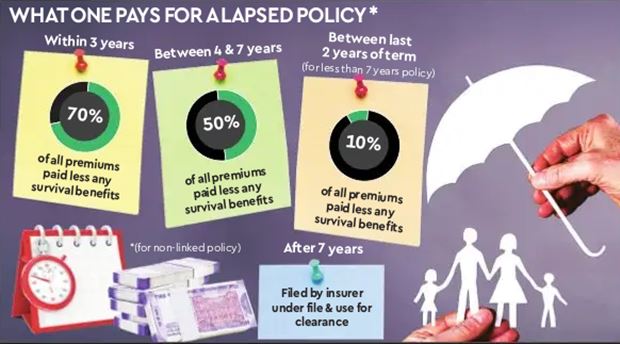

In case of a non-linked regular premium product, the policy will acquire a guaranteed surrender value on payment of premium for at least two consecutive years. It will be 30% of the total premium paid less any survival benefits paid if surrendered during the second year of the policy. If surrendered between the fourth and the seventh year of the policy (both year inclusive) it will be 50% of the premium paid less any survival benefits already paid. And 90% of total premiums will be paid if surrendered during the last two years. Life insurance companies will have to disclose the surrender value across years upfront in the policy document.

Fine balance

Insurance experts say that Irdai’s final regulations on surrender value strike a commendable balance. This empowers customers to make informed decisions about their financial security without significant penalty if their circumstances change. Importantly, the impact on life insurers is expected to be minimal. The finalised regulations avoid the initially proposed high surrender values, which could have decreased Internal Rate of Returns (IRRs) for policyholders.

In the December draft exposure, the regulator had proposed a threshold premium (Rs 25,000 as an example) and the surrender charge of 35% to be levied on the accumulated premium with surrender. The threshold premium was to be defined for each product.

Sanjiv Bajaj, joint chairman & MD, BajajCapital, says, the regulator has emphasised that for non-linked insurance products, benefits in savings plans must be guaranteed with a specific amount at the policy’s outset, ensuring policyholders have clear expectations about their benefits. “Regarding savings products, excluding those with the return of insurance premium clause, IRDAI has highlighted the importance of guaranteeing survival and maturity benefits, ensuring policyholders receive a positive return, thus deriving value from their savings plans.”

Rahul M Mishra, director and co-founder, Policy Ensure, says the regulator’s new guidelines prioritises the alignment of customer protection with the industry’s sustainability. It aims to strike a balance between maintaining the financial stability of the insurance sector and providing fair surrender values to policyholders. “By preventing premature policy exits, Irdai aims to foster trust and strengthen the longevity of insurance relationships,” he says and adds that it is advisable to avoid terminating policies prematurely.

Additional clarifications

The regulator has clarified that pension products provided to individual customers must offer specific assured benefits, which may be disbursed in the event of death or any covered health contingency. Moreover, under non-linked pension products, assured benefits should be disbursed upon vesting, except in the case of linked pension products where the payment of defined assured benefits upon vesting is discretionary.