The housing prices in the NCR region continued to see an upward trend in the July-September 2025 quarter, driven by robust demand from end-users and stable economic conditions, according to the latest report by real estate consultancy Knight Frank India. The average price rise in the residential segment year-on-year was recorded at 19% among the top 8 Indian cities.

The report, Q3 2025 – Residential and Office (July-September 2025), indicates a robust and maturing market in the Delhi NCR. The report analyses real estate market trends across 8 cities like Mumbai, Bengaluru, NCR, Pune Hyderabad, Ahmedabad, Chennai and Kolkata.

Residential segment star performer in terms of prices

“The residential market was the star performer in terms of price growth during the third quarter of 2025. Driven by stable economic conditions, reduced inventory risk, and strong end-user demand, average residential prices in the region surged by 19% YoY, marking the highest increase among the top Indian cities,” the property consultancy firm said.

This robust growth, the report said, reflects the sustained high demand for premium and luxury properties, particularly in established micro-markets across Gurugram and Noida.

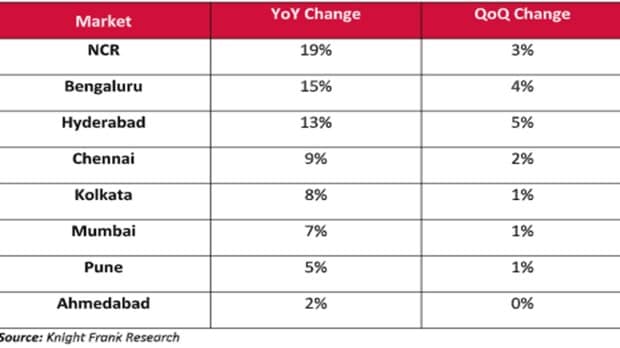

Average price change across markets during Q3 2025

Office rental maintained positive traction with a healthy 9% YoY rise

The office space demand is supported by India-facing businesses and flex workspace operators, the report said.

While the residential segment dominated headlines by registering the highest annual price appreciation in India, the commercial office market continued its resilient performance, driven by strong occupier fundamentals, the consultancy said.

NCR residential market: Price appreciation peaks

The trend of premiumisation continues to reshape the market, with homebuyers demonstrating a strong preference for larger homes, better amenities, and ready-to-move-in or near-completion inventory, the report said. While overall sales volume saw stabilisation after previous high-growth phases, the underlying sales value of transactions continued to climb, reinforcing buyer confidence and developer focus on high-ticket launches, it added.

Mudassir Zaidi, Executive Director – North, Knight Frank India, commented on the market performance, “The NCR real estate story in Q3 2025 is clearly one of two robust but distinct markets. On the residential front, the staggering 19% YoY price appreciation is a clear indicator that the region’s luxury and premium segments are firing on all cylinders. This growth is healthy, not speculative, as it is backed by genuine end-user confidence and a diminishing supply of quality inventory. The high-value segment continues to lead the way, affirming NCR’s status as a high-growth residential investment destination in India.”

NCR office market: Rentals and leasing stabilise

The NCR office market showcased resilient stability in Q3 2025. While overall pan-India leasing volumes saw a marginal softening compared to the exceptional performance in Q3 2024, NCR continued to attract steady demand, according to the report.

Gross leasing was primarily fueled by sustained space take-up from Global Capability Centres (GCCs) and domestic corporate expansion plans across BFSI and consulting sectors, it said.