Securing your family’s future is necessary. Therefore, you should take a precautionary action. Term plans help you secure your family’s financial needs in case of any unfortunate event. Though life insurance is for everyone, but any person who has dependents and is a sole earning member of the family must have a life insurance protection plan.

Along with financial protection, life insurance plans also serve as a long-term investment which helps to cope up with the different liabilities of life, like children’s education, their marriage, retirement phase, among others.

It is always advisable to buy a term insurance plan early in life as the premium amount is directly proportional to the policyholder’s age. The older you get, the more will be the premium. Also, you must have a term insurance cover which is at least 20 times of your annual income to suffice your family’s future liabilities and debts.

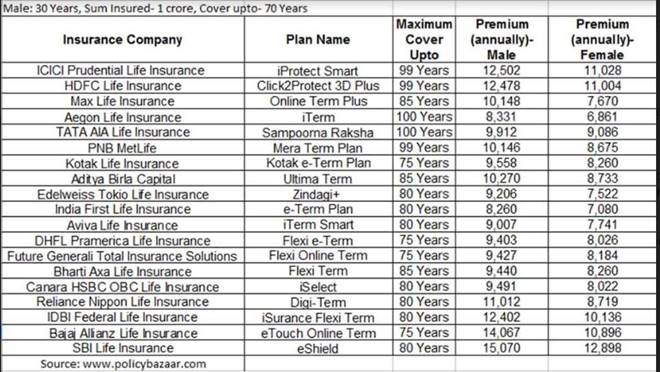

Below is the premium comparison of a 30-year-old male and female, non-smoker, residing in a metro city, for Rs 1-crore sum insured, and cover up to 70 years.