It all started about six decades ago when the Unit Trust of India launched the Unit Scheme-1964 scheme or US 64 as it was popularly known. UTI held sway over the mutual funds market for nearly 25 years thereafter before the space was thrown open to other state-owned players. But even after the private sector was allowed entry it took until May, 2014 for the average assets under management (AAUM) to hit the Rs 10-trillion mark. That had probably less to do with the chequered career of US 64 than the low levels of awareness of the stock market. However, over the last decade the value of assets has soared, crossing Rs 46 trillion in July; in the last three years, the industry clocked in a compounded annual growth rate of nearly 20%. Now, given how fast folios are being added and how the stock market is booming, the Rs 50 trillion mark seems just round the corner.

Investors are buying the industry’s motto—Mutual funds sahi hain—in their quest to accumulate wealth. On its part, the Association of Mutual Funds in India (Amfi) has onboarded two former cricketers – Sachin Tendulkar and Mahendra Singh Dhoni – known for their consistency and longevity— to showcase its products as long-term wealth creation tools.

Since bigger AUMs can be very rewarding for the bottom line, asset management companies (AMCs) can be expected to keep at it. They have a fast-growing economy, rising incomes and favourable demographics on their side. As A Balasubramanian, MD and CEO of Aditya Birla Sun Life AMC, points out, with the per capita income of the country increasing, more investors will discover the power of MFs and tools like systematic investment plans (SIPs). “There is huge scope for further penetration because there are only about 40 million unique MF investors, which is less than 10% of the 500 million PAN holders that we have,” Balasubramanian said.

Shamsher Singh, MD & CEO, SBI Mutual Fund believes that higher awareness and a pick-up in digital assets have been the two major driving factors behind the industry’s growth. And that there’s plenty of room to grow. “The industry has seen a 19.6% CAGR over the last three years and yet is significantly under-penetrated with the MF AUM-to-GDP ratio at 17%. The penetration is much higher among global peers,” Singh said. The next leg of growth, Singh feels, would require equal focus on distribution, marketing, product innovation and investor services.

Nilesh Shah, MD and CEO of Kotak MF, believes growth is linked to investor trust. MFs, he points out, have an inherent advantage as the interests of the investor, manufacturer, and distributor are aligned, unlike in the case of peers where it is tilted either in favour of the manufacturer or investor. “Trust depends on value addition to the investor through outperformance over the benchmark and providing the service at a competitive cost,” Shah said, adding that retaining and enhancing investor trust for the long term is also key. At the same time, Shah says this is easier said than done because in terms of popularity, gold, real estate, and bank deposits are the go-to products.

Nonetheless, new players are entering the fray. Among these are Bajaj, Zerodha and Helios although it is the joint venture between Jio Financial Services and BlackRock that has made the headlines. Does the intensifying competition worry incumbents? For now they’re putting on a brave face. “The more, the merrier. Our industry requires more players to expand distribution network and coverage. The industry landscape is competitive but that will bring out the best in us,” says Shah.

Distributor still the backbone

Industry players have, time and again, emphasised the role of distributors in expanding reach. The capital market regulator has suspended B30 incentives for distributors and is taking a relook at the expense structure for MFs. This has upset both fund managers and distributors who say it is a tad unfair to punish the entire industry because of a few bad apples.

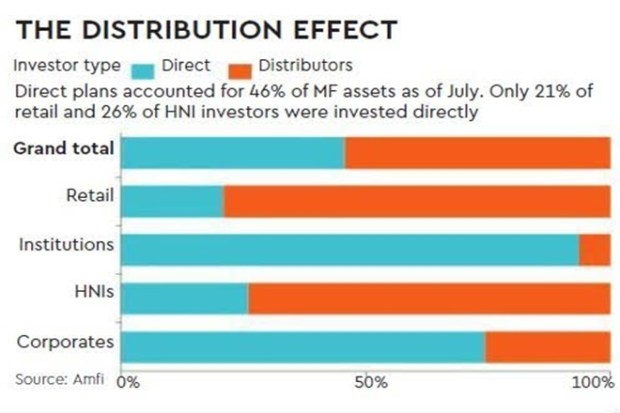

The regulator seems to be batting for direct plans, but the end beneficiaries have really been institutional investors. Overall, direct plans accounted for 46% of the industry AUM as of July, according to AMFI. Only 21% of retail and 26% of HNI investors invested in direct plans. On the contrary, it was close to 75% for corporates and over 90% for institutional investors.

“Our challenges are also evolving because it’s now a digital era with the focus on ‘How to do’ instead of ‘What to do’,” says Misbah Baxamusa, CEO of the country’s largest distributor NJ Wealth. Baxamusa’s firm topped the distributor rankings, in terms of commission income at Rs 1,539 crore for the eighth straight year in FY23. Balasubramanian too sees the role of the distribution fraternity deepening with the rise in wealth, especially in Tier-3 and 4 towns, where educating and hand-holding investors will be of primary importance.

A significant segment of the population is still unaware of the benefits of MFs and how they work. SBI MF’s Singh says the focus should be on increasing knowledge through simple communication in the languages they understand. “The ease of onboarding investors with tech-enabled innovation, use of artificial intelligence and machine learning for customised solutions, and long-term solution-based investing, are trends that will drive future growth,” says Balasubramanian. All of this and a sizzling Sensex poised for new highs should see the Rs 100-trillion opportunity being unlocked soon.