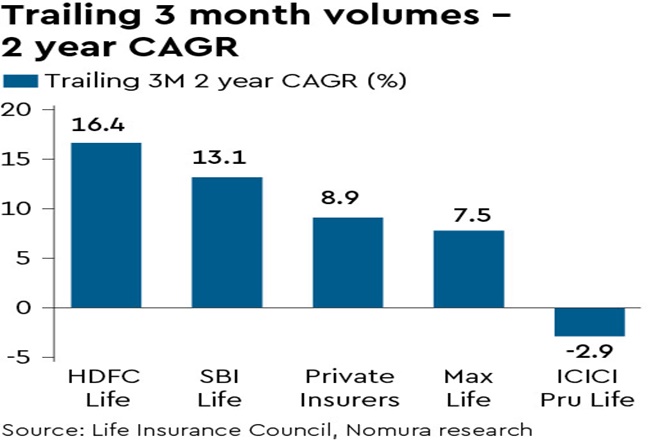

India’s life insurance industry registered strong volumes in Mar-21, largely aided by a favourable base (-40% y-o-y in Mar-20) with 56-120% y-o-y growth for top private insurers (private insurers +89% y-o-y). Flows were strong in March across insurers and AMCs reported positive net flows as well. On a 2-yr CAGR basis, Mar-21/Q4FY21 growth was 7%/9% for private insurers with: (i) momentum picking up for SBI Life following a weak H1FY21, (+12.6%/13%) and (ii) HDFC Life continued to deliver well with 13%/ 16% growth while Max Life delivered 0/ 8% growth with some moderation seen in Mar-21. IPRU also saw a pick-up in growth off a weak base, but remained lower than FY19 levels, a -3% CAGR over Q4FY19.

For FY21, the industry saw a 5% CAGR, with private players delivering 6% CAGR (10% excluding IPRU). On a 2-yr CAGR basis, HDFC Life delivered strong 18% growth; Max Life also performed well, delivering 12% growth; SBI Life delivered a relatively muted 7% CAGR while IPRU saw a 12% CAGR decline over two years. With this, HDFC Life and Max Life gained 130-110bp market share in FY21, while SBI Life and IPRU lost 60bp/ 370bp market share.

Our view: With a lower base effect playing out now (from March) over H1FY22, growth will optically look better; thus we find the 2-yr CAGRs to be a more appropriate metric to gauge the industry’s performance. Life insurers delivered relatively robust growth in a pandemic year (10% 2-yr CAGR ex IPRU for the private players). Margins trends have also been strong for companies under our coverage. We continue to monitor the impact of a second COVID-19 wave on growth.

Player-wise performance

SBI Life (SBILIFE IN, Buy) – strong momentum: SBI Life delivered individual APE of +119% y-o-y in Mar-21. On a 2-yr CAGR basis, Q4FY21 APE was 13.1%. We remain positive given the stock’s reasonable valuation for a strong distribution, solid pick-up in growth, improvement in margins and low-cost franchise.

HDFC Life (HDFCLIFE IN, Neutral) – strong performance: HDFC Life saw +75% y-o-y in individual APE in Mar-21. This implies a 13%/16% 2-yr CAGR for Mar’21/Q4FY21 (strongest among peers).

Max Life (MAXF IN, Buy) – relatively soft: Max Life’s Individual new business APE was +56% y-o-y. This implies a flattish 2-yr CAGR for Mar-21 and 7.5% 2-yr CAGR for Q4FY21. We remain positive on Max, given its steady growth, healthy structural margins and consistent RoEVs.

IPRU Life (IPRU IN, Buy) getting back on its feet: IPRU delivered 98% y-y growth on a weak 50% y-o-y decline base. On a 2-yr CAGR basis – Mar’21/Q4FY21 volumes were flat/down 3%. Mar’21 volume performance gives us confidence that growth has bottomed out. We turn incrementally positive on stock given cheap valuations and growth showing initial signs of recovery.