While individuals are increasingly investing in hybrid mutual funds, they can look at a Tier II account of National Pension System (NPS) which invests in both equity and debt, has no lock-in at all, and the expense ratio is significantly low making it the lowest-cost pension product available in the country. This voluntary savings facility is available as an add-on to any Tier-1 account holder and investors can select different pension fund managers for Tier I and Tier II accounts to diversify the money across fund managers.

Retirement corpus with flexibility

A Tier II NPS account can help an individual to meet-short-term goals. With higher internal rate of return and low account maintenance fees, the account can help an investor to accumulate a sizable pension wealth at the time of retirement. It provides an auto-choice option for asset allocation for those who do not want to manage the asset allocation themselves and an investor can opt for a maximum investment of 75% in equity. In active choice, the subscriber will have to choose the investment option himself as per his preference and should have adequate knowledge about markets and interest rate movements.

However, investors must note that there are no tax benefits on investing in the Tier II NPS account for private sector employees. The tax benefit is available only to central and state government employees and there is a three-year lock-in period for them if they wish to avail tax benefits. In a Tier I account, a subscriber can claim tax benefit of Rs 1.5 lakh under Section 80 and an additional deduction of Rs 50,000 under Subsection 80CCD (1B) of the Income Tax Act.

In case of a Tier II account, the subscriber will have to pay tax as per the marginal tax rate applicable to him on the returns earned. In the case of a Tier I account, 60% of the corpus can be withdrawn tax-free on maturity and the 40% amount is invested for purchase of an annuity plan. The annuity received is taxable at the investor’s marginal tax rate.

NPS Tier II or hybrid MFs?

In a Tier II account where there is no minimum balance requirement, the transaction amount is credited in the subscriber’s account in T+2 days. An individual has the flexibility to withdraw money from an NPS Tier-II account at any point of time without any exit load as is the case with hybrid funds. However, as the investment in a Tier II account is also market-linked, the redemption amount will depend upon the applicable NAV at the time of redemption and funds will be transferred to the subscriber’s account in three working days.

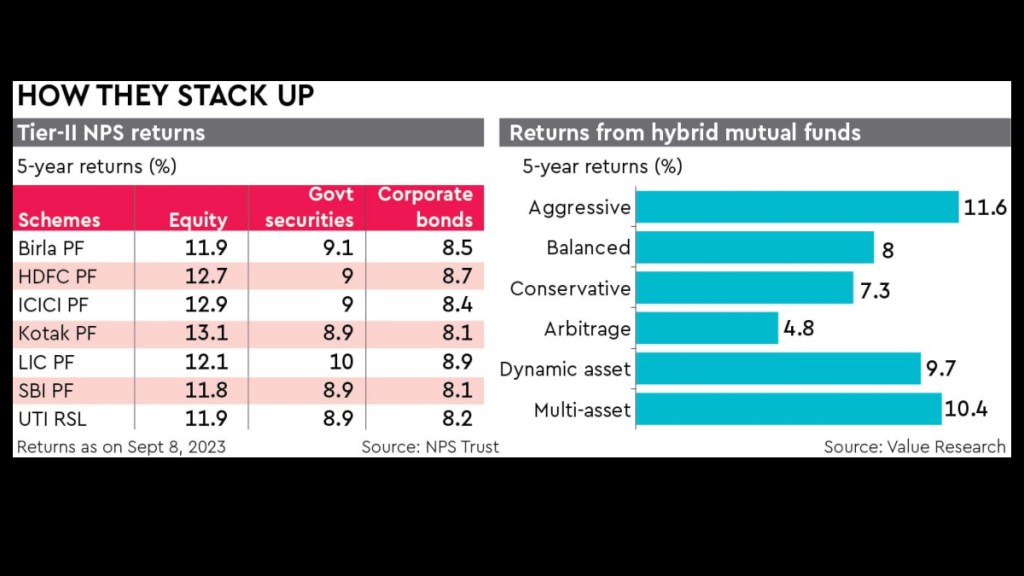

Hybrid mutual funds invest in both equity and debt and within equity, the funds invest across large, mid and small caps. Fund managers adjust the portfolio based on market conditions and actively manage the funds between both equity and debt instruments. Data shows while aggressive hybrid funds have given returns of around 12% over a five-year period, the conservative hybrid funds have given around 5% over five years. In contrast, NPS Tier II equity funds have given returns of up to 13% over five years and government securities around 10%.

Just like hybrid mutual funds, investors have the choice of equity, government securities and corporate debt and can opt for a combination of these asset classes. For higher returns, higher exposure to equity will help in the long run. As NPS offers tax-free rebalancing, investors must look at changing the asset allocation based on market conditions.

An investor has the flexibility to transfer funds from Tier II account to Tier I account. However, if he wishes to close the NPS Tier I, the balance outstanding in the NPS Tier II account will have to be withdrawn simultaneously. Premature closure of Tier II is not permitted if the Tier 1 account is active. So, if an individual wants to build a retirement fund with regular investments over the long term and yet have some flexibility in withdrawals should opt for an NPS Tier II account along with the mandatory Tier I NPS account.

FLEXIBLE NORMS

You can withdraw money from an NPS Tier II account at any point of time without any exit load as is the case with hybrid funds

Choose from equity, government securities and corporate debt or any combination of these asset classes, based on your risk appetite.