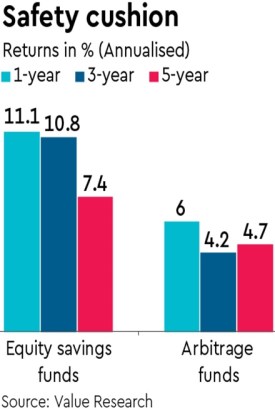

Equity savings funds are gaining popularity among investors, especially those looking for stable returns, because of their unique investment strategy and benefit of equity taxation. These hybrid funds invest in equities, debt securities and arbitrage opportunities to generate capital appreciation, manage risk and enhance returns.

Equity savings funds delegate the decision of optimal asset allocation between debt and equity to professional fund managers and are now increasingly seen as a debt fund alternative. These funds invest 30-40% in equities, 25-35% in equity arbitrage, and the rest in debt, offering a balanced risk-reward proposition. Due to this structure, volatility in returns tends to be low though these can be highly volatile during major equity market declines.

Abhishek Banerjee, founder & CEO, Lotusdew Wealth & Investment Advisors, says equity savings funds are required to hold at least 65% equity investment and at least 10% debt. “The fund manager can provide cash market like returns using an arbitrage sleeve, while managing risk using equity and debt sleeves. For example, it might be possible to get government bond yields while using that to generate margins to deploy arbitrage strategies in single stock futures,” he says.

Siddharth Bhaisora, investment advisor, Wright Research, says the equity component ensures potential for higher long-term returns, while the debt portion offers steady income, cushioning it against the volatility associated with equities. “The arbitrage opportunities, which involve exploiting price differentials in different markets, further mitigate risks while boosting returns. The appeal of equity savings funds is magnified by the recent changes in the taxation of debt funds.”

Tax benefits

The amendment of taxation of debt funds has removed the indexation benefits, which significantly increased the tax liability for investors. On the other hand, equity funds, including equity savings funds, have retained their favourable tax treatment, which includes a 10% long-term capital gains tax on profits above Rs 1 lakh and a 15% short-term capital gains tax.

So, with debt funds now attracting marginal income tax, equity savings funds give investors an opportunity to design a portfolio where the debt portion is allocated within a savings fund, get the debt returns and have equity taxation on gains. This makes them a more tax-efficient alternative to pure debt funds if held for more than a year. These funds are now particularly appealing to investors seeking stable returns while keeping their tax liability low.

The tax efficiency, combined with the potential for higher returns, has increased the attractiveness of equity savings funds. Shrinath ML, senior research analyst, FundsIndia, says as equity savings funds hold more than 65% gross exposure to equity, the gains get taxed similar to equity funds. “This results in a taxation advantage for investors, especially for those in the 20%-plus tax bracket. This tax advantage could add an extra 0.5% to 1.5% in annualised post-tax returns relative to debt funds (assuming similar pre-tax returns),” he says.

Factors to keep in mind

Investors should opt for equity savings funds if they have a 3-5 year time-frame, their return expectations are slightly above debt fund returns and they can withstand declines in the short term. Investors must note the fund’s approach to asset allocation, including its mix of debt, equity, and arbitrage strategies, as well as the use of hedged and unhedged strategies. The amount of the fund’s assets invested in equities can help gauge the risk involved.

Experts say the arbitrage strategy settlement is guaranteed by clearing corporations which makes it safer than short-term commercial papers or short-term corporate debt. “This gives floating rate short-term exposure as the cash-future arbitrage pricing incorporates short-term interest rates. Hence, in an uncertain inflation environment the arbitrage portion offers inflation hedging with equity taxation,” says Banerjee.

Investors must look at the credit quality of the debt component as high credit quality means lower risk. They should also look at the duration risk, which relates to the sensitivity of a bond’s price to changes in interest rates. Longer-duration funds are more sensitive to interest rate changes. Bhaisora of Wright Research says these funds are ideal for medium to long-term investment horizons. “Since these funds involve exposure to equities, they carry a certain degree of risk. Investors should assess their risk tolerance before investing.”